Page 364 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 364

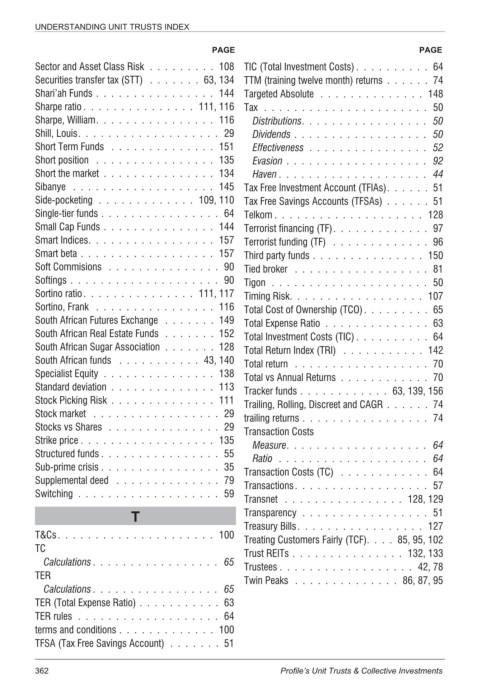

UNDERSTANDING UNIT TRUSTS INDEX

PAGE PAGE

Sector and Asset Class Risk ......... 108 TIC (Total Investment Costs) .......... 64

Securities transfer tax (STT) ....... 63, 134 TTM (training twelve month) returns ...... 74

Shari’ah Funds ................ 144 Targeted Absolute .............. 148

Sharpe ratio ............... 111, 116 Tax ...................... 50

Sharpe, William................ 116 Distributions................. 50

Shill, Louis................... 29 Dividends .................. 50

Short Term Funds .............. 151 Effectiveness ................ 52

Short position ................ 135 Evasion ................... 92

Short the market ............... 134 Haven .................... 44

Sibanye ................... 145 Tax Free Investment Account (TFIAs)...... 51

Side-pocketing ............. 109, 110 Tax Free Savings Accounts (TFSAs) ...... 51

Single-tier funds ................ 64 Telkom .................... 128

Small Cap Funds ............... 144 Terrorist financing (TF)............. 97

Smart Indices................. 157 Terrorist funding (TF) ............. 96

Smart beta .................. 157 Third party funds ............... 150

Soft Commisions ............... 90 Tied broker .................. 81

Softings .................... 90 Tigon ..................... 50

Sortino ratio............... 111, 117 Timing Risk.................. 107

Sortino, Frank ................ 116 Total Cost of Ownership (TCO)......... 65

South African Futures Exchange ....... 149 Total Expense Ratio .............. 63

South African Real Estate Funds ....... 152 Total Investment Costs (TIC) .......... 64

South African Sugar Association ....... 128 Total Return Index (TRI) ........... 142

South African funds ........... 43, 140

Total return .................. 70

Specialist Equity ............... 138 Total vs Annual Returns ............ 70

Standard deviation .............. 113 Tracker funds ............ 63, 139, 156

Stock Picking Risk .............. 111 Trailing, Rolling, Discreet and CAGR ...... 74

Stock market ................. 29

trailing returns ................. 74

Stocks vs Shares ............... 29

Transaction Costs

Strike price .................. 135

Measure................... 64

Structured funds ................ 55

Ratio .................... 64

Sub-prime crisis ................ 35

Transaction Costs (TC) ............ 64

Supplemental deed .............. 79

Transactions.................. 57

Switching ................... 59

Transnet ................ 128, 129

T Transparency ................. 51

Treasury Bills................. 127

T&Cs..................... 100

Treating Customers Fairly (TCF).... 85, 95, 102

TC

Trust REITs ............... 132, 133

Calculations ................. 65

Trustees .................. 42, 78

TER

Twin Peaks .............. 86, 87, 95

Calculations ................. 65

TER (Total Expense Ratio) ........... 63

TER rules ................... 64

terms and conditions ............. 100

TFSA (Tax Free Savings Account) ....... 51

362 Profile’s Unit Trusts & Collective Investments