Page 359 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 359

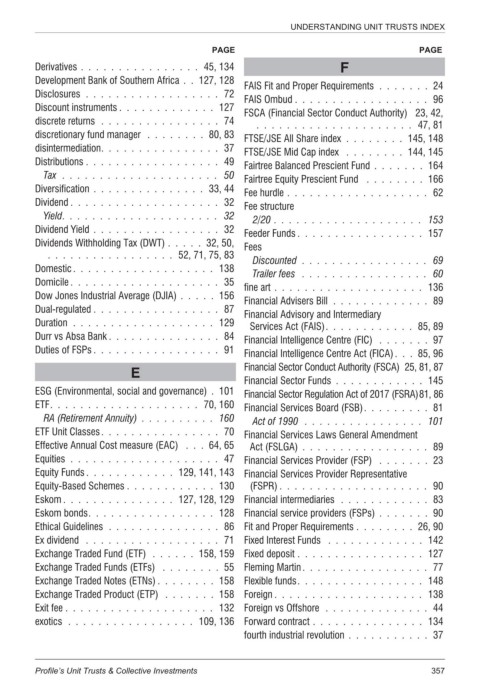

UNDERSTANDING UNIT TRUSTS INDEX

PAGE PAGE

Derivatives ................ 45, 134 F

Development Bank of Southern Africa . . 127, 128

FAIS Fit and Proper Requirements ....... 24

Disclosures .................. 72

FAIS Ombud .................. 96

Discount instruments ............. 127

FSCA (Financial Sector Conduct Authority) 23, 42,

discrete returns ................ 74 ..................... 47, 81

discretionary fund manager ........ 80, 83 FTSE/JSE All Share index ........ 145, 148

disintermediation................ 37

FTSE/JSE Mid Cap index ........ 144, 145

Distributions .................. 49 Fairtree Balanced Prescient Fund ....... 164

Tax ..................... 50 Fairtree Equity Prescient Fund ........ 166

Diversification ............... 33, 44

Fee hurdle ................... 62

Dividend .................... 32

Fee structure

Yield..................... 32 2/20 .................... 153

Dividend Yield ................. 32 Feeder Funds ................. 157

Dividends Withholding Tax (DWT) ..... 32, 50,

Fees

................. 52, 71, 75, 83

Discounted ................. 69

Domestic................... 138

Trailer fees ................. 60

Domicile .................... 35

fine art .................... 136

Dow Jones Industrial Average (DJIA) ..... 156

Financial Advisers Bill ............. 89

Dual-regulated ................. 87

Financial Advisory and Intermediary

Duration ................... 129 Services Act (FAIS)............ 85, 89

Durr vs Absa Bank ............... 84 Financial Intelligence Centre (FIC) ....... 97

Duties of FSPs ................. 91 Financial Intelligence Centre Act (FICA). . . 85, 96

Financial Sector Conduct Authority (FSCA) 25, 81, 87

E

Financial Sector Funds ............ 145

ESG (Environmental, social and governance) . 101 Financial Sector Regulation Act of 2017 (FSRA)81, 86

ETF.................... 70, 160 Financial Services Board (FSB)......... 81

RA (Retirement Annuity) .......... 160 Act of 1990 ................ 101

ETF Unit Classes................ 70 Financial Services Laws General Amendment

Effective Annual Cost measure (EAC) . . . 64, 65 Act (FSLGA) ................. 89

Equities .................... 47 Financial Services Provider (FSP) ....... 23

Equity Funds ............ 129, 141, 143 Financial Services Provider Representative

Equity-Based Schemes ............ 130 (FSPR) .................... 90

Eskom ............... 127, 128, 129 Financial intermediaries ............ 83

Eskom bonds................. 128 Financial service providers (FSPs) ....... 90

Ethical Guidelines ............... 86 Fit and Proper Requirements ........ 26, 90

Ex dividend .................. 71 Fixed Interest Funds ............. 142

Exchange Traded Fund (ETF) ...... 158, 159 Fixed deposit ................. 127

Exchange Traded Funds (ETFs) ........ 55 Fleming Martin................. 77

Exchange Traded Notes (ETNs) ........ 158 Flexible funds................. 148

Exchange Traded Product (ETP) ....... 158 Foreign .................... 138

Exit fee .................... 132 Foreign vs Offshore .............. 44

exotics ................. 109, 136 Forward contract ............... 134

fourth industrial revolution ........... 37

Profile’s Unit Trusts & Collective Investments 357