Page 225 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 225

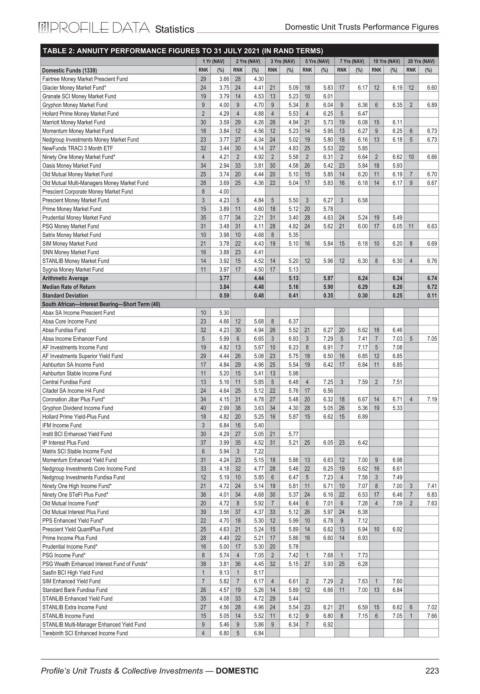

Statistics Domestic Unit Trusts Performance Figures

TABLE 2: ANNUITY PERFORMANCE FIGURES TO 31 JULY 2021 (IN RAND TERMS)

1 Yr (NAV) 2 Yrs (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 20 Yrs (NAV)

Domestic Funds (1339) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

Fairtree Money Market Prescient Fund 29 3.66 28 4.30

Glacier Money Market Fund* 24 3.75 24 4.41 21 5.09 18 5.83 17 6.17 12 6.19 12 6.60

Granate SCI Money Market Fund 19 3.79 14 4.53 13 5.23 10 6.01

Gryphon Money Market Fund 9 4.00 9 4.70 9 5.34 8 6.04 9 6.36 6 6.35 2 6.89

Hollard Prime Money Market Fund 2 4.29 4 4.88 4 5.53 4 6.25 5 6.47

Marriott Money Market Fund 30 3.59 29 4.26 26 4.94 21 5.73 19 6.08 15 6.11

Momentum Money Market Fund 18 3.84 12 4.56 12 5.23 14 5.95 13 6.27 9 6.25 6 6.73

Nedgroup Investments Money Market Fund 23 3.77 27 4.34 24 5.02 19 5.80 18 6.16 13 6.18 5 6.73

NewFunds TRACI 3 Month ETF 32 3.44 30 4.14 27 4.83 25 5.53 22 5.85

Ninety One Money Market Fund* 4 4.21 2 4.92 2 5.58 2 6.31 2 6.64 2 6.62 10 6.66

Oasis Money Market Fund 34 2.94 33 3.81 30 4.58 26 5.42 23 5.84 18 5.93

Old Mutual Money Market Fund 25 3.74 20 4.44 20 5.10 15 5.85 14 6.20 11 6.19 7 6.70

Old Mutual Multi-Managers Money Market Fund 28 3.69 25 4.36 22 5.04 17 5.83 16 6.18 14 6.17 9 6.67

Prescient Corporate Money Market Fund 8 4.00

Prescient Money Market Fund 3 4.23 5 4.84 5 5.50 3 6.27 3 6.58

Prime Money Market Fund 15 3.89 11 4.60 18 5.12 20 5.78

Prudential Money Market Fund 35 0.77 34 2.21 31 3.40 28 4.63 24 5.24 19 5.49

PSG Money Market Fund 31 3.48 31 4.11 28 4.82 24 5.62 21 6.00 17 6.05 11 6.63

Satrix Money Market Fund 10 3.98 10 4.68 8 5.35

SIM Money Market Fund 21 3.78 22 4.43 19 5.10 16 5.84 15 6.18 10 6.20 8 6.69

SNN Money Market Fund 16 3.88 23 4.41

STANLIB Money Market Fund 14 3.92 15 4.52 14 5.20 12 5.96 12 6.30 8 6.30 4 6.76

Sygnia Money Market Fund 11 3.97 17 4.50 17 5.13

Arithmetic Average 3.77 4.44 5.13 5.87 6.24 6.24 6.74

Median Rate of Return 3.84 4.48 5.16 5.90 6.29 6.20 6.72

Standard Deviation 0.59 0.48 0.41 0.35 0.30 0.25 0.11

South African—Interest Bearing—Short Term (40)

Abax SA Income Prescient Fund 10 5.30

Absa Core Income Fund 23 4.66 12 5.68 8 6.37

Absa Fundisa Fund 32 4.23 30 4.94 26 5.52 21 6.27 20 6.62 18 6.46

Absa Income Enhancer Fund 5 5.99 6 6.65 3 6.93 3 7.29 5 7.41 7 7.03 5 7.05

AF Investments Income Fund 19 4.82 13 5.67 10 6.23 8 6.91 7 7.17 5 7.08

AF Investments Superior Yield Fund 29 4.44 26 5.08 23 5.75 18 6.50 16 6.85 12 6.85

Ashburton SA Income Fund 17 4.84 29 4.96 25 5.54 19 6.42 17 6.84 11 6.85

Ashburton Stable Income Fund 11 5.20 15 5.41 13 5.98

Central Fundisa Fund 13 5.16 11 5.85 5 6.48 4 7.25 3 7.59 2 7.51

Citadel SA Income H4 Fund 24 4.64 25 5.12 22 5.76 17 6.56

Coronation Jibar Plus Fund* 34 4.15 31 4.78 27 5.48 20 6.32 18 6.67 14 6.71 4 7.19

Gryphon Dividend Income Fund 40 2.99 38 3.63 34 4.30 28 5.05 26 5.36 19 5.33

Hollard Prime Yield-Plus Fund 18 4.82 20 5.25 16 5.87 15 6.62 15 6.89

IFM Income Fund 3 6.84 16 5.40

Instit BCI Enhanced Yield Fund 30 4.29 27 5.05 21 5.77

IP Interest Plus Fund 37 3.99 35 4.52 31 5.21 25 6.05 23 6.42

Matrix SCI Stable Income Fund 6 5.94 3 7.22

Momentum Enhanced Yield Fund 31 4.24 23 5.15 18 5.86 13 6.63 12 7.00 9 6.98

Nedgroup Investments Core Income Fund 33 4.18 32 4.77 28 5.46 22 6.25 19 6.62 16 6.61

Nedgroup Investments Fundisa Fund 12 5.19 10 5.85 6 6.47 5 7.23 4 7.58 3 7.49

Ninety One High Income Fund* 21 4.72 24 5.14 19 5.81 11 6.71 10 7.07 8 7.00 3 7.41

Ninety One STeFI Plus Fund* 36 4.01 34 4.68 30 5.37 24 6.16 22 6.53 17 6.46 7 6.83

Old Mutual Income Fund* 20 4.72 8 5.92 7 6.44 6 7.01 6 7.28 4 7.09 2 7.63

Old Mutual Interest Plus Fund 39 3.56 37 4.37 33 5.12 26 5.97 24 6.38

PPS Enhanced Yield Fund* 22 4.70 18 5.30 12 5.99 10 6.78 9 7.12

Prescient Yield QuantPlus Fund 25 4.63 21 5.24 15 5.89 14 6.62 13 6.94 10 6.92

Prime Income Plus Fund 28 4.49 22 5.21 17 5.86 16 6.60 14 6.93

Prudential Income Fund* 16 5.00 17 5.30 20 5.78

PSG Income Fund* 8 5.74 4 7.05 2 7.42 1 7.68 1 7.73

PSG Wealth Enhanced Interest Fund of Funds* 38 3.81 36 4.45 32 5.15 27 5.93 25 6.28

Sasfin BCI High Yield Fund 1 9.13 1 8.17

SIM Enhanced Yield Fund 7 5.82 7 6.17 4 6.61 2 7.29 2 7.63 1 7.60

Standard Bank Fundisa Fund 26 4.57 19 5.26 14 5.89 12 6.66 11 7.00 13 6.84

STANLIB Enhanced Yield Fund 35 4.08 33 4.72 29 5.44

STANLIB Extra Income Fund 27 4.56 28 4.96 24 5.54 23 6.21 21 6.59 15 6.62 6 7.02

STANLIB Income Fund 15 5.05 14 5.52 11 6.12 9 6.80 8 7.15 6 7.05 1 7.66

STANLIB Multi-Manager Enhanced Yield Fund 9 5.46 9 5.86 9 6.34 7 6.92

Terebinth SCI Enhanced Income Fund 4 6.80 5 6.84

223

Profile’s Unit Trusts & Collective Investments — DOMESTIC