Page 44 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 44

CHAPTER 2

Chart 2.4

REGISTRAR

TRUSTEE/

CUSTODIAN

PORTFOLIO

PORTFOLIO

PORTFOLIO

DEED (Fund/Assets)und/Assets)und/Assets)

(F (F

MANAGER

(Management

Company)

P

PARTICIPATORYARTICIPATORY

INTERESTS

INTERESTS

(Units)

(Units)

INVESTORSNVESTORS

I INVESTORS

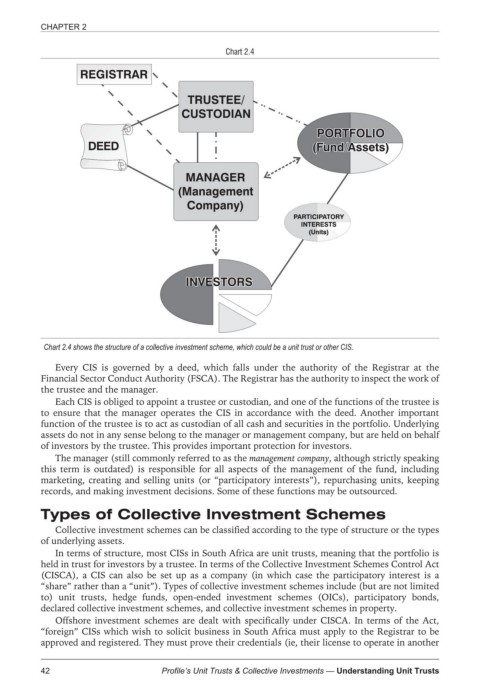

Chart 2.4 shows the structure of a collective investment scheme, which could be a unit trust or other CIS.

Every CIS is governed by a deed, which falls under the authority of the Registrar at the

Financial Sector Conduct Authority (FSCA). The Registrar has the authority to inspect the work of

the trustee and the manager.

Each CIS is obliged to appoint a trustee or custodian, and one of the functions of the trustee is

to ensure that the manager operates the CIS in accordance with the deed. Another important

function of the trustee is to act as custodian of all cash and securities in the portfolio. Underlying

assets do not in any sense belong to the manager or management company, but are held on behalf

of investors by the trustee. This provides important protection for investors.

The manager (still commonly referred to as the management company, although strictly speaking

this term is outdated) is responsible for all aspects of the management of the fund, including

marketing, creating and selling units (or “participatory interests”), repurchasing units, keeping

records, and making investment decisions. Some of these functions may be outsourced.

Types of Collective Investment Schemes

Collective investment schemes can be classified according to the type of structure or the types

of underlying assets.

In terms of structure, most CISs in South Africa are unit trusts, meaning that the portfolio is

held in trust for investors by a trustee. In terms of the Collective Investment Schemes Control Act

(CISCA), a CIS can also be set up as a company (in which case the participatory interest is a

“share” rather than a “unit”). Types of collective investment schemes include (but are not limited

to) unit trusts, hedge funds, open-ended investment schemes (OICs), participatory bonds,

declared collective investment schemes, and collective investment schemes in property.

Offshore investment schemes are dealt with specifically under CISCA. In terms of the Act,

“foreign” CISs which wish to solicit business in South Africa must apply to the Registrar to be

approved and registered. They must prove their credentials (ie, their license to operate in another

42 Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts