Page 325 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 325

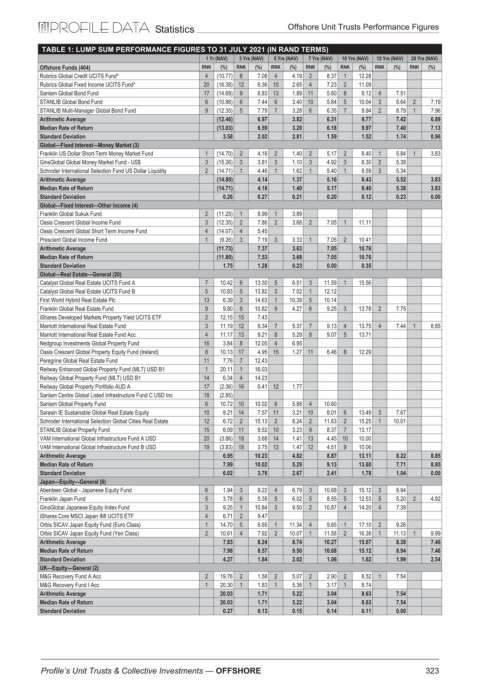

Statistics Offshore Unit Trusts Performance Figures

TABLE 1: LUMP SUM PERFORMANCE FIGURES TO 31 JULY 2021 (IN RAND TERMS)

1 Yr (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 15 Yrs (NAV) 20 Yrs (NAV)

Offshore Funds (404) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

Rubrics Global Credit UCITS Fund* 4 (10.77) 8 7.08 4 4.19 2 8.37 1 12.28

Rubrics Global Fixed Income UCITS Fund* 20 (16.38) 12 6.36 10 2.65 4 7.23 2 11.09

Sanlam Global Bond Fund 17 (14.69) 9 6.83 13 1.89 11 5.60 8 9.12 4 7.51

STANLIB Global Bond Fund 6 (10.86) 6 7.44 6 3.40 10 5.84 5 10.04 3 8.64 2 7.19

STANLIB Multi-Manager Global Bond Fund 9 (12.35) 5 7.79 7 3.28 6 6.35 7 9.94 2 8.79 1 7.96

Arithmetic Average (12.46) 6.97 3.82 6.31 9.77 7.42 6.89

Median Rate of Return (13.03) 6.59 3.20 6.18 9.97 7.40 7.13

Standard Deviation 3.58 2.02 2.81 1.59 1.52 1.74 0.96

Global—Fixed Interest—Money Market (3)

Franklin US Dollar Short-Term Money Market Fund 1 (14.70) 2 4.16 2 1.40 2 5.17 2 8.40 1 5.84 1 3.83

GinsGlobal Global Money Market Fund - US$ 3 (15.26) 3 3.81 3 1.10 3 4.92 3 8.30 2 5.38

Schroder International Selection Fund US Dollar Liquidity 2 (14.71) 1 4.46 1 1.62 1 5.40 1 8.59 3 5.34

Arithmetic Average (14.89) 4.14 1.37 5.16 8.43 5.52 3.83

Median Rate of Return (14.71) 4.16 1.40 5.17 8.40 5.38 3.83

Standard Deviation 0.26 0.27 0.21 0.20 0.12 0.23 0.00

Global—Fixed Interest—Other Income (4)

Franklin Global Sukuk Fund 2 (11.25) 1 8.99 1 3.89

Oasis Crescent Global Income Fund 3 (12.35) 2 7.86 2 3.68 2 7.05 1 11.11

Oasis Crescent Global Short Term Income Fund 4 (14.07) 4 5.45

Prescient Global Income Fund 1 (9.26) 3 7.19 3 3.33 1 7.05 2 10.41

Arithmetic Average (11.73) 7.37 3.63 7.05 10.76

Median Rate of Return (11.80) 7.53 3.68 7.05 10.76

Standard Deviation 1.75 1.28 0.23 0.00 0.35

Global—Real Estate—General (20)

Catalyst Global Real Estate UCITS Fund A 7 10.42 6 13.30 5 6.51 3 11.59 1 15.56

Catalyst Global Real Estate UCITS Fund B 5 10.83 5 13.82 3 7.02 1 12.12

First World Hybrid Real Estate Plc 13 6.39 3 14.63 1 10.39 5 10.14

Franklin Global Real Estate Fund 9 9.80 9 10.82 9 4.27 6 9.25 3 13.78 2 7.75

iShares Developed Markets Property Yield UCITS ETF 2 12.15 15 7.43

Marriott International Real Estate Fund 3 11.19 12 9.34 7 5.37 7 9.13 4 13.75 4 7.44 1 8.85

Marriott International Real Estate Fund Acc 4 11.17 13 9.21 8 5.29 8 9.07 5 13.71

Nedgroup Investments Global Property Fund 16 3.84 8 12.05 4 6.95

Oasis Crescent Global Property Equity Fund (Ireland) 8 10.13 17 4.95 15 1.27 11 6.46 8 12.29

Peregrine Global Real Estate Fund 11 7.76 7 12.43

Reitway Enhanced Global Property Fund (MLT) USD B1 1 20.11 1 16.03

Reitway Global Property Fund (MLT) USD B1 14 6.34 4 14.23

Reitway Global Property Portfolio AUD A 17 (2.36) 16 6.41 12 1.77

Sanlam Centre Global Listed Infrastructure Fund C USD Inc 18 (2.85)

Sanlam Global Property Fund 6 10.72 10 10.02 6 5.88 4 10.60

Sarasin IE Sustainable Global Real Estate Equity 10 8.21 14 7.57 11 3.21 10 8.01 6 13.49 3 7.67

Schroder International Selection Global Cities Real Estate 12 6.72 2 15.13 2 8.24 2 11.63 2 15.25 1 10.01

STANLIB Global Property Fund 15 6.09 11 9.52 10 3.23 9 8.37 7 13.17

VAM International Global Infrastructure Fund A USD 20 (3.86) 19 3.68 14 1.41 13 4.45 10 10.00

VAM International Global Infrastructure Fund B USD 19 (3.83) 18 3.75 13 1.47 12 4.51 9 10.06

Arithmetic Average 6.95 10.23 4.82 8.87 13.11 8.22 8.85

Median Rate of Return 7.99 10.02 5.29 9.13 13.60 7.71 8.85

Standard Deviation 6.02 3.76 2.67 2.41 1.78 1.04 0.00

Japan—Equity—General (6)

Aberdeen Global - Japanese Equity Fund 6 1.94 3 9.22 4 6.79 3 10.68 3 15.12 3 8.94

Franklin Japan Fund 5 3.78 6 5.35 5 6.02 5 8.55 5 12.53 5 5.20 2 4.92

GinsGlobal Japanese Equity Index Fund 3 9.25 1 10.84 3 9.50 2 10.87 4 14.20 4 7.39

iShares Core MSCI Japan IMI UCITS ETF 4 6.71 2 9.47

Orbis SICAV Japan Equity Fund (Euro Class) 1 14.70 5 6.65 1 11.34 4 9.65 1 17.10 2 9.26

Orbis SICAV Japan Equity Fund (Yen Class) 2 10.61 4 7.92 2 10.07 1 11.58 2 16.38 1 11.13 1 9.99

Arithmetic Average 7.83 8.24 8.74 10.27 15.07 8.38 7.46

Median Rate of Return 7.98 8.57 9.50 10.68 15.12 8.94 7.46

Standard Deviation 4.27 1.84 2.02 1.06 1.62 1.99 2.54

UK—Equity—General (2)

M&G Recovery Fund A Acc 2 19.76 2 1.58 2 5.07 2 2.90 2 8.52 1 7.54

M&G Recovery Fund I Acc 1 20.30 1 1.83 1 5.36 1 3.17 1 8.74

Arithmetic Average 20.03 1.71 5.22 3.04 8.63 7.54

Median Rate of Return 20.03 1.71 5.22 3.04 8.63 7.54

Standard Deviation 0.27 0.13 0.15 0.14 0.11 0.00

323

Profile’s Unit Trusts & Collective Investments — OFFSHORE