Page 228 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 228

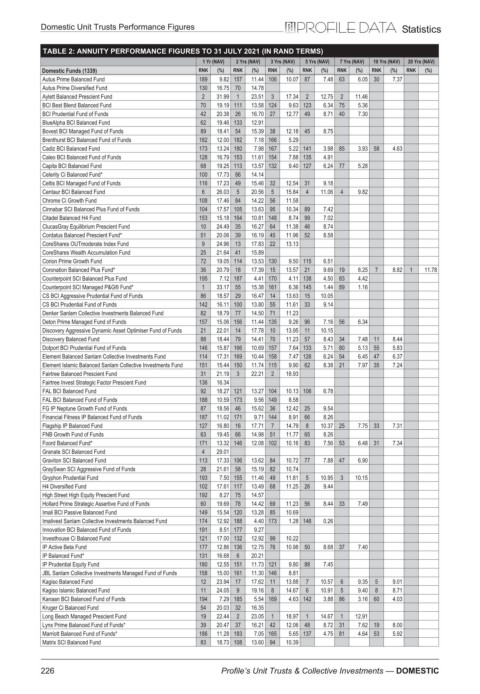

Domestic Unit Trusts Performance Figures Statistics

TABLE 2: ANNUITY PERFORMANCE FIGURES TO 31 JULY 2021 (IN RAND TERMS)

1 Yr (NAV) 2 Yrs (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 20 Yrs (NAV)

Domestic Funds (1339) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

Autus Prime Balanced Fund 189 9.82 157 11.44 106 10.07 87 7.48 63 6.05 30 7.37

Autus Prime Diversified Fund 130 16.75 70 14.78

Aylett Balanced Prescient Fund 2 31.99 1 23.51 3 17.34 2 12.75 2 11.46

BCI Best Blend Balanced Fund 70 19.19 111 13.58 124 9.63 123 6.34 75 5.36

BCI Prudential Fund of Funds 42 20.38 26 16.70 27 12.77 49 8.71 40 7.30

BlueAlpha BCI Balanced Fund 62 19.46 133 12.91

Bovest BCI Managed Fund of Funds 89 18.41 54 15.39 38 12.18 45 8.75

Brenthurst BCI Balanced Fund of Funds 182 12.00 182 7.18 166 5.29

Cadiz BCI Balanced Fund 173 13.24 180 7.98 167 5.22 141 3.98 85 3.93 58 4.63

Caleo BCI Balanced Fund of Funds 128 16.79 153 11.61 154 7.88 135 4.91

Capita BCI Balanced Fund 68 19.25 113 13.57 132 9.40 127 6.24 77 5.28

Celerity Ci Balanced Fund* 100 17.73 86 14.14

Celtis BCI Managed Fund of Funds 116 17.23 49 15.46 32 12.54 31 9.18

Centaur BCI Balanced Fund 6 26.03 5 20.56 5 15.84 4 11.06 4 9.82

Chrome Ci Growth Fund 108 17.46 84 14.22 56 11.58

Cinnabar SCI Balanced Plus Fund of Funds 104 17.57 105 13.63 95 10.34 89 7.42

Citadel Balanced H4 Fund 153 15.18 164 10.81 148 8.74 99 7.02

ClucasGray Equilibrium Prescient Fund 10 24.49 35 16.27 64 11.38 46 8.74

Cordatus Balanced Prescient Fund* 51 20.06 39 16.19 45 11.96 52 8.58

CoreShares OUTmoderate Index Fund 9 24.96 13 17.83 22 13.13

CoreShares Wealth Accumulation Fund 25 21.64 41 15.89

Corion Prime Growth Fund 72 19.05 114 13.53 130 9.50 115 6.51

Coronation Balanced Plus Fund* 36 20.79 18 17.39 15 13.57 21 9.69 19 8.25 7 8.82 1 11.78

Counterpoint SCI Balanced Plus Fund 195 7.12 187 4.41 170 4.11 138 4.50 83 4.42

Counterpoint SCI Managed P&G® Fund* 1 33.17 55 15.38 161 6.36 145 1.44 89 1.16

CS BCI Aggressive Prudential Fund of Funds 86 18.57 29 16.47 14 13.63 15 10.05

CS BCI Prudential Fund of Funds 142 16.11 100 13.80 55 11.61 33 9.14

Denker Sanlam Collective Investments Balanced Fund 82 18.79 77 14.50 71 11.23

Deton Prime Managed Fund of Funds 157 15.06 156 11.44 135 9.26 96 7.16 56 6.34

Discovery Aggressive Dynamic Asset Optimiser Fund of Funds 21 22.01 14 17.78 10 13.95 11 10.15

Discovery Balanced Fund 88 18.44 79 14.41 70 11.23 57 8.43 34 7.48 11 8.44

Dotport BCI Prudential Fund of Funds 146 15.87 166 10.69 157 7.64 133 5.71 80 5.13 55 5.83

Element Balanced Sanlam Collective Investments Fund 114 17.31 169 10.44 158 7.47 126 6.24 54 6.45 47 6.37

Element Islamic Balanced Sanlam Collective Investments Fund 151 15.44 150 11.74 115 9.90 62 8.38 21 7.97 35 7.24

Fairtree Balanced Prescient Fund 31 21.19 3 22.21 2 18.93

Fairtree Invest Strategic Factor Prescient Fund 136 16.34

FAL BCI Balanced Fund 92 18.27 121 13.27 104 10.13 106 6.78

FAL BCI Balanced Fund of Funds 188 10.59 173 9.56 149 8.58

FG IP Neptune Growth Fund of Funds 87 18.56 46 15.62 36 12.42 25 9.54

Financial Fitness IP Balanced Fund of Funds 187 11.02 171 9.71 144 8.91 66 8.26

Flagship IP Balanced Fund 127 16.80 16 17.71 7 14.79 8 10.37 25 7.75 33 7.31

FNB Growth Fund of Funds 63 19.45 66 14.98 51 11.77 65 8.26

Foord Balanced Fund* 171 13.32 146 12.08 102 10.16 83 7.56 53 6.48 31 7.34

Granate SCI Balanced Fund 4 29.01

Graviton SCI Balanced Fund 113 17.33 106 13.62 84 10.72 77 7.88 47 6.90

GraySwan SCI Aggressive Fund of Funds 28 21.61 58 15.19 82 10.74

Gryphon Prudential Fund 193 7.50 155 11.46 49 11.81 5 10.95 3 10.15

H4 Diversified Fund 102 17.61 117 13.49 68 11.25 26 9.44

High Street High Equity Prescient Fund 192 8.27 75 14.57

Hollard Prime Strategic Assertive Fund of Funds 60 19.69 78 14.42 69 11.23 56 8.44 33 7.49

Imali BCI Passive Balanced Fund 149 15.54 120 13.28 85 10.69

Imalivest Sanlam Collective Investments Balanced Fund 174 12.92 188 4.40 173 1.28 146 0.26

Innovation BCI Balanced Fund of Funds 191 8.51 177 9.27

Investhouse Ci Balanced Fund 121 17.00 132 12.92 99 10.22

IP Active Beta Fund 177 12.86 136 12.75 76 10.98 50 8.68 37 7.40

IP Balanced Fund* 131 16.68 6 20.21

IP Prudential Equity Fund 180 12.55 151 11.73 121 9.80 88 7.45

JBL Sanlam Collective Investments Managed Fund of Funds 158 15.00 161 11.30 146 8.81

Kagiso Balanced Fund 12 23.94 17 17.62 11 13.88 7 10.57 6 9.35 5 9.01

Kagiso Islamic Balanced Fund 11 24.05 9 19.16 8 14.67 6 10.91 5 9.40 8 8.71

Kanaan BCI Balanced Fund of Funds 194 7.29 185 5.54 169 4.63 142 3.88 86 3.16 60 4.03

Kruger Ci Balanced Fund 54 20.03 32 16.35

Long Beach Managed Prescient Fund 19 22.44 2 23.05 1 18.97 1 14.67 1 12.91

Lynx Prime Balanced Fund of Funds* 39 20.47 37 16.21 42 12.06 48 8.72 31 7.62 19 8.00

Marriott Balanced Fund of Funds* 186 11.28 183 7.05 165 5.65 137 4.75 81 4.64 53 5.92

Matrix SCI Balanced Fund 83 18.73 108 13.60 94 10.39

226 Profile’s Unit Trusts & Collective Investments — DOMESTIC