Page 320 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 320

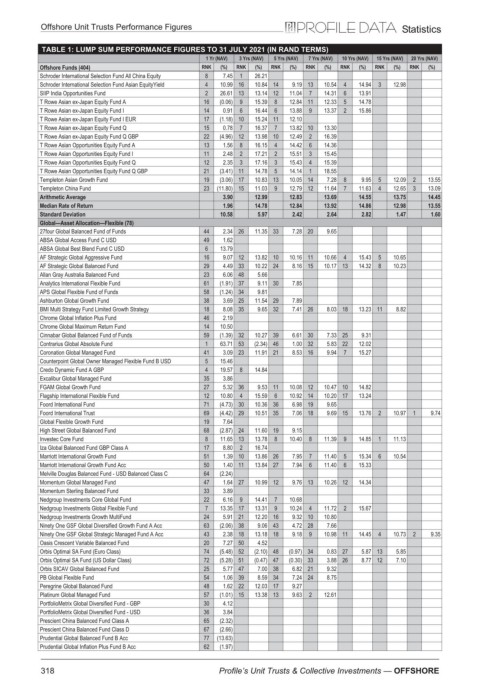

Offshore Unit Trusts Performance Figures Statistics

TABLE 1: LUMP SUM PERFORMANCE FIGURES TO 31 JULY 2021 (IN RAND TERMS)

1 Yr (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 15 Yrs (NAV) 20 Yrs (NAV)

Offshore Funds (404) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

Schroder International Selection Fund All China Equity 8 7.45 1 26.21

Schroder International Selection Fund Asian EquityYield 4 10.99 16 10.84 14 9.19 13 10.54 4 14.94 3 12.98

SIIP India Opportunities Fund 2 26.61 13 13.14 12 11.04 7 14.31 6 13.91

T Rowe Asian ex-Japan Equity Fund A 16 (0.06) 9 15.39 8 12.84 11 12.33 5 14.78

T Rowe Asian ex-Japan Equity Fund I 14 0.91 6 16.44 6 13.88 9 13.37 2 15.86

T Rowe Asian ex-Japan Equity Fund I EUR 17 (1.18) 10 15.24 11 12.10

T Rowe Asian ex-Japan Equity Fund Q 15 0.78 7 16.37 7 13.82 10 13.30

T Rowe Asian ex-Japan Equity Fund Q GBP 22 (4.96) 12 13.98 10 12.49 2 16.39

T Rowe Asian Opportunities Equity Fund A 13 1.56 8 16.15 4 14.42 6 14.36

T Rowe Asian Opportunities Equity Fund I 11 2.48 2 17.21 2 15.51 3 15.45

T Rowe Asian Opportunities Equity Fund Q 12 2.35 3 17.16 3 15.43 4 15.39

T Rowe Asian Opportunities Equity Fund Q GBP 21 (3.41) 11 14.78 5 14.14 1 18.55

Templeton Asian Growth Fund 19 (3.06) 17 10.83 13 10.05 14 7.28 8 9.95 5 12.09 2 13.55

Templeton China Fund 23 (11.80) 15 11.03 9 12.79 12 11.64 7 11.63 4 12.65 3 13.09

Arithmetic Average 3.90 12.99 12.83 13.69 14.55 13.75 14.45

Median Rate of Return 1.96 14.78 12.84 13.92 14.86 12.98 13.55

Standard Deviation 10.58 5.97 2.42 2.64 2.82 1.47 1.60

Global—Asset Allocation—Flexible (78)

27four Global Balanced Fund of Funds 44 2.34 26 11.35 33 7.28 20 9.65

ABSA Global Access Fund C USD 49 1.62

ABSA Global Best Blend Fund C USD 6 13.79

AF Strategic Global Aggressive Fund 16 9.07 12 13.82 10 10.16 11 10.66 4 15.43 5 10.65

AF Strategic Global Balanced Fund 29 4.49 33 10.22 24 8.16 15 10.17 13 14.32 8 10.23

Allan Gray Australia Balanced Fund 23 6.06 48 5.66

Analytics International Flexible Fund 61 (1.91) 37 9.11 30 7.85

APS Global Flexible Fund of Funds 58 (1.24) 34 9.81

Ashburton Global Growth Fund 38 3.69 25 11.54 29 7.89

BMI Multi Strategy Fund Limited Growth Strategy 18 8.08 35 9.65 32 7.41 26 8.03 18 13.23 11 8.82

Chrome Global Inflation Plus Fund 46 2.19

Chrome Global Maximum Return Fund 14 10.50

Cinnabar Global Balanced Fund of Funds 59 (1.39) 32 10.27 39 6.61 30 7.33 25 9.31

Contrarius Global Absolute Fund 1 63.71 53 (2.34) 46 1.00 32 5.83 22 12.02

Coronation Global Managed Fund 41 3.09 23 11.91 21 8.53 16 9.94 7 15.27

Counterpoint Global Owner Managed Flexible Fund B USD 5 15.46

Credo Dynamic Fund A GBP 4 19.57 8 14.84

Excalibur Global Managed Fund 35 3.86

FGAM Global Growth Fund 27 5.32 36 9.53 11 10.08 12 10.47 10 14.82

Flagship International Flexible Fund 12 10.80 4 15.59 6 10.92 14 10.20 17 13.24

Foord International Fund 71 (4.73) 30 10.36 36 6.98 19 9.65

Foord International Trust 69 (4.42) 29 10.51 35 7.06 18 9.69 15 13.76 2 10.97 1 9.74

Global Flexible Growth Fund 19 7.64

High Street Global Balanced Fund 68 (2.87) 24 11.60 19 9.15

Investec Core Fund 8 11.65 13 13.78 8 10.40 8 11.39 9 14.85 1 11.13

Iza Global Balanced Fund GBP Class A 17 8.80 2 16.74

Marriott International Growth Fund 51 1.39 10 13.86 26 7.95 7 11.40 5 15.34 6 10.54

Marriott International Growth Fund Acc 50 1.40 11 13.84 27 7.94 6 11.40 6 15.33

Melville Douglas Balanced Fund - USD Balanced Class C 64 (2.24)

Momentum Global Managed Fund 47 1.64 27 10.99 12 9.76 13 10.26 12 14.34

Momentum Sterling Balanced Fund 33 3.89

Nedgroup Investments Core Global Fund 22 6.16 9 14.41 7 10.68

Nedgroup Investments Global Flexible Fund 7 13.35 17 13.31 9 10.24 4 11.72 2 15.67

Nedgroup Investments Growth MultiFund 24 5.91 21 12.20 16 9.32 10 10.80

Ninety One GSF Global Diversified Growth Fund A Acc 63 (2.06) 38 9.06 43 4.72 28 7.66

Ninety One GSF Global Strategic Managed Fund A Acc 43 2.38 18 13.18 18 9.18 9 10.98 11 14.45 4 10.73 2 9.35

Oasis Crescent Variable Balanced Fund 20 7.27 50 4.52

Orbis Optimal SA Fund (Euro Class) 74 (5.48) 52 (2.10) 48 (0.97) 34 0.83 27 5.87 13 5.85

Orbis Optimal SA Fund (US Dollar Class) 72 (5.28) 51 (0.47) 47 (0.30) 33 3.88 26 8.77 12 7.10

Orbis SICAV Global Balanced Fund 25 5.77 47 7.00 38 6.82 21 9.32

PB Global Flexible Fund 54 1.06 39 8.59 34 7.24 24 8.75

Peregrine Global Balanced Fund 48 1.62 22 12.03 17 9.27

Platinum Global Managed Fund 57 (1.01) 15 13.38 13 9.63 2 12.61

PortfolioMetrix Global Diversified Fund - GBP 30 4.12

PortfolioMetrix Global Diversified Fund - USD 36 3.84

Prescient China Balanced Fund Class A 65 (2.32)

Prescient China Balanced Fund Class D 67 (2.66)

Prudential Global Balanced Fund B Acc 77 (13.63)

Prudential Global Inflation Plus Fund B Acc 62 (1.97)

318 Profile’s Unit Trusts & Collective Investments — OFFSHORE