Page 230 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 230

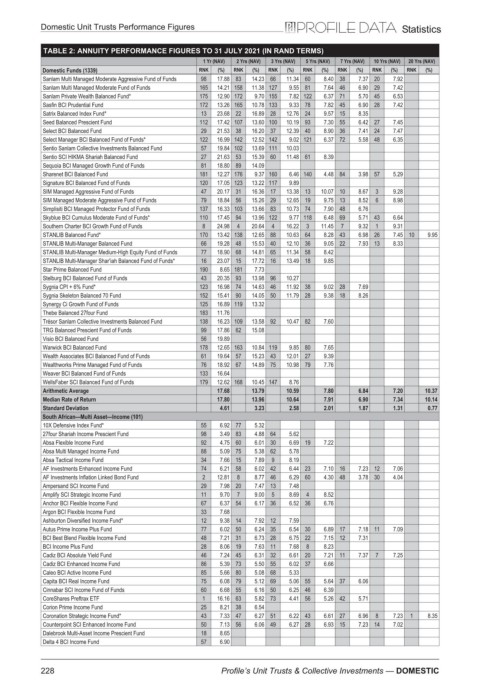

Domestic Unit Trusts Performance Figures Statistics

TABLE 2: ANNUITY PERFORMANCE FIGURES TO 31 JULY 2021 (IN RAND TERMS)

1 Yr (NAV) 2 Yrs (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 20 Yrs (NAV)

Domestic Funds (1339) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

Sanlam Multi Managed Moderate Aggressive Fund of Funds 98 17.88 83 14.23 66 11.34 60 8.40 38 7.37 20 7.92

Sanlam Multi Managed Moderate Fund of Funds 165 14.21 158 11.38 127 9.55 81 7.64 46 6.90 29 7.42

Sanlam Private Wealth Balanced Fund* 175 12.90 172 9.70 155 7.82 122 6.37 71 5.70 45 6.53

Sasfin BCI Prudential Fund 172 13.26 165 10.78 133 9.33 78 7.82 45 6.90 28 7.42

Satrix Balanced Index Fund* 13 23.68 22 16.89 28 12.76 24 9.57 15 8.35

Seed Balanced Prescient Fund 112 17.42 107 13.60 100 10.19 93 7.30 55 6.42 27 7.45

Select BCI Balanced Fund 29 21.53 38 16.20 37 12.39 40 8.90 36 7.41 24 7.47

Select Manager BCI Balanced Fund of Funds* 122 16.99 142 12.52 142 9.02 121 6.37 72 5.58 48 6.35

Sentio Sanlam Collective Investments Balanced Fund 57 19.84 102 13.69 111 10.03

Sentio SCI HIKMA Shariah Balanced Fund 27 21.63 53 15.39 60 11.48 61 8.39

Sequoia BCI Managed Growth Fund of Funds 81 18.80 89 14.09

Sharenet BCI Balanced Fund 181 12.27 176 9.37 160 6.46 140 4.48 84 3.98 57 5.29

Signature BCI Balanced Fund of Funds 120 17.05 123 13.22 117 9.89

SIM Managed Aggressive Fund of Funds 47 20.17 31 16.36 17 13.38 13 10.07 10 8.67 3 9.28

SIM Managed Moderate Aggressive Fund of Funds 79 18.84 56 15.26 29 12.65 19 9.75 13 8.52 6 8.98

Simplisiti BCI Managed Protector Fund of Funds 137 16.33 103 13.66 83 10.73 74 7.90 48 6.76

Skyblue BCI Cumulus Moderate Fund of Funds* 110 17.45 94 13.96 122 9.77 118 6.48 69 5.71 43 6.64

Southern Charter BCI Growth Fund of Funds 8 24.98 4 20.64 4 16.22 3 11.45 7 9.32 1 9.31

STANLIB Balanced Fund* 170 13.42 138 12.65 88 10.63 64 8.28 43 6.98 26 7.45 10 9.95

STANLIB Multi-Manager Balanced Fund 66 19.28 48 15.53 40 12.10 36 9.05 22 7.93 13 8.33

STANLIB Multi-Manager Medium-High Equity Fund of Funds 77 18.90 68 14.81 65 11.34 58 8.42

STANLIB Multi-Manager Shar'iah Balanced Fund of Funds* 16 23.07 15 17.72 16 13.49 18 9.85

Star Prime Balanced Fund 190 8.65 181 7.73

Stelburg BCI Balanced Fund of Funds 43 20.35 93 13.98 96 10.27

Sygnia CPI + 6% Fund* 123 16.98 74 14.63 46 11.92 38 9.02 28 7.69

Sygnia Skeleton Balanced 70 Fund 152 15.41 90 14.05 50 11.79 28 9.38 18 8.26

Synergy Ci Growth Fund of Funds 125 16.89 119 13.32

Thebe Balanced 27four Fund 183 11.76

Trésor Sanlam Collective Investments Balanced Fund 138 16.23 109 13.58 92 10.47 82 7.60

TRG Balanced Prescient Fund of Funds 99 17.86 62 15.08

Visio BCI Balanced Fund 56 19.89

Warwick BCI Balanced Fund 178 12.65 163 10.84 119 9.85 80 7.65

Wealth Associates BCI Balanced Fund of Funds 61 19.64 57 15.23 43 12.01 27 9.39

Wealthworks Prime Managed Fund of Funds 76 18.92 67 14.89 75 10.98 79 7.76

Weaver BCI Balanced Fund of Funds 133 16.64

WellsFaber SCI Balanced Fund of Funds 179 12.62 168 10.45 147 8.76

Arithmetic Average 17.68 13.79 10.59 7.80 6.84 7.20 10.37

Median Rate of Return 17.80 13.96 10.64 7.91 6.90 7.34 10.14

Standard Deviation 4.61 3.23 2.58 2.01 1.87 1.31 0.77

South African—Multi Asset—Income (101)

10X Defensive Index Fund* 55 6.92 77 5.32

27four Shariah Income Prescient Fund 98 3.49 83 4.88 64 5.62

Absa Flexible Income Fund 92 4.75 60 6.01 30 6.69 19 7.22

Absa Multi Managed Income Fund 88 5.09 75 5.38 62 5.78

Absa Tactical Income Fund 34 7.66 15 7.89 9 8.19

AF Investments Enhanced Income Fund 74 6.21 58 6.02 42 6.44 23 7.10 16 7.23 12 7.06

AF Investments Inflation Linked Bond Fund 2 12.81 8 8.77 46 6.29 60 4.30 48 3.78 30 4.04

Ampersand SCI Income Fund 29 7.98 20 7.47 13 7.48

Amplify SCI Strategic Income Fund 11 9.70 7 9.00 5 8.69 4 8.52

Anchor BCI Flexible Income Fund 67 6.37 54 6.17 36 6.52 36 6.76

Argon BCI Flexible Income Fund 33 7.68

Ashburton Diversified Income Fund* 12 9.38 14 7.92 12 7.59

Autus Prime Income Plus Fund 77 6.02 50 6.24 35 6.54 30 6.89 17 7.18 11 7.09

BCI Best Blend Flexible Income Fund 48 7.21 31 6.73 28 6.75 22 7.15 12 7.31

BCI Income Plus Fund 28 8.06 19 7.63 11 7.68 8 8.23

Cadiz BCI Absolute Yield Fund 46 7.24 45 6.31 32 6.61 20 7.21 11 7.37 7 7.25

Cadiz BCI Enhanced Income Fund 86 5.39 73 5.50 55 6.02 37 6.66

Caleo BCI Active Income Fund 85 5.66 80 5.08 68 5.33

Capita BCI Real Income Fund 75 6.08 79 5.12 69 5.06 55 5.64 37 6.06

Cinnabar SCI Income Fund of Funds 60 6.68 55 6.16 50 6.25 46 6.39

CoreShares Preftrax ETF 1 16.16 63 5.82 73 4.41 56 5.26 42 5.71

Corion Prime Income Fund 25 8.21 38 6.54

Coronation Strategic Income Fund* 43 7.33 47 6.27 51 6.22 43 6.61 27 6.96 8 7.23 1 8.35

Counterpoint SCI Enhanced Income Fund 50 7.13 56 6.06 49 6.27 28 6.93 15 7.23 14 7.02

Dalebrook Multi-Asset Income Prescient Fund 18 8.65

Delta 4 BCI Income Fund 57 6.90

228 Profile’s Unit Trusts & Collective Investments — DOMESTIC