Page 118 - SHB 2020 Issue 1

P. 118

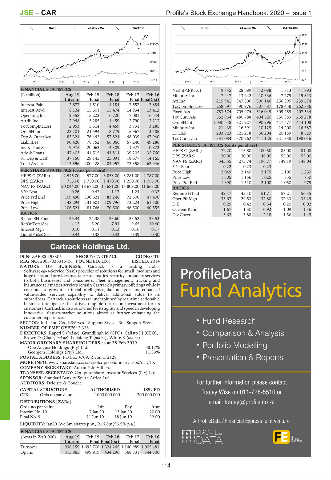

JSE – CAR Profile’s Stock Exchange Handbook: 2020 – Issue 1

BANK 40 Week MA CAPITEC SUPS 40 Week MA CARTRACK

2801

121303 2336

97106 1872

72909 1407

48712 942

24514 477

2015 | 2016 | 2017 | 2018 | 2019 2015 | 2016 | 2017 | 2018 | 2019

FINANCIAL STATISTICS NetIntPd(Rcvd) 9 845 28 689 12 088 1 813 - 1 793

(R million) Aug 19 Feb 19 Feb 18 Feb 17 Feb 16 Minority Int 7 447 13 242 10 336 7 279 19 813

Interim Final Final Final Final(rst) Att Inc 215 941 347 806 300 146 256 895 239 674

Interest Paid 2 677 4 510 4 184 3 552 2 884

TotCompIncLoss 258 697 390 976 307 687 178 458 262 886

Interest Rcvd 8 124 15 501 15 474 14 934 13 412 Fixed Ass 783 574 705 974 516 045 309 255 207 534

Operating Inc 2 358 5 223 6 720 7 081 6 544 Tot Curr Ass 552 964 480 788 404 620 350 883 269 278

Attrib Inc 2 948 5 285 4 459 3 790 3 213 Ord SH Int 1 030 648 821 227 590 296 447 577 444 108

TotCompIncLoss 2 953 5 314 4 459 3 731 3 285 Minority Int 21 435 16 391 10 125 14 200 16 387

Ord SH Int 23 101 21 594 18 779 15 967 13 485 LT Liab 293 923 321 218 36 204 20 189 8 829

Dep & OtherAcc 85 324 76 443 57 824 48 039 47 940 Tot Curr Liab 331 084 370 262 441 125 321 858 198 016

Liabilities 90 420 78 752 66 066 57 240 49 286 PER SHARE STATISTICS (cents per share)

Inv & Trad Sec 19 975 20 063 14 309 11 927 10 823

Adv & Loans 47 403 44 515 41 814 39 205 35 760 HEPS-C (ZARc) 72.20 115.80 100.50 85.00 81.00

ST Dep & Cash 37 150 29 145 25 091 18 677 14 165 DPS (ZARc) 20.00 30.00 46.00 55.00 55.00

Total Assets 113 596 100 428 84 957 73 358 62 946 NAV PS (ZARc) 343.55 273.74 196.77 149.19 148.04

3 Yr Beta 0.22 0.23 - 0.23 - -

PER SHARE STATISTICS (cents per share) Price High 2 049 2 140 2 175 1 100 1 250

HEPS-C (ZARc) 2 545.00 4 577.00 3 858.00 3 281.00 2 787.00 Price Low 1 305 1 156 1 025 855 750

DPS (ZARc) 755.00 1 750.00 1 470.00 1 250.00 1 055.00 Price Prd End 1 890 1 510 2 100 1 050 975

NAV PS (ZARc) 20 044.00 18 676.00 15 681.00 13 809.00 11 663.00 RATIOS

3 Yr Beta 0.26 0.43 1.17 1.24 0.32 Ret on SH Fnd 42.47 43.10 51.71 57.21 56.35

Price Prd End 109 490 130 621 83 246 72 500 47 400 Oper Pft Mgn 33.67 29.53 32.80 32.33 34.29

Price High 143 294 131 601 109 796 73 224 61 500 D:E 0.29 0.42 0.34 0.20 0.02

Price Low 106 521 81 766 70 500 46 500 40 555 Current Ratio 1.67 1.30 0.92 1.09 1.36

RATIOS Div Cover 3.62 3.88 2.18 1.56 1.45

Ret on SH Fund 25.44 24.38 23.60 23.52 23.53

RetOnTotalAss 4.15 5.20 7.91 9.65 10.40

Interest Mgn 0.10 0.11 0.13 0.16 0.17

LiquidFnds:Dep 0.44 0.38 0.43 0.39 0.30

Cartrack Holdings Ltd.

CAR

ISIN: ZAE000198305 SHORT: CARTRACK CODE: CTK

REG NO: 2005/036316/06 FOUNDED: 2001 LISTED: 2014

NATURE OF BUSINESS: Cartrack is a leading global

Software-as-a-Service (SaaS) provider of solutions for small, medium and

large fleets and provides insurance telematics, security and safety services

to both businesses and consumers. Fleet management, tracking and

insurance telematics services remain Cartrack’s primary offerings while it

continues to grow its artificial intelligence, data analytics and enhanced

value-added services capability to deliver additional value to its

subscribers. Cartrack’s solutions are underpinned by real-time actionable

business intelligence that drives tangible return on investment for its

customers. Cartrack is also renowned for its agility and speed in developing

innovative, first-to-market solutions aimed at further enhancing the

customer experience.

SECTOR: Ind—Ind Goods&Srvcs—Support Srvcs—Bus Support Srvcs l Fund Research

NUMBER OF EMPLOYEES: 2 338

DIRECTORS: Rapeti S (ind ne), Grundlingh M (CFO), Calisto I J (CEO), l Comparison & Analysis

Brown D (Chair, ind ne), Ikalafeng T (ind ne), White K (ind ne)

MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2019 l Portfolio Modelling

One August Holdings (Pty) Ltd. 68.17%

Georgem Holdings (Pty) Ltd. 11.83%

POSTAL ADDRESS: PO Box 4709, Rivonia, 2128 l Presentation & Reports

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=CTK

COMPANY SECRETARY: Annamè de Villiers

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Standard Bank of South Africa Ltd.

AUDITORS: Deloitte & Touche For further information please contact

CAPITAL STRUCTURE AUTHORISED ISSUED

CTK Ords no par value 1 000 000 000 300 000 000 Tracey Wise on 011-728-5510 or

DISTRIBUTIONS [ZARc] email: tracey@profile.co.za

Ords no par value Ldt Pay Amt

Interim No 10 7 Jan 20 13 Jan 20 20.00

Final No 9 11 Jun 19 18 Jun 19 12.00

A ProfileData / Financial Express joint venture

LIQUIDITY: Jan20 Ave 3m shares p.w., R46.8m(56.5% p.a.)

FINANCIAL STATISTICS

(Amts in ZAR’000) Aug 19 Feb 19 Feb 18 Feb 17 Feb 16

Interim Final Final(rst) Final Final

Turnover 938 159 1 692 708 1 324 245 1 140 989 1 005 481

Op Inc 315 865 499 919 434 296 368 831 344 806

114