Page 94 - SHB 2021 Issue 4

P. 94

JSE – BAR Profile’s Stock Exchange Handbook: 2021 – Issue 4

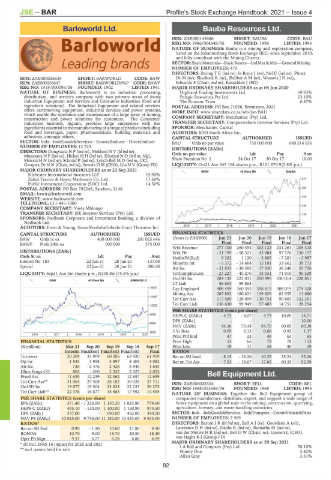

Barloworld Ltd. Bauba Resources Ltd.

BAR BAU

ISIN: ZAE000145686 SHORT: BAUBA CODE: BAU

REG NO: 1986/004649/06 FOUNDED: 1996 LISTED: 1996

NATURE OF BUSINESS: Bauba is a mining and exploration company,

listed on the Johannesburg Stock Exchange (JSE) since September 2010,

and fully compliant with the Mining Charter.

SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining

NUMBER OF EMPLOYEES: 470

DIRECTORS: BaringTE(ind ne), le Roux J (ne), Nel E (ind ne), Phosa

ISIN: ZAE000026639 SHORT: BARWORLD CODE: BAW DrM(ne), Shedlock R (ne), SlabberAM(ne), WesselsJH(ne),

ISIN: ZAE000026647 SHORT: BARWORLD6%P CODE: BAWP Edwards S (Chair, ind ne), Knowlden J (FD)

REG NO: 1918/000095/06 FOUNDED: 1902 LISTED: 1941 MAJOR ORDINARY SHAREHOLDERS as at 04 Jun 2020

NATURE OF BUSINESS: Barloworld is an industrial processing, Highland Trading Investments Ltd. 59.93%

distribution, and services company with two primary areas of focus: Pelagic Resources Pte Ltd. 23.10%

Industrial Equipment and Services and Consumer Industries (food and The Kumane Trust 6.47%

ingredient solutions). The Industrial Equipment and related services POSTAL ADDRESS: PO Box 71036, Bryanston, 2021

offers earthmoving equipment, industrial services and power systems, MORE INFO: www.sharedata.co.za/sdo/jse/BAU

which enable the operation and maintenance of a large array of mining, COMPANY SECRETARY: Merchantec (Pty) Ltd.

construction and power solutions for customers. The Consumer

Industries business, Ingrain, provides large enterprises with the TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

ingredients essential to the manufacturing of a range of products including SPONSOR: Merchantec Capital

food and beverages, paper, pharmaceuticals, building materials and AUDITORS: BDO South Africa Inc.

adhesives, amongst others. CAPITAL STRUCTURE AUTHORISED ISSUED

SECTOR: Inds—IndsGoods&Services—GeneralIndustr—DiversIndustr BAU Ords no par value 750 000 000 640 514 656

NUMBER OF EMPLOYEES: 12 723 DISTRIBUTIONS [ZARc]

DIRECTORS: Dongwana N P (ind ne), Mokhesi N V (ld ind ne), Ords no par value Ldt Pay Amt

Mnxasana N P (ind ne), Hickey H H (ind ne), Edozien N O (ind ne, Nig),

Molotsi H N (ind ne), Schmid P (ind ne), Lynch-Bell M D (ind ne, UK), Share Premium No 1 24 Oct 17 30 Oct 17 10.00

Gwagwa Dr N N (Chair, ind ne), Sewela D M (CEO), Lila N V (Group FD) LIQUIDITY: Oct21 Ave 345 168 shares p.w., R121 879.9(2.8% p.a.)

MAJOR ORDINARY SHAREHOLDERS as at 23 Sep 2021 INDM 40 Week MA BAUBA

Silchester International Investors LLP 19.90%

Zahid Tractor & Heavy Machinery Co. Ltd. 17.60% 570

Public Investment Corporation (SOC) Ltd. 14.50%

POSTAL ADDRESS: PO Box 782248, Sandton, 2146 459

EMAIL: bawir@barloworld.com

WEBSITE: www.barloworld.com 349

TELEPHONE: 011-445-1000

COMPANY SECRETARY: Vasta Mhlongo 238

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. 128

SPONSORS: Nedbank Corporate and Investment Banking, a division of

Nedbank Ltd. 17

2016 | 2017 | 2018 | 2019 | 2020 | 2021

AUDITORS: Ernst & Young, SizweNtsalubaGobodo Grant Thornton Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED FINANCIAL STATISTICS

BAW Ords 5c ea 400 000 000 201 025 646 (Amts in ZAR'000) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17

BAWP Prefs 200c ea 500 000 375 000 Final Final Final Final Final

Wrk Revenue 277 100 260 394 302 122 234 261 205 318

DISTRIBUTIONS [ZARc] Wrk Pft - 21 199 - 58 321 43 884 97 576 130 157

Ords 5c ea Ldt Pay Amt NetIntPd(Rcd) 9 362 1 120 - 3 865 - 7 281 - 3 987

Interim No 183 22 Jun 21 28 Jun 21 137.00 Minority Int - 5 372 - 14 684 15 101 33 662 39 773

Special 22 Jun 21 28 Jun 21 200.00 Att Inc - 21 855 - 30 592 17 930 38 248 55 756

LIQUIDITY: Sep21 Ave 3m shares p.w., R230.8m(75.5% p.a.) TotCompIncLoss - 27 227 - 45 276 33 031 71 910 95 529

Ord SH Int 284 135 223 031 250 995 230 014 228 851

GENI 40 Week MA BARWORLD

LT Liab 56 603 59 863 - - -

18451 Cap Employed 408 459 360 555 358 415 308 019 274 328

Mining Ass 285 892 180 621 139 829 82 955 11 880

15487

Tot Curr Ass 117 589 128 099 130 754 90 805 132 351

Tot Curr Liab 136 630 99 949 57 483 14 751 28 254

12522

PER SHARE STATISTICS (cents per share)

9558

HEPS-C (ZARc) - 4.73 - 8.07 4.73 10.09 14.71

DPS (ZARc) - - - - 10.00

6594

NAV (ZARc) 44.36 73.44 84.70 60.69 60.38

3630 3 Yr Beta 0.09 0.13 0.68 0.92 1.37

2016 | 2017 | 2018 | 2019 | 2020 | 2021

Price Prd End 47 23 49 63 65

FINANCIAL STATISTICS Price High 53 66 72 78 112

(R million) Mar 21 Sep 20 Sep 19 Sep 18 Sep 17 Price Low 19 11 35 40 19

Interim Final(rst) Final(rst) Final(rst) Final RATIOS

Turnover 20 209 33 909 60 206 63 420 61 959 Ret on SH fund - 8.15 - 16.26 10.29 25.24 35.26

Op Inc 1 935 1 958 3 897 4 404 4 082 Ret on Tot Ass - 7.53 - 18.67 17.65 60.35 92.98

Att Inc 736 - 2 476 2 428 3 846 1 643

Hline Erngs-CO 803 - 260 2 322 2 427 2 053

Fixed Ass 11 639 12 239 12 062 12 657 12 659 Bell Equipment Ltd.

Tot Curr Ass** 31 064 27 408 28 182 30 028 27 711 ISIN: ZAE000028304 SHORT: BELL CODE: BEL

BEL

Ord SH Int 19 877 19 504 23 623 22 233 20 275 REG NO: 1968/013656/06 FOUNDED: 1968 LISTED: 1995

Tot Curr Liab** 22 376 16 877 15 563 17 592 14 595

NATURE OF BUSINESS: Together the Bell Equipment group of

PER SHARE STATISTICS (cents per share) companies manufacture, distribute, export, and support a wide range of

EPS (ZARc) 371.40 - 1 236.00 1 150.20 1 823.80 779.60 heavy equipment on a global scale to the mining, construction, quarrying,

HEPS-C (ZARc) 405.10 - 130.00 1 100.00 1 150.90 974.50 agriculture, forestry, and waste handling industries.

DPS (ZARc) 337.00 - 690.00 462.00 390.00 SECTOR: Inds—IndsGoods&Services—IndsTransport—CommVehicle&Parts

NAV PS (ZARc) 10 025.00 9 736.00 11 182.00 10 453.00 9 533.00 NUMBER OF EMPLOYEES: 2 969

RATIOS* DIRECTORS: BartonJR(ld ind ne), BellAJ(ne), Goordeen A (alt),

Ret on SH Fnd 0.90 - 1.50 10.60 11.80 9.50 LawranceDH(ind ne), Naidu R (ind ne), Ramathe M (ind ne),

RONOA 10.70 9.00 18.70 20.50 18.40 van der MerweHR(ind ne), Bell G W (Chair, ne), Goosen L (CEO),

Oper Pft Mgn 9.57 5.77 6.28 6.80 6.59 van Haght K J (Group FD)

* all incl. IFRS 16 impact for 2020 and 2021 MAJOR ORDINARY SHAREHOLDERS as at 29 Sep 2021

** incl. assets held for sale I A Bell and Company (Pty) Ltd. 70.10%

Ninety One 3.82%

Allan Gray 3.31%

92