Page 235 - SHB 2021 Issue 4

P. 235

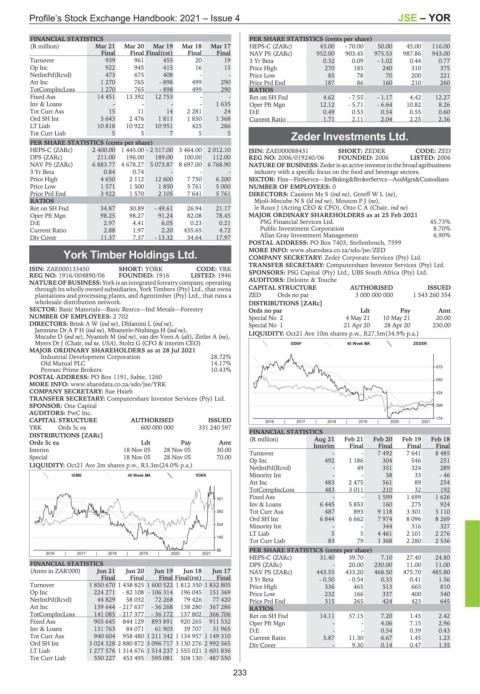

Profile’s Stock Exchange Handbook: 2021 – Issue 4 JSE – YOR

FINANCIAL STATISTICS PER SHARE STATISTICS (cents per share)

(R million) Mar 21 Mar 20 Mar 19 Mar 18 Mar 17 HEPS-C (ZARc) 43.00 - 70.00 50.00 45.00 116.00

Final Final Final(rst) Final Final NAV PS (ZARc) 952.00 903.45 975.53 987.86 943.00

Turnover 939 961 455 20 19 3 Yr Beta 0.32 0.09 - 1.02 0.44 0.77

Op Inc 922 945 415 16 15 Price High 270 185 240 310 375

NetIntPd(Rcvd) 473 675 408 - - Price Low 85 78 70 200 221

Att Inc 1 270 765 - 898 499 290 Price Prd End 187 86 160 210 260

TotCompIncLoss 1 270 765 - 898 499 290 RATIOS

Fixed Ass 14 451 13 392 12 753 - - Ret on SH Fnd 4.62 - 7.55 - 1.17 4.42 12.27

Inv & Loans - - - - 1 635 Oper Pft Mgn 12.12 - 5.71 - 6.64 10.82 8.26

Tot Curr Ass 15 11 14 2 281 24 D:E 0.49 0.53 0.54 0.55 0.60

Ord SH Int 3 643 2 476 1 811 1 850 1 368 Current Ratio 1.71 2.11 2.04 2.25 2.36

LT Liab 10 818 10 922 10 951 425 286

Tot Curr Liab 5 5 7 5 5 Zeder Investments Ltd.

PER SHARE STATISTICS (cents per share)

ZED

HEPS-C (ZARc) 2 400.00 1 445.00 - 2 517.00 3 464.00 2 012.10 ISIN: ZAE000088431 SHORT: ZEDER CODE: ZED

DPS (ZARc) 211.00 196.00 189.00 100.00 112.00 REG NO: 2006/019240/06 FOUNDED: 2006 LISTED: 2006

NAV PS (ZARc) 6 883.77 4 678.27 5 073.87 8 697.00 6 768.90 NATURE OF BUSINESS: Zederisanactive investorinthe broadagribusiness

3 Yr Beta 0.84 0.74 - - - industry with a specific focus on the food and beverage sectors.

Price High 4 650 2 112 12 600 7 750 6 200 SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs—AssMgrs&Custodians

Price Low 1 571 1 500 1 850 5 761 5 000 NUMBER OF EMPLOYEES: 0

Price Prd End 3 922 1 570 2 105 7 641 5 761 DIRECTORS: Cassiem Ms S (ind ne), GreeffWL(ne),

RATIOS Mjoli-MncubeNS(ld ind ne), MoutonPJ(ne),

Ret on SH Fnd 34.87 30.89 - 49.61 26.94 21.17 le Roux J (Acting CEO & CFO), Otto C A (Chair, ind ne)

Oper Pft Mgn 98.25 98.27 91.24 82.08 78.45 MAJOR ORDINARY SHAREHOLDERS as at 25 Feb 2021

D:E 2.97 4.41 6.05 0.23 0.21 PSG Financial Services Ltd. 45.73%

Current Ratio 2.88 1.97 2.20 435.65 4.72 Public Investment Corporation 8.70%

Div Cover 11.37 7.37 - 13.32 34.64 17.97 Allan Gray Investment Management 6.90%

POSTAL ADDRESS: PO Box 7403, Stellenbosch, 7599

MORE INFO: www.sharedata.co.za/sdo/jse/ZED

York Timber Holdings Ltd. COMPANY SECRETARY: Zeder Corporate Services (Pty) Ltd.

YOR TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

ISIN: ZAE000133450 SHORT: YORK CODE: YRK SPONSORS: PSG Capital (Pty) Ltd., UBS South Africa (Pty) Ltd.

REG NO: 1916/004890/06 FOUNDED: 1916 LISTED: 1946

NATUREOF BUSINESS:York isanintegrated forestry company, operating AUDITORS: Deloitte & Touche

through its wholly owned subsidiaries, York Timbers (Pty) Ltd., that owns CAPITAL STRUCTURE AUTHORISED ISSUED

plantations and processing plants, and Agentimber (Pty) Ltd., that runs a ZED Ords no par 3 000 000 000 1 543 260 354

wholesale distribution network. DISTRIBUTIONS [ZARc]

SECTOR: Basic Materials—Basic Resrcs—Ind Metals—Forestry Ords no par Ldt Pay Amt

NUMBER OF EMPLOYEES: 2 702 Special No 2 4 May 21 10 May 21 20.00

DIRECTORS: Brink A W (ind ne), Dhlamini L (ind ne), Special No 1 21 Apr 20 28 Apr 20 230.00

Jammine Dr A P H (ind ne), Mbanyele-Ntshinga H (ind ne), LIQUIDITY: Oct21 Ave 10m shares p.w., R27.5m(34.9% p.a.)

Mncube D (ind ne), Nyanteh M (ind ne), van der Veen A (alt), Zetler A (ne),

Myers Dr J (Chair, ind ne, USA), Stoltz G (CFO & interim CEO) GENF 40 Week MA ZEDER

MAJOR ORDINARY SHAREHOLDERS as at 28 Jul 2021

Industrial Development Corporation 28.72%

Old Mutual PLC 14.17%

Peresec Prime Brokers 10.43% 675

POSTAL ADDRESS: PO Box 1191, Sabie, 1260 550

MORE INFO: www.sharedata.co.za/sdo/jse/YRK

COMPANY SECRETARY: Sue Hsieh 424

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: One Capital 299

AUDITORS: PwC Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED 2016 | 2017 | 2018 | 2019 | 2020 | 2021 174

YRK Ords 5c ea 600 000 000 331 240 597

DISTRIBUTIONS [ZARc] FINANCIAL STATISTICS

Aug 21

Ords 5c ea Ldt Pay Amt (R million) Interim Feb 21 Feb 20 Feb 19 Feb 18

Final

Final

Final

Final

Interim 18 Nov 05 28 Nov 05 30.00 Turnover - - 7 492 7 641 8 485

Special 18 Nov 05 28 Nov 05 70.00

Op Inc 492 1 186 304 546 251

LIQUIDITY: Oct21 Ave 2m shares p.w., R3.3m(24.0% p.a.)

NetIntPd(Rcvd) - 49 351 324 289

Minority Int - - 38 33 - 46

IDMS 40 Week MA YORK

Att Inc 483 2 475 561 89 254

TotCompIncLoss 483 3 011 210 32 192

Fixed Ass - - 1 599 1 699 1 626

321

Inv & Loans 6 445 5 853 160 275 924

262 Tot Curr Ass 487 893 9 118 3 301 3 110

Ord SH Int 6 844 6 662 7 974 8 096 8 269

204 Minority Int - - 344 316 327

LT Liab 5 5 4 461 2 101 2 276

145

Tot Curr Liab 83 79 1 368 2 280 2 536

86 PER SHARE STATISTICS (cents per share)

2016 | 2017 | 2018 | 2019 | 2020 | 2021

HEPS-C (ZARc) 31.40 39.70 7.10 27.40 24.80

FINANCIAL STATISTICS DPS (ZARc) - 20.00 230.00 11.00 11.00

(Amts in ZAR'000) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17 NAV PS (ZARc) 443.55 433.20 468.50 475.70 485.80

Final Final Final Final(rst) Final 3 Yr Beta - 0.50 - 0.54 0.33 0.41 1.56

Turnover 1 850 670 1 438 825 1 600 522 1 812 350 1 832 805 Price High 336 465 513 665 810

Op Inc 224 271 - 82 108 - 106 314 196 045 151 369 Price Low 232 166 337 400 540

NetIntPd(Rcvd) 44 829 58 032 72 268 79 426 77 420 Price Prd End 315 265 424 423 645

Att Inc 139 644 - 217 637 - 36 268 138 280 367 286 RATIOS

TotCompIncLoss 141 085 - 217 377 - 36 172 137 802 366 706 Ret on SH Fnd 14.11 37.15 7.20 1.45 2.42

Fixed Ass 905 645 844 129 893 891 920 265 911 532 Oper Pft Mgn - - 4.06 7.15 2.96

Inv & Loans 131 763 84 071 61 903 39 707 31 965 D:E - - 0.54 0.39 0.43

Tot Curr Ass 940 604 958 480 1 211 342 1 134 957 1 149 310 Current Ratio 5.87 11.30 6.67 1.45 1.23

Ord SH Int 3 024 328 2 880 872 3 096 717 3 130 276 2 992 565 Div Cover - 9.30 0.14 0.47 1.35

LT Liab 1 277 576 1 314 676 1 514 237 1 555 021 1 601 836

Tot Curr Liab 550 227 453 495 595 081 504 130 487 550

233