Page 358 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 358

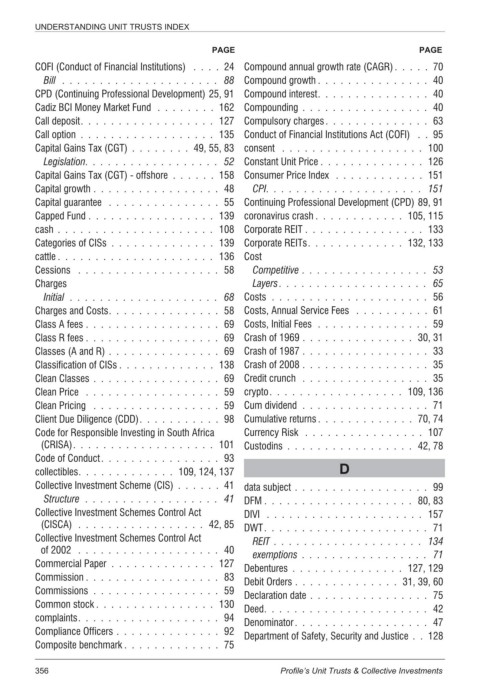

UNDERSTANDING UNIT TRUSTS INDEX

PAGE PAGE

COFI (Conduct of Financial Institutions) .... 24 Compound annual growth rate (CAGR)..... 70

Bill ..................... 88 Compound growth ............... 40

CPD (Continuing Professional Development) 25, 91 Compound interest............... 40

Cadiz BCI Money Market Fund ........ 162 Compounding ................. 40

Call deposit.................. 127 Compulsory charges.............. 63

Call option .................. 135 Conduct of Financial Institutions Act (COFI) . . 95

Capital Gains Tax (CGT) ........ 49, 55, 83 consent ................... 100

Legislation.................. 52 Constant Unit Price .............. 126

Capital Gains Tax (CGT) - offshore ...... 158 Consumer Price Index ............ 151

Capital growth ................. 48 CPI..................... 151

Capital guarantee ............... 55 Continuing Professional Development (CPD) 89, 91

Capped Fund ................. 139 coronavirus crash ............ 105, 115

cash ..................... 108 Corporate REIT ................ 133

Categories of CISs .............. 139 Corporate REITs............. 132, 133

cattle ..................... 136 Cost

Cessions ................... 58 Competitive ................. 53

Charges Layers.................... 65

Initial .................... 68 Costs ..................... 56

Charges and Costs............... 58 Costs, Annual Service Fees .......... 61

Class A fees .................. 69 Costs, Initial Fees ............... 59

Class R fees .................. 69 Crash of 1969 ............... 30, 31

Classes (A and R) ............... 69 Crash of 1987 ................. 33

Classification of CISs ............. 138 Crash of 2008 ................. 35

Clean Classes ................. 69 Credit crunch ................. 35

Clean Price .................. 59 crypto.................. 109, 136

Clean Pricing ................. 59 Cum dividend ................. 71

Client Due Diligence (CDD)........... 98 Cumulative returns ............. 70, 74

Code for Responsible Investing in South Africa Currency Risk ................ 107

(CRISA)................... 101 Custodins ................. 42, 78

Code of Conduct................ 93

collectibles............. 109, 124, 137 D

Collective Investment Scheme (CIS) ...... 41 data subject .................. 99

Structure .................. 41 DFM .................... 80, 83

Collective Investment Schemes Control Act DIVI ..................... 157

(CISCA) ................. 42, 85 DWT...................... 71

Collective Investment Schemes Control Act REIT .................... 134

of 2002 ................... 40

exemptions ................. 71

Commercial Paper .............. 127

Debentures ............... 127, 129

Commission .................. 83

Debit Orders .............. 31, 39, 60

Commissions ................. 59

Declaration date ................ 75

Common stock ................ 130

Deed...................... 42

complaints................... 94

Denominator.................. 47

Compliance Officers .............. 92

Department of Safety, Security and Justice . . 128

Composite benchmark ............. 75

356 Profile’s Unit Trusts & Collective Investments