Page 324 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 324

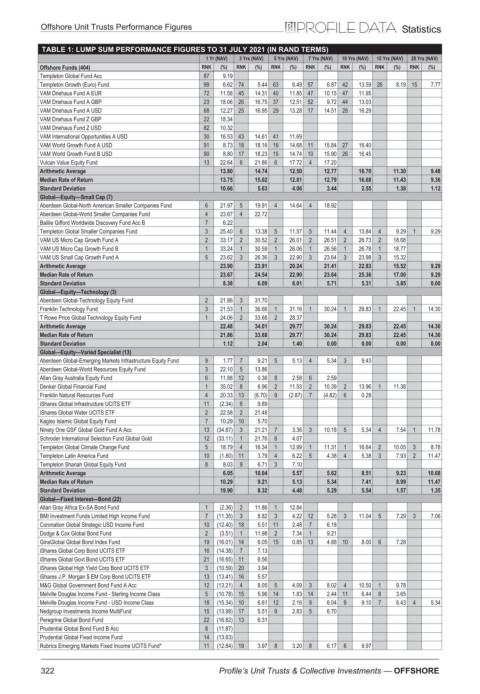

Offshore Unit Trusts Performance Figures Statistics

TABLE 1: LUMP SUM PERFORMANCE FIGURES TO 31 JULY 2021 (IN RAND TERMS)

1 Yr (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 15 Yrs (NAV) 20 Yrs (NAV)

Offshore Funds (404) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

Templeton Global Fund Acc 87 9.19

Templeton Growth (Euro) Fund 99 6.62 74 5.44 63 6.49 57 6.87 42 13.59 26 8.19 15 7.77

VAM Driehaus Fund A EUR 72 11.58 45 14.31 40 11.85 47 10.15 47 11.95

VAM Driehaus Fund A GBP 23 18.06 26 16.75 37 12.51 52 9.72 44 13.03

VAM Driehaus Fund A USD 68 12.27 25 16.95 29 13.28 17 14.51 28 16.29

VAM Driehaus Fund Z GBP 22 18.34

VAM Driehaus Fund Z USD 82 10.32

VAM International Opportunities A USD 30 16.53 43 14.61 41 11.69

VAM World Growth Fund A USD 91 8.73 18 18.16 16 14.68 11 15.84 27 16.40

VAM World Growth Fund B USD 90 8.80 17 18.23 15 14.74 10 15.90 26 16.45

Vulcan Value Equity Fund 13 22.64 6 21.86 6 17.72 4 17.20

Arithmetic Average 13.80 14.74 12.50 12.77 16.70 11.30 9.48

Median Rate of Return 13.75 15.02 12.81 12.79 16.68 11.43 9.36

Standard Deviation 10.66 5.63 4.06 3.44 2.55 1.38 1.12

Global—Equity—Small Cap (7)

Aberdeen Global-North American Smaller Companies Fund 6 21.97 5 19.91 4 14.64 4 18.92

Aberdeen Global-World Smaller Companies Fund 4 23.67 4 22.72

Baillie Gifford Worldwide Discovery Fund Acc B 7 6.22

Templeton Global Smaller Companies Fund 3 25.40 6 13.38 5 11.57 5 11.44 4 13.84 4 9.29 1 9.29

VAM US Micro Cap Growth Fund A 2 33.17 2 30.52 2 26.01 2 26.51 2 26.73 2 18.68

VAM US Micro Cap Growth Fund B 1 33.24 1 30.59 1 26.06 1 26.56 1 26.78 1 18.77

VAM US Small Cap Growth Fund A 5 23.62 3 26.36 3 22.90 3 23.64 3 23.98 3 15.32

Arithmetic Average 23.90 23.91 20.24 21.41 22.83 15.52 9.29

Median Rate of Return 23.67 24.54 22.90 23.64 25.36 17.00 9.29

Standard Deviation 8.38 6.09 6.01 5.71 5.31 3.85 0.00

Global—Equity—Technology (3)

Aberdeen Global-Technology Equity Fund 2 21.86 3 31.70

Franklin Technology Fund 3 21.53 1 36.66 1 31.16 1 30.24 1 29.83 1 22.45 1 14.30

T Rowe Price Global Technology Equity Fund 1 24.06 2 33.68 2 28.37

Arithmetic Average 22.48 34.01 29.77 30.24 29.83 22.45 14.30

Median Rate of Return 21.86 33.68 29.77 30.24 29.83 22.45 14.30

Standard Deviation 1.12 2.04 1.40 0.00 0.00 0.00 0.00

Global—Equity—Varied Specialist (13)

Aberdeen Global-Emerging Markets Infrastructure Equity Fund 9 1.77 7 9.21 5 5.13 4 5.34 3 9.43

Aberdeen Global-World Resources Equity Fund 3 22.10 5 13.86

Allan Gray Australia Equity Fund 6 11.88 12 0.36 8 2.58 6 2.59

Denker Global Financial Fund 1 35.02 8 6.96 2 11.53 2 10.39 2 13.96 1 11.38

Franklin Natural Resources Fund 4 20.33 13 (6.70) 9 (2.87) 7 (4.82) 6 0.28

iShares Global Infrastructure UCITS ETF 11 (2.34) 6 9.89

iShares Global Water UCITS ETF 2 22.58 2 21.48

Kagiso Islamic Global Equity Fund 7 10.29 10 5.70

Ninety One GSF Global Gold Fund A Acc 13 (34.87) 3 21.21 7 3.36 3 10.18 5 5.34 4 7.54 1 11.78

Schroder International Selection Fund Global Gold 12 (33.11) 1 21.76 6 4.07

Templeton Global Climate Change Fund 5 18.79 4 16.34 1 12.99 1 11.31 1 16.64 2 10.05 3 8.78

Templeton Latin America Fund 10 (1.80) 11 3.79 4 6.22 5 4.38 4 5.38 3 7.93 2 11.47

Templeton Shariah Global Equity Fund 8 8.03 9 6.71 3 7.10

Arithmetic Average 6.05 10.04 5.57 5.62 8.51 9.23 10.68

Median Rate of Return 10.29 9.21 5.13 5.34 7.41 8.99 11.47

Standard Deviation 19.90 8.32 4.48 5.29 5.54 1.57 1.35

Global—Fixed Interest—Bond (22)

Allan Gray Africa Ex-SA Bond Fund 1 (2.36) 2 11.86 1 12.84

BMI Investment Funds Limited High Income Fund 7 (11.35) 3 8.82 3 4.22 12 5.28 3 11.04 5 7.29 3 7.06

Coronation Global Strategic USD Income Fund 10 (12.40) 18 5.51 11 2.48 7 6.18

Dodge & Cox Global Bond Fund 2 (3.51) 1 11.98 2 7.34 1 9.21

GinsGlobal Global Bond Index Fund 19 (16.01) 14 6.05 15 0.85 13 4.88 10 8.00 6 7.28

iShares Global Corp Bond UCITS ETF 16 (14.38) 7 7.13

iShares Global Govt Bond UCITS ETF 21 (16.65) 11 6.56

iShares Global High Yield Corp Bond UCITS ETF 3 (10.59) 20 3.94

iShares J.P. Morgan $ EM Corp Bond UCITS ETF 13 (13.41) 16 5.57

M&G Global Government Bond Fund A Acc 12 (13.21) 4 8.05 5 4.09 3 8.02 4 10.50 1 9.78

Melville Douglas Income Fund - Sterling Income Class 5 (10.78) 15 5.96 14 1.83 14 2.44 11 6.44 8 3.65

Melville Douglas Income Fund - USD Income Class 18 (15.34) 10 6.61 12 2.16 9 6.04 9 9.10 7 6.43 4 5.34

Nedgroup Investments Income MultiFund 15 (13.98) 17 5.51 9 2.83 5 6.70

Peregrine Global Bond Fund 22 (16.82) 13 6.31

Prudential Global Bond Fund B Acc 8 (11.87)

Prudential Global Fixed Income Fund 14 (13.63)

Rubrics Emerging Markets Fixed Income UCITS Fund* 11 (12.84) 19 3.97 8 3.20 8 6.17 6 9.97

322 Profile’s Unit Trusts & Collective Investments — OFFSHORE