Page 206 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 206

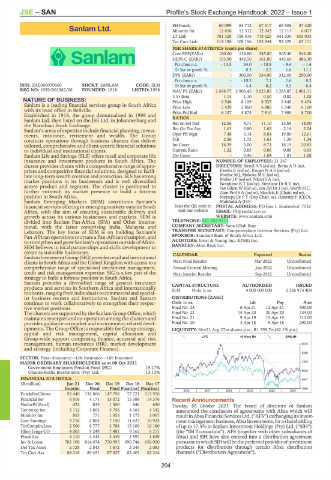

JSE – SAN Profile’s Stock Exchange Handbook: 2022 – Issue 1

SH Funds 60 099 64 712 67 317 69 506 57 420

Sanlam Ltd. Minority Int 12 656 12 512 12 043 12 111 6 017

LT Liab 781 328 758 416 718 625 641 630 603 035

SAN

Tot Curr Liab 114 196 108 156 102 244 92 329 67 111

PER SHARE STATISTICS (cents per share)

Core EPS(ZARc) 180.00 138.80 345.80 565.40 544.40

HEPS-C (ZARc) 193.90 448.50 361.80 445.60 486.30

Pct chng p.a. - 13.5 24.0 - 18.8 - 8.4 - 1.4

Tr 5yr av grwth % - 0.3 - 2.2 1.6 11.1

DPS (ZARc) - 300.00 334.00 312.00 290.00

Pct chng p.a. - - 10.2 7.1 7.6 8.2

ISIN: ZAE000070660 SHORT: SANLAM CODE: SLM Tr 5yr av grwth % - 4.4 8.2 9.3 6.4

REG NO: 1959/001562/06 FOUNDED: 1918 LISTED: 1998 NAV PS (ZARc) 2 698.77 2 906.45 3 023.85 3 285.87 2 801.11

3 Yr Beta 1.15 1.10 0.50 0.82 1.08

NATURE OF BUSINESS: Price High 6 546 8 109 8 525 9 849 9 474

Sanlam is a leading financial services group in South Africa Price Low 5 439 3 850 6 886 6 540 6 100

with its head office in Bellville. Price Prd End 6 137 5 875 7 910 7 980 8 700

Established in 1918, the group demutualised in 1998 and

Sanlam Ltd. then listed on the JSE Ltd. in Johannesburg and RATIOS

the Namibian Stock Exchange. Ret on SH Fnd 12.56 4.71 11.10 15.69 18.90

Sanlam’s areas of expertise include financial planning, invest- Ret On Tot Ass 1.61 0.80 1.65 2.14 2.24

ments, insurance, retirement and wealth. The Group Oper Pft Mgn 7.48 3.14 8.84 19.80 12.61

conducts operations through business clusters that deliver D:E 2.56 1.72 1.61 1.20 1.24

tailored, comprehensive and client-centric financial solutions Int Cover 16.39 5.00 8.71 18.19 20.83

to individual and institutional clients. Current Ratio 1.32 0.85 0.86 0.89 0.93

Sanlam Life and Savings (SLS) offers retail and corporate life Div Cover - 0.46 1.04 1.81 1.88

insurance and investment products in South Africa. The NUMBER OF EMPLOYEES: 21 267

cluster provides clients with a comprehensive range of appro- DIRECTORS: Birrell A S (ind ne), BothaAD(ne),

priate and competitive financial solutions, designed to facili- Essoka E (ind ne), Kruger N A S (ind ne),

tate long-term wealth creation and protection. SLS has strong Modise M J, Mokoka M G (ind ne),

market positions in its businesses and is well diversified Moller J P (ind ne), Nkosi S A (ne),

Nondumo K T (ind ne), Simelane Dr R V (ne),

across product and segment. The cluster is positioned to van Biljon W (ind ne), van Zyl Dr J (ne), Werth H C,

further entrench its market presence to build a fortress Zinn Prof S A (ind ne), Masilela E (Chair, ind ne),

position in South Africa. Motsepe Dr P T (Dep Chair, ne), Hanratty P (CEO),

Sanlam Emerging Markets (SEM) constitutes Sanlam’s Mukhuba A (FD)

financial services offering in emerging markets outside South Scan the QR code to POSTAL ADDRESS: PO Box 1, Sanlamhof, 7532

Africa, with the aim of ensuring sustainable delivery and visit our website EMAIL: IR@sanlam.co.za

growth across its various businesses and markets. SEM is WEBSITE: www.sanlam.com

divided into Sanlam Pan-Africa (SPA) and Other Interna- TELEPHONE: 021-947-9111

tional, with the latter comprising India, Malaysia and COMPANY SECRETARY: Sana-Ullah Bray

Lebanon. The key focus of SEM is on building Sanlam’s TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Pan-African operations to create a Pan-African champion, and SPONSOR: Standard Bank of South Africa Ltd.

to strengthen and grow Sanlam’s operations outside of Africa. AUDITORS: Ernst & Young Inc., KPMG Inc.

SEM believes in local partnerships and skills development to BANKERS: Absa Bank Ltd.

create sustainable businesses. CALENDAR Expected Status

SanlamInvestmentGroup(SIG)providesretailandinstitutional

clients in South Africa and the United Kingdom with access to a Next Final Results Mar 2022 Unconfirmed

comprehensive range of specialised investment management, Annual General Meeting Jun 2022 Unconfirmed

credit and risk management expertise. SIG is a key part of the Next Interim Results Sep 2022 Unconfirmed

strategy to build a fortress position in South Africa.

Santam provides a diversified range of general insurance CAPITAL STRUCTURE AUTHORISED ISSUED

products and services in Southern Africa and internationally SLM Ords 1c ea 4 000 000 000 2 226 974 408

toclients,rangingfromindividuals tocommercialandspecial-

ist business owners and institutions. Sanlam and Santam DISTRIBUTIONS [ZARc]

continue to work collaboratively to strengthen their respec- Ords 1c ea Ldt Pay Amt

tive market positions. Final No 23 6 Apr 21 12 Apr 21 300.00

The clusters are supported by the Sanlam Group Office, which Final No 22 14 Apr 20 20 Apr 20 334.00

maintains synergies and co-operation among the clusters and Final No 21 9 Apr 19 15 Apr 19 312.00

provides guidance on market and environment-related devel- Final No 20 3 Apr 18 9 Apr 18 290.00

opments. The Group Office is responsible for Group strategy, LIQUIDITY: Nov21 Avg 27m shares p.w., R1 595.7m(62.1% p.a.)

capital and risk management, capital allocation and

Group-wide support comprising finance, actuarial and risk LIFE 40 Week MA SANLAM

management, human resources (HR), market development 9570

and strategy (including Corporate Finance).

8389

SECTOR: Fins—Insurance—Life Insurance—Life Insurance

MAJOR ORDINARY SHAREHOLDERS as at 08 Oct 2021 7208

Government Employees Pension Fund (PIC) 15.17%

Ubuntu-Botho Investments (Pty) Ltd. 13.13% 6028

FINANCIAL STATISTICS 4847

(R million) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17

Interim Final Final Final(rst) Final(rst) 3666

2016 | 2017 | 2018 | 2019 | 2020 | 2021

FundsFmClients 92 440 132 866 147 796 77 721 113 976

Financial Ser 6 916 4 171 13 072 15 388 14 376 Recent Announcements

NetIntPd(Rcvd) 422 835 1 500 846 690 Tuesday, 05 October 2021: The board of directors of Sanlam

Tax on op inc 3 112 3 805 5 756 4 164 4 342 announced the conclusion of agreements with Absa which will

Minority Int 853 771 1 655 1 175 1 067 resultinAbsaFinancialServicesLtd.(“AFS”)exchangingitsinvest-

Core Earnings 3 716 2 863 7 150 11 627 10 923 mentmanagementbusiness,AbsaInvestments,forashareholding

TotCompIncLoss 2 506 6 777 3 788 15 100 10 180 of up to 17.5% in Sanlam Investment Holdings (Pty) Ltd. (“SIH”)

Hline Erngs-CO 4 003 9 249 7 481 9 162 9 757 (the “IM Transaction”). AFS (together with other subsidiaries of

Fixed Ass 4 110 4 344 3 449 3 597 1 839 Absa) and SIH have also entered into a distribution agreement

Inv & Loans 782 108 814 074 770 995 690 744 656 020 pursuanttowhichSIHwillbethepreferredproviderofinvestment

Def Tax Asset 2 728 2 843 1 872 2 249 2 083 products for distribution through certain Absa distribution

Tot Curr Ass 88 218 89 451 87 627 82 403 62 314 channels (“Distribution Agreement”).

204