Page 357 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 357

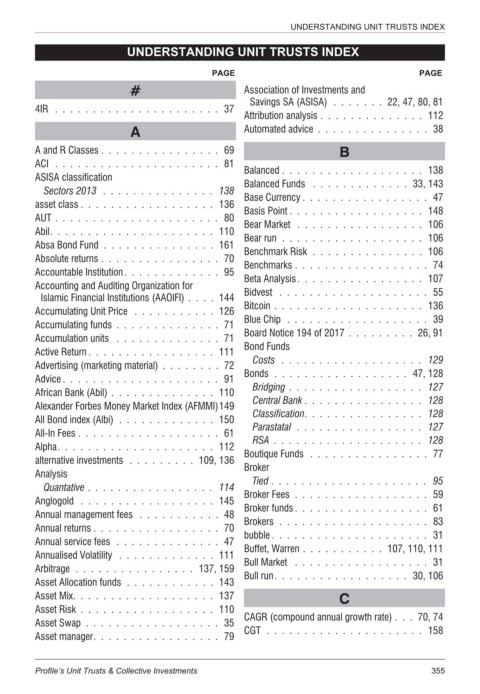

UNDERSTANDING UNIT TRUSTS INDEX

UNDERSTANDING UNIT TRUSTS INDEX

UNDERSTANDING UNIT TRUSTS INDEX

PAGE PAGE

# Association of Investments and

Savings SA (ASISA) ....... 22, 47, 80, 81

4IR ...................... 37

Attribution analysis .............. 112

A Automated advice ............... 38

A and R Classes ................ 69 B

ACI ...................... 81

Balanced ................... 138

ASISA classification

Balanced Funds ............. 33, 143

Sectors 2013 ............... 138

Base Currency ................. 47

asset class .................. 136 Basis Point .................. 148

AUT ...................... 80

Bear Market ................. 106

Abil...................... 110

Bear run ................... 106

Absa Bond Fund ............... 161

Benchmark Risk ............... 106

Absolute returns ................ 70

Benchmarks .................. 74

Accountable Institution............. 95

Beta Analysis................. 107

Accounting and Auditing Organization for Bidvest .................... 55

Islamic Financial Institutions (AAOIFI) .... 144

Bitcoin .................... 136

Accumulating Unit Price ........... 126

Blue Chip ................... 39

Accumulating funds .............. 71

Accumulation units .............. 71 Board Notice 194 of 2017 ......... 26, 91

Bond Funds

Active Return ................. 111

Costs ................... 129

Advertising (marketing material) ........ 72

Advice ..................... 91 Bonds .................. 47, 128

Bridging .................. 127

African Bank (Abil) .............. 110

Central Bank ................ 128

Alexander Forbes Money Market Index (AFMMI)149

Classification................ 128

All Bond index (Albi) ............. 150

Parastatal ................. 127

All-In Fees ................... 61

RSA .................... 128

Alpha..................... 112

Boutique Funds ................ 77

alternative investments ......... 109, 136

Analysis Broker

Tied ..................... 95

Quantative ................. 114

Broker Fees .................. 59

Anglogold .................. 145

Annual management fees ........... 48 Broker funds.................. 61

Brokers .................... 83

Annual returns ................. 70

bubble ..................... 31

Annual service fees .............. 47

Buffet, Warren ........... 107, 110, 111

Annualised Volatility ............. 111

Bull Market .................. 31

Arbitrage ................ 137, 159

Bull run.................. 30, 106

Asset Allocation funds ............ 143

Asset Mix................... 137 C

Asset Risk .................. 110

CAGR (compound annual growth rate) . . . 70, 74

Asset Swap .................. 35

CGT ..................... 158

Asset manager................. 79

Profile’s Unit Trusts & Collective Investments 355