Page 363 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 363

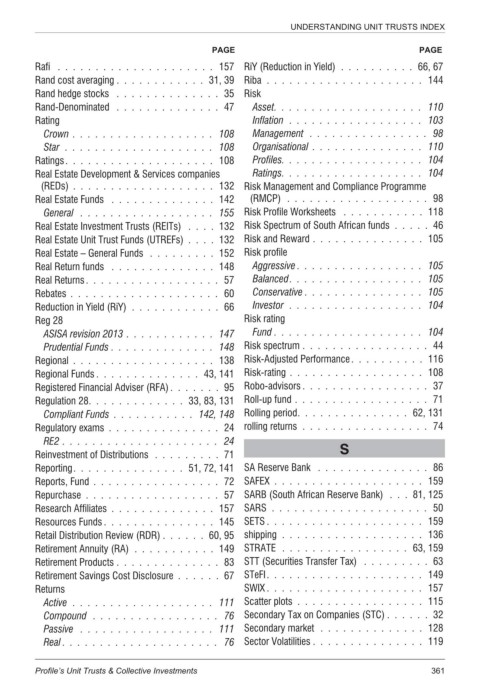

UNDERSTANDING UNIT TRUSTS INDEX

PAGE PAGE

Rafi ..................... 157 RiY (Reduction in Yield) .......... 66, 67

Rand cost averaging ............ 31, 39 Riba ..................... 144

Rand hedge stocks .............. 35 Risk

Rand-Denominated .............. 47 Asset.................... 110

Rating Inflation .................. 103

Crown ................... 108 Management ................ 98

Star .................... 108 Organisational ............... 110

Ratings.................... 108 Profiles................... 104

Real Estate Development & Services companies Ratings................... 104

(REDs) ................... 132 Risk Management and Compliance Programme

Real Estate Funds .............. 142 (RMCP) ................... 98

General .................. 155 Risk Profile Worksheets ........... 118

Real Estate Investment Trusts (REITs) .... 132 Risk Spectrum of South African funds ..... 46

Real Estate Unit Trust Funds (UTREFs) .... 132 Risk and Reward ............... 105

Real Estate – General Funds ......... 152 Risk profile

Real Return funds .............. 148 Aggressive ................. 105

Real Returns.................. 57 Balanced.................. 105

Rebates .................... 60 Conservative ................ 105

Reduction in Yield (RiY) ............ 66 Investor .................. 104

Reg 28 Risk rating

ASISA revision 2013 ............ 147 Fund .................... 104

Prudential Funds .............. 148 Risk spectrum ................. 44

Regional ................... 138 Risk-Adjusted Performance.......... 116

Regional Funds .............. 43, 141 Risk-rating .................. 108

Registered Financial Adviser (RFA) ....... 95 Robo-advisors ................. 37

Regulation 28............. 33, 83, 131 Roll-up fund .................. 71

Compliant Funds ........... 142, 148 Rolling period............... 62, 131

Regulatory exams ............... 24 rolling returns ................. 74

RE2 ..................... 24

Reinvestment of Distributions ......... 71 S

Reporting............... 51, 72, 141 SA Reserve Bank ............... 86

Reports, Fund ................. 72 SAFEX .................... 159

Repurchase .................. 57 SARB (South African Reserve Bank) . . . 81, 125

Research Affiliates .............. 157 SARS ..................... 50

Resources Funds ............... 145 SETS ..................... 159

Retail Distribution Review (RDR) ...... 60, 95 shipping ................... 136

Retirement Annuity (RA) ........... 149 STRATE ................. 63, 159

Retirement Products .............. 83 STT (Securities Transfer Tax) ......... 63

Retirement Savings Cost Disclosure ...... 67 STeFI..................... 149

Returns SWIX ..................... 157

Active ................... 111 Scatter plots ................. 115

Compound ................. 76 Secondary Tax on Companies (STC) ...... 32

Passive .................. 111 Secondary market .............. 128

Real ..................... 76 Sector Volatilities ............... 119

Profile’s Unit Trusts & Collective Investments 361