Page 42 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 42

CHAPTER 2

Chart 2.1

125

115

105

95

85

75

65

Oct 19 Jan 20 Apr 20 Jul 20 Oct 20 Jan 21

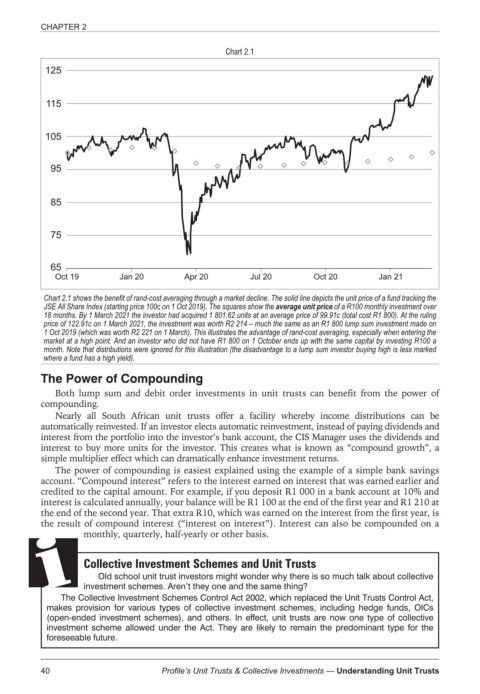

Chart 2.1 shows the benefit of rand-cost averaging through a market decline. The solid line depicts the unit price of a fund tracking the

JSE All Share Index (starting price 100c on 1 Oct 2019). The squares show the average unit price of a R100 monthly investment over

18 months. By 1 March 2021 the investor had acquired 1 801.62 units at an average price of 99.91c (total cost R1 800). At the ruling

price of 122.91c on 1 March 2021, the investment was worth R2 214 – much the same as an R1 800 lump sum investment made on

1 Oct 2019 (which was worth R2 221 on 1 March). This illustrates the advantage of rand-cost averaging, especially when entering the

market at a high point. And an investor who did not have R1 800 on 1 October ends up with the same capital by investing R100 a

month. Note that distributions were ignored for this illustration (the disadvantage to a lump sum investor buying high is less marked

where a fund has a high yield).

The Power of Compounding

Both lump sum and debit order investments in unit trusts can benefit from the power of

compounding.

Nearly all South African unit trusts offer a facility whereby income distributions can be

automatically reinvested. If an investor elects automatic reinvestment, instead of paying dividends and

interest from the portfolio into the investor’s bank account, the CIS Manager uses the dividends and

interest to buy more units for the investor. This creates what is known as “compound growth”, a

simple multiplier effect which can dramatically enhance investment returns.

The power of compounding is easiest explained using the example of a simple bank savings

account. “Compound interest” refers to the interest earned on interest that was earned earlier and

credited to the capital amount. For example, if you deposit R1 000 in a bank account at 10% and

interest is calculated annually, your balance will be R1 100 at the end of the first year and R1 210 at

the end of the second year. That extra R10, which was earned on the interest from the first year, is

the result of compound interest (“interest on interest”). Interest can also be compounded on a

monthly, quarterly, half-yearly or other basis.

Collective Investment Schemes and Unit Trusts

Old school unit trust investors might wonder why there is so much talk about collective

investment schemes. Aren’t they one and the same thing?

The Collective Investment Schemes Control Act 2002, which replaced the Unit Trusts Control Act,

makesprovision forvarious typesof collective investment schemes, including hedge funds, OICs

(open-ended investment schemes), and others. In effect, unit trusts are now one type of collective

investment scheme allowed under the Act. They are likely to remain the predominant type for the

foreseeable future.

40 Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts