Page 176 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 176

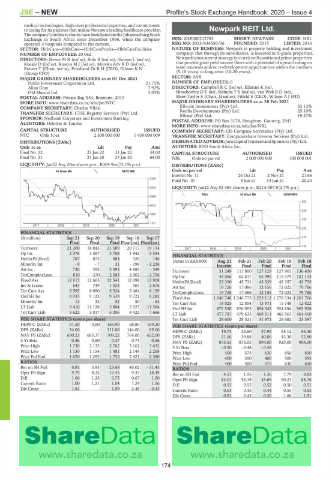

JSE – NEW Profile’s Stock Exchange Handbook: 2020 – Issue 4

medical technologies, high-level professional expertise, and commitment

to caring for its patients that makes Netcare a leading healthcare provider. Newpark REIT Ltd.

Thecompany’sordinaryshareshavebeenlistedontheJohannesburgStock NEW

Exchange in South Africa since December 1996, when the company ISIN: ZAE000212783 SHORT: NEWPARK CODE: NRL

operated 4 hospitals compared to the current. REG NO: 2015/436550/06 FOUNDED: 2015 LISTED: 2016

SECTOR: HlthCare—HtlhCare—HlthCarePrvdrs—HlthCareFacilities NATURE OF BUSINESS: Newpark is property holding and investment

NUMBER OF EMPLOYEES: 20 062 company, that through its subsidiaries, is invested in A-grade properties.

DIRECTORS: BowerMR(ind ne), Bulo B (ind ne), Human L (ind ne), Newpark's investment strategy is to seek well-positioned prime properties

Kneale D (ind ne), KuscusMJ(ind ne), Moroka AdvKD(ind ne), that provide good yield income flows with a potential of upward rating on

Brewer T (Chair, ind ne), Friedland Dr R H (CEO), Gibson K N lease renewals and/or re-development opportunities within the medium

(Group CFO) (5-10 years) to long-term (10-20 years).

MAJOR ORDINARY SHAREHOLDERS as at 01 Dec 2021 SECTOR: AltX

Public Investment Corporation Ltd. 21.75% NUMBER OF EMPLOYEES: 0

Allan Gray 7.92% DIRECTORS: CampbellRC(ind ne), Ellerine K (ne),

Old Mutual Ltd. 5.03% HirschowitzDT(ne), SishubaTS(ind ne), van WykBD(ne),

POSTAL ADDRESS: Private Bag X34, Benmore, 2010 Shaw-Taylor S (Chair, ld ind ne), Fifield S (CEO), Wilson A J (FD)

MORE INFO: www.sharedata.co.za/sdo/jse/NTC MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2021

COMPANY SECRETARY: Charles Vikisi Ellwain Investments (Pty) Ltd. 32.12%

TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd. Renlia Developments (Pty) Ltd. 25.10%

19.27%

Ellvest (Pty) Ltd.

SPONSOR: Nedbank Corporate and Investment Banking

AUDITORS: Deloitte & Touche POSTAL ADDRESS: PO Box 3178, Houghton, Gauteng, 2041

MORE INFO: www.sharedata.co.za/sdo/jse/NRL

CAPITAL STRUCTURE AUTHORISED ISSUED COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd.

NTC Ords 1c ea 2 500 000 000 1 439 090 009 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DISTRIBUTIONS [ZARc] DESIGNATEDADVISOR:JavaCapitalTrusteesandSponsors(Pty)Ltd.

Ords 1c ea Ldt Pay Amt AUDITORS: BDO South Africa Inc.

Final No 22 25 Jan 22 31 Jan 22 34.00 CAPITAL STRUCTURE AUTHORISED ISSUED

Final No 21 21 Jan 20 27 Jan 20 64.00 NRL Ords no par val 2 000 000 000 100 000 001

LIQUIDITY: Jan22 Avg 20m shares p.w., R304.9m(73.1% p.a.) DISTRIBUTIONS [ZARc]

40 Week MA NETCARE Ords no par val Ldt Pay Amt

Interim No 11 26 Oct 21 2 Nov 21 21.66

3300

Final No 10 8 Jun 21 14 Jun 21 20.25

2875 LIQUIDITY: Jan22 Avg 52 384 shares p.w., R214 087.9(2.7% p.a.)

REIV 40 Week MA NEWPARK

2449

670

2023

570

1597

470

1171

2017 | 2018 | 2019 | 2020 | 2021

370

FINANCIAL STATISTICS

(R million) Sep 21 Sep 20 Sep 19 Sep 18 Sep 17 270

Final Final Final Final(rst) Final(rst)

Turnover 21 200 18 843 21 589 20 717 19 114 2017 | 2018 | 2019 | 2020 | 2021 170

Op Inc 2 076 1 567 3 768 1 942 3 534 FINANCIAL STATISTICS

NetIntPd(Rcvd) 787 875 484 326 146 (Amts in ZAR'000) Aug 21 Feb 21 Feb 20 Feb 19 Feb 18

Minority Int - 9 - 7 31 - 196 - 2 236 Interim Final Final Final Final

Att Inc 730 392 2 393 4 885 - 549 Turnover 51 249 111 800 127 129 127 901 136 450

TotCompIncLoss 810 370 2 383 2 902 - 2 796 Op Inc 43 056 62 817 55 495 115 379 121 113

Fixed Ass 12 915 12 665 12 541 12 098 13 908 NetIntPd(Rcvd) 23 330 45 731 43 339 43 357 43 755

Inv & Loans 643 749 1 024 965 2 876 Att Inc 19 726 17 086 12 156 72 022 79 786

Tot Curr Ass 5 595 6 050 5 524 5 464 8 159 TotCompIncLoss 19 726 17 086 12 156 72 022 79 786

Ord SH Int 9 933 9 123 9 539 9 721 8 282 Fixed Ass 1 246 748 1 246 775 1 253 112 1 278 334 1 261 766

Minority Int 12 32 52 50 - 64 Tot Curr Ass 18 025 12 854 13 971 15 748 12 822

LT Liab 9 410 11 128 5 884 5 927 11 584 Ord SH Int 875 530 876 053 894 342 924 856 903 928

Tot Curr Liab 5 622 5 017 5 296 4 422 7 666 LT Liab 477 787 479 633 468 011 466 563 464 450

PER SHARE STATISTICS (cents per share) Tot Curr Liab 28 600 28 521 31 971 28 682 23 397

HEPS-C (ZARc) 61.50 - 3.60 165.90 68.80 169.20 PER SHARE STATISTICS (cents per share)

DPS (ZARc) 34.00 - 111.00 144.00 95.00

HEPS-C (ZARc) 19.73 23.60 37.93 55.12 54.40

NAV PS (ZARc) 690.23 683.37 709.22 764.00 652.00 DPS (ZARc) 21.66 39.88 40.06 43.30 52.80

3 Yr Beta 0.46 0.60 0.47 0.71 0.66 NAV PS (ZARc) 875.53 876.05 894.00 925.00 904.00

Price High 1 738 2 132 2 762 3 161 3 632 3 Yr Beta - 0.50 - 0.48 - 0.48 - -

Price Low 1 130 1 154 1 481 2 144 2 268 Price High 400 575 630 650 690

Price Prd End 1 620 1 292 1 755 2 421 2 380 Price Low 400 350 400 500 595

RATIOS Price Prd End 400 400 575 630 650

Ret on SH Fnd 6.81 3.93 23.68 45.02 - 31.43 RATIOS

Oper Pft Mgn 9.79 8.32 17.45 9.37 18.49 Ret on SH Fnd 4.51 1.95 1.36 7.79 8.83

D:E 1.06 1.25 0.75 0.67 1.50 Oper Pft Mgn 84.01 56.19 43.65 90.21 88.76

Current Ratio 1.00 1.21 1.04 1.24 1.06 D:E 0.55 0.55 0.52 0.50 0.51

Div Cover 1.61 - 1.59 2.48 - 0.43 Current Ratio 0.63 0.45 0.44 0.55 0.55

Div Cover 0.91 0.43 0.30 1.66 1.51

174