Page 117 - SHB 2020 Issue 1

P. 117

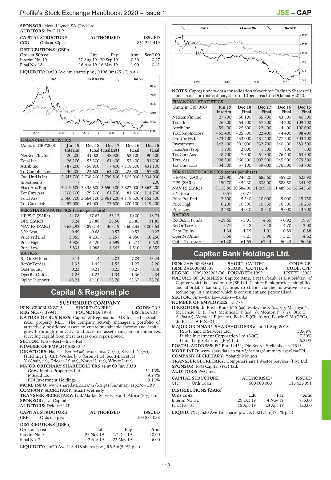

Profile’s Stock Exchange Handbook: 2020 – Issue 1 JSE – CAP

SPONSOR: Merrill Lynch SA (Pty) Ltd.

SAPY 40 Week MA CAPREG

AUDITORS: PwC LLP

1630

CAPITAL STRUCTURE AUTHORISED ISSUED

CCO Ords at 80p ea - 851 291 419

1356

DISTRIBUTIONS [GBPp]

Ords at 80p ea Ldt Pay Amt Scr/100 1082

Interim No 19 27 Aug 19 20 Sep 19 0.50 0.27

Final No 18 16 Apr 19 16 May 19 1.00 0.41 808

LIQUIDITY: Jan20 Ave 4m shares p.w., R198.0m(25.4% p.a.) 534

FINA 40 Week MA CAPCO 260

| 2016 | 2017 | 2018 | 2019

10348

NOTES: Capreg underwent a con sol i da tion of every ten Ordinary Shares of 1

8972 pence each into one ordinary share of 10 pence each on 15 January 2020.

FINANCIAL STATISTICS

7595

(Amts in GBP’000) Jun 19 Dec 18 Dec 17 Dec 16 Dec 15

6219 Interim Final Final Final Final

NetRent/InvInc 27 700 56 100 55 700 43 800 40 800

4842 Total Inc 26 200 54 700 57 200 44 200 109 700

Attrib Inc - 55 400 - 25 600 22 400 - 4 400 100 000

3466

2015 | 2016 | 2017 | 2018 | 2019 TotCompIncLoss - 55 400 - 25 600 22 400 - 4 400 98 400

FINANCIAL STATISTICS Ord UntHs Int 373 700 433 000 481 400 477 600 503 200

(Amts in GBP’000) Jun 19 Dec 18 Dec 17 Dec 16 Dec 15 Investments 842 400 901 000 932 700 840 400 883 300

Interim Final Final(rst) Final Final FixedAss/Prop 1 900 2 000 1 800 900 600

NetRent/InvInc 20 200 41 000 48 900 52 100 90 500 Tot Curr Ass 48 700 47 300 51 800 76 400 63 600

Total Inc 26 100 53 300 61 400 52 400 91 200 Total Ass 908 300 966 800 1 007 900 945 900 979 300

Attrib Inc - 87 200 - 56 900 - 400 - 118 600 431 100 Tot Curr Liab 34 300 37 100 39 000 376 300 33 700

TotCompIncLoss - 130 200 - 123 600 - 63 100 - 225 900 457 800 PER SHARE STATISTICS (cents per share)

Ord UntHs Int 2 643 700 2 736 200 2 799 800 2 805 000 2 934 000 HEPS-C (ZARc) 227.90 746.20 685.60 359.20 623.90

Investments - - - - 200 DPS (ZARc) 190.70 454.30 638.00 588.50 341.90

FixedAss/Prop 3 219 500 3 338 600 3 650 300 3 827 000 3 862 200 NAV PS (ZARc) 9 118.80 10 584.00 11 209.10 11 489.30 16 545.60

Tot Curr Ass 106 100 79 200 61 700 81 600 114 700 3 Yr Beta 0.57 0.77 - - -

Total Ass 3 560 700 3 664 100 3 961 200 4 118 600 4 152 300 Price Prd End 2 600 5 540 10 000 9 000 15 750

Tot Curr Liab 57 000 64 000 73 600 100 100 119 200 Price High 6 200 10 800 10 850 16 500 16 250

PER SHARE STATISTICS (cents per share) Price Low 2 480 4 010 8 510 9 000 13 900

HEPS-C (ZARc) - 44.08 47.63 53.13 - 10.00 18.74 RATIOS

DPS (ZARc) 9.24 27.88 25.50 26.85 31.85 RetOnSH Funds - 29.65 - 5.91 4.65 - 0.92 19.87

NAV PS (ZARc) 5 632.92 5 898.14 365.19 5 602.35 8 008.53 RetOnTotAss 5.77 5.18 5.48 4.70 12.00

3 Yr Beta 0.49 0.68 0.57 0.52 0.27 Debt:Equity 1.34 1.15 1.01 0.89 0.88

Price Prd End 3 855 4 235 5 257 4 950 10 250 OperRetOnInv 6.56 6.21 5.96 5.21 4.62

Price High 4 906 5 420 5 699 10 271 10 620 OpInc:Turnover 61.28 61.65 62.44 50.23 50.56

Price Low 3 834 4 088 4 342 4 510 6 355

RATIOS Capitec Bank Holdings Ltd.

RetOnSH Funds - 9.14 - 4.14 - 2.03 - 7.04 13.44 CAP

RetOnTotAss 1.33 1.45 1.55 1.27 2.20 ISIN: ZAE000035861 SHORT: CAPITEC CODE: CPI

Debt:Equity 0.23 0.21 0.25 0.27 0.18 ISIN: ZAE000083838 SHORT: CAPITEC-P CODE: CPIP

OperRetOnInv 1.25 1.23 1.34 1.36 2.34 REG NO: 1999/025903/06 FOUNDED: 1999 LISTED: 2002

OpInc:Turnover 48.21 49.10 55.76 55.37 78.76 NATURE OF BUSINESS: Capitec Bank, a retail bank, is a subsidiary of

Capitec which is listed on the JSE Ltd. Capitec Bank provides simplified

and affordable banking facilities to clients via the innovative use of

Capital & Regional plc technology in a manner which is convenient and personalised.

SECTOR: Fins—Banks—Banks—Banks

CAP

SUS PENDED COM PANY NUMBER OF EMPLOYEES: 13 774

ISIN: GB00BL6XZ716 SHORT: CAPREG CODE: CRP DIRECTORS: du Pré le Roux M S (ne), Makwane K (ind ne), Mashiya N,

REG NO: 01399411 FOUNDED: 1978 LISTED: 2015 McKenzie J D (ind ne), Meintjes D P (ind ne), Mouton P J (ne), Otto C

NATURE OF BUSINESS: Capital & Regional is a UK focused specialist A (ind ne), Verster J P (ind ne), Botha S (Chair, ne), Fourie G M (CEO),

retail property REIT. The company actively manages a portfolio of du Plessis A P (CFO)

attractively positioned assets to create sustainable income and capital MAJOR ORDINARY SHAREHOLDERS as at 11 Sep 2018

growth through innovative and accretive asset management initiatives, PSG Financial Services Ltd. 30.69%

recycling capital from these assets once repositioned. Public Investment Corporation Ltd (SOC) 7.20%

SECTOR: Fins—Rest—Inv—Ret Limietberg Sekuriteit (Pty) Ltd. 6.31%

NUMBER OF EMPLOYEES: 257 POSTAL ADDRESS: PO Box 12451, Die Boord, Stellenbosch, 7613

DIRECTORS: Hales T (snr ind ne), Muchanya G (ne), Sasse L N (ne), MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=CPI

Hutchings L (CE), Wetherly S (Group FD), Scott-Barrett H COMPANY SECRETARY: Yolandé Mouton

Y (Chair, ne), Krieger I S (ne), Norval L (ne), Whyte L (ne) TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 09 Jan 2020 SPONSOR: PSG Capital (Pty) Ltd.

Growthpoint Properties Ltd. 51.13% AUDITORS: PwC Inc.

MStead Ltd. 9.94%

PDI Investment Holdings 9.11% CAPITAL STRUCTURE AUTHORISED ISSUED

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=CRP CPI Ords 1c ea 500 000 000 115 626 991

COMPANY SECRETARY: Stuart Wetherly DISTRIBUTIONS [ZARc]

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd. Ords 1c ea Ldt Pay Amt

SPONSOR: Java Capital Interim No 32 29 Oct 19 4 Nov 19 755.00

AUDITORS: Deloitte LLP Final No 31 15 Apr 19 23 Apr 19 1120.00

CAPITAL STRUCTURE AUTHORISED ISSUED LIQUIDITY: Jan20 Ave 1m shares p.w., R1 321.1m(47.1% p.a.)

CRP Ords of 1p ea - 103 884 038

DISTRIBUTIONS [GBPp]

Ords of 1p ea Ldt Pay Amt

Interim No 8 26 Nov 19 27 Dec 19 10.00

Final No 7 2 Apr 19 23 May 19 6.00

LIQUIDITY: Jan20 Ave 118 418 shares p.w., R5.5m(5.9% p.a.)

113