Page 361 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 361

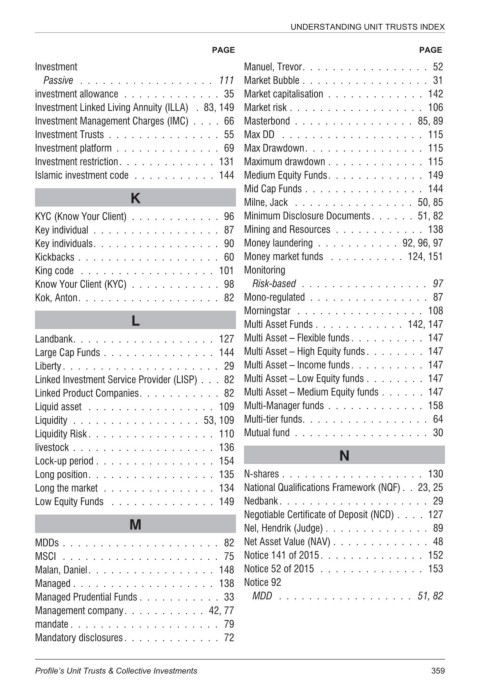

UNDERSTANDING UNIT TRUSTS INDEX

PAGE PAGE

Investment Manuel, Trevor................. 52

Passive .................. 111 Market Bubble ................. 31

investment allowance ............. 35 Market capitalisation ............. 142

Investment Linked Living Annuity (ILLA) . 83, 149 Market risk .................. 106

Investment Management Charges (IMC) .... 66 Masterbond ................ 85, 89

Investment Trusts ............... 55 Max DD ................... 115

Investment platform .............. 69 Max Drawdown................ 115

Investment restriction............. 131 Maximum drawdown ............. 115

Islamic investment code ........... 144 Medium Equity Funds............. 149

Mid Cap Funds ................ 144

K Milne, Jack ................ 50, 85

KYC (Know Your Client) ............ 96 Minimum Disclosure Documents...... 51, 82

Key individual ................. 87 Mining and Resources ............ 138

Key individuals................. 90 Money laundering ........... 92, 96, 97

Kickbacks ................... 60 Money market funds .......... 124, 151

King code .................. 101 Monitoring

Know Your Client (KYC) ............ 98 Risk-based ................. 97

Kok, Anton................... 82 Mono-regulated ................ 87

Morningstar ................. 108

L Multi Asset Funds ............ 142, 147

Landbank................... 127 Multi Asset – Flexible funds .......... 147

Large Cap Funds ............... 144 Multi Asset – High Equity funds........ 147

Liberty..................... 29 Multi Asset – Income funds.......... 147

Linked Investment Service Provider (LISP) . . . 82 Multi Asset – Low Equity funds ........ 147

Linked Product Companies........... 82 Multi Asset – Medium Equity funds ...... 147

Liquid asset ................. 109 Multi-Manager funds ............. 158

Liquidity ................. 53, 109 Multi-tier funds................. 64

Liquidity Risk ................. 110 Mutual fund .................. 30

livestock ................... 136

Lock-up period ................ 154 N

Long position................. 135 N-shares ................... 130

Long the market ............... 134 National Qualifications Framework (NQF) . . 23, 25

Low Equity Funds .............. 149 Nedbank .................... 29

Negotiable Certificate of Deposit (NCD) .... 127

M Nel, Hendrik (Judge) .............. 89

MDDs ..................... 82 Net Asset Value (NAV) ............. 48

MSCI ..................... 75 Notice 141 of 2015.............. 152

Malan, Daniel................. 148 Notice 52 of 2015 .............. 153

Managed ................... 138 Notice 92

Managed Prudential Funds ........... 33 MDD .................. 51, 82

Management company........... 42, 77

mandate .................... 79

Mandatory disclosures............. 72

Profile’s Unit Trusts & Collective Investments 359