Page 199 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 199

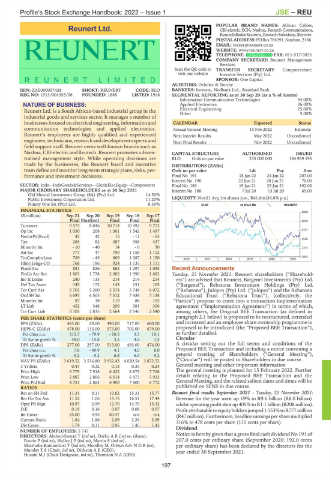

Profile’s Stock Exchange Handbook: 2022 – Issue 1 JSE – REU

POPULAR BRAND NAMES: African Cables,

Reunert Ltd. CBI-electric, ECN, Nashua, Reutech Communications,

ReutechRadarSystems,ReutechSolutions,Skywire

REU

POSTALADDRESS:POBox784391,Sandton,2146

EMAIL: invest@reunert.co.za

WEBSITE: www.reunert.co.za

TELEPHONE: 011-517-9000 FAX: 011-517-9035

COMPANY SECRETARY: Reunert Management

Services

Scan the QR code to TRANSFER SECRETARY: Computershare

visit our website Investor Services (Pty) Ltd.

SPONSOR: One Capital

AUDITORS: Deloitte & Touche

ISIN: ZAE000057428 SHORT: REUNERT CODE: RLO BANKERS: Investec, Nedbank Ltd., Standard Bank

REG NO: 1913/004355/06 FOUNDED: 1888 LISTED: 1948 SEGMENTAL REPORTING as at 30 Sep 20 (asa%of Assets)

Information Communication Technologies 44.00%

NATURE OF BUSINESS: Applied Electronics 26.00%

Reunert Ltd. is a South African-based industrial group in the Electrical Engineering 25.00%

5.00%

Other

industrial goods and services sector. It manages a number of

businesses focused on electrical engineering, information and CALENDAR Expected Status

communication technologies and applied electronics. Annual General Meeting 15 Feb 2022 Estimate

Reunert’s employees are highly qualified and experienced Next Interim Results May 2022 Unconfirmed

engineers, technicians, research and developmentexperts and Next Final Results Nov 2022 Unconfirmed

field support staff. Reunert owns well-known brands such as

Nashua, CBI-electric and Reutech. Reunert promotes a decen- CAPITAL STRUCTURE AUTHORISED ISSUED

tralised management style. While operating decisions are RLO Ords no par value 235 000 000 184 969 196

made by the businesses, the Reunert board and executive DISTRIBUTIONS [ZARc]

team define and monitor long-term strategic plans, risks, per- Ords no par value Ldt Pay Amt

formance and investment decisions. Final No 191 18 Jan 22 24 Jan 22 207.00

Interim No 190 22 Jun 21 28 Jun 21 70.00

SECTOR: Inds—IndsGoods&Services—Elec&ElecEquip—Components Final No 189 19 Jan 21 25 Jan 21 192.00

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2021 Interim No 188 7 Jul 20 13 Jul 20 65.00

Old Mutual Investment Group (SA) (Pty) Ltd. 14.50%

Public Investment Corporation Ltd. 11.20% LIQUIDITY: Nov21 Avg 1m shares p.w., R61.8m(36.8% p.a.)

Ninety One SA (Pty) Ltd. 8.30% ELEE 40 Week MA REUNERT

FINANCIAL STATISTICS

8200

(R million) Sep 21 Sep 20 Sep 19 Sep 18 Sep 17

Final Final(rst) Final Final Final 6979

Turnover 9 575 8 046 10 714 10 492 9 773

Op Inc 1 050 208 1 361 1 542 1 497 5757

NetIntPd(Rcvd) 42 42 15 - 11 - 65

4536

Tax 265 82 387 358 437

Minority Int - 10 - 40 14 - 6 30 3314

Att Inc 777 47 790 1 158 1 112

TotCompIncLoss 769 - 49 809 1 087 1 150 2016 | 2017 | 2018 | 2019 | 2020 | 2021 2093

Hline Erngs-CO 768 186 924 1 135 1 111

Fixed Ass 881 826 862 1 297 1 095 Recent Announcements

FinCo Acc Rec 1 803 1 778 2 082 1 990 1 682 Tuesday, 23 November 2021: Reunert shareholders (“Sharehold-

Inv & Loans 240 135 214 214 214 ers”) are advised that Reunert, Bargenel Investments (Pty) Ltd.

Def Tax Asset 145 172 143 151 105 (“Bargenel”), Rebatona Investment Holdings (Pty) Ltd.

Tot Curr Ass 5 703 5 260 5 574 5 748 6 072 (“Rebatona”), Julopro (Pty) Ltd. (“Julopro”) and the Rebatona

Ord SH Int 6 695 6 505 7 312 7 438 7 138 Educational Trust (“Rebatona Trust”), (collectively, the

Minority Int 87 38 119 88 105 “Parties”) propose to enter into a transaction implementation

LT Liab 452 348 209 381 306 agreement (“Implementation Agreement”) in terms of which,

Tot Curr Liab 3 103 2 835 2 664 2 546 2 540 among others, the Original BEE Transaction (as defined in

PER SHARE STATISTICS (cents per share) paragraph 2.1 below) is proposed to be restructured, extended

EPS (ZARc) 483.00 29.00 490.00 717.00 680.00 and increased and an employee share ownership programme is

HEPS-C (ZARc) 478.00 115.00 573.00 703.00 679.00 proposed to be introduced (the “Proposed BEE Transaction”),

Pct chng p.a. 315.7 - 79.9 - 18.5 3.5 19.1 as further detailed.

Tr 5yr av grwth % 48.0 - 15.8 3.5 4.5 1.5 Circular

DPS (ZARc) 277.00 257.00 513.00 493.00 474.00 A circular setting out the full terms and conditions of the

Pct chng p.a. 7.8 - 49.9 4.1 4.0 8.0 Proposed BEE Transaction and including a notice convening a

Tr 5yr av grwth % - 5.2 - 5.2 6.8 6.0 5.2 general meeting of Shareholders (“General Meeting”),

NAV PS (ZARc) 3 619.52 3 516.80 3 952.43 4 020.54 3 872.52 (“Circular”) will be posted to Shareholders in due course.

3 Yr Beta 0.47 0.32 0.13 0.35 0.24 General meeting and other important information

Price High 5 779 7 918 8 422 8 875 7 768 The general meeting is planned for 15 February 2022. Further

Price Low 2 887 2 806 6 014 6 473 5 933 details relating to the Proposed BEE Transaction and the

General Meeting, and the related salient dates and times will be

Price Prd End 4 751 2 863 6 900 7 600 6 772

RATIOS published on SENS in due course.

Ret on SH Fnd 11.31 0.11 10.82 15.31 15.77 Reunert final results September 2021 - Tuesday, 23 November 2021:

Ret On Tot Ass 11.52 1.06 15.15 16.51 17.44 Revenuefor theyearwentup19% to R9.6 billion (R8.0 billion)

Oper Pft Mgn 10.97 2.59 12.70 14.70 15.32 whilst operating profit shot up 405% to R1.1 billion (R208 million).

D:E 0.19 0.16 0.07 0.08 0.07 Profitattributabletoequityholdersjumped1553%toR777million

Int Cover 25.00 4.95 80.47 n/a n/a (R47million).Furthermore,headlineearningspersharemultiplied

Current Ratio 1.84 1.86 2.09 2.26 2.39 316% to 478 cents per share (115 cents per share).

Div Cover 1.74 0.11 0.96 1.45 1.43

NUMBER OF EMPLOYEES: 5 747 Dividend

DIRECTORS: Abdool-Samad T (ind ne), DarkoAB(ind ne, Ghana), Notice is hereby given that a gross final cash dividend No 191 of

Fourie P (ind ne), HulleyJP(ind ne), Martin S (ind ne), 207.0 cents per ordinary share (September 2020: 192.0 cents

Matshoba-Ramuedzisi T (ind ne), Moodley M, Orleyn AdvNDB(ne), per ordinary share) has been declared by the directors for the

Munday T S (Chair, ind ne), Dickson A E (CEO), year ended 30 September 2021.

Husain M J (Chair Designate, ind ne), Thomson N A (CFO)

197