Page 234 - SHB 2021 Issue 4

P. 234

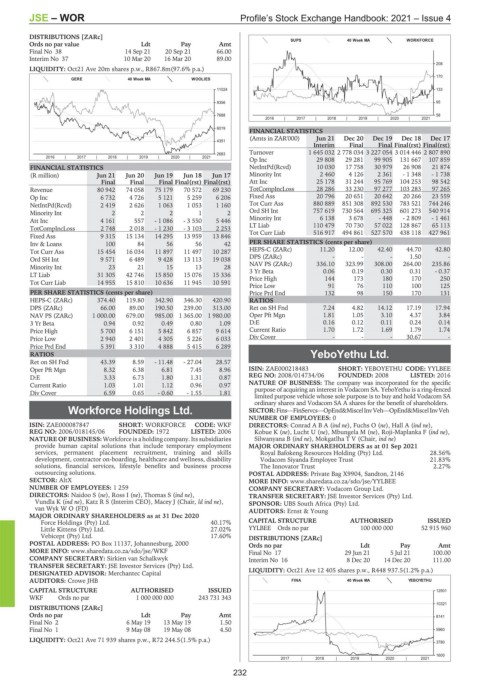

JSE – WOR Profile’s Stock Exchange Handbook: 2021 – Issue 4

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt SUPS 40 Week MA WORKFORCE

Final No 38 14 Sep 21 20 Sep 21 66.00

Interim No 37 10 Mar 20 16 Mar 20 89.00

208

LIQUIDITY: Oct21 Ave 20m shares p.w., R867.8m(97.6% p.a.)

170

GERE 40 Week MA WOOLIES

11024 133

9356 95

7688 58

2016 | 2017 | 2018 | 2019 | 2020 | 2021

6019

FINANCIAL STATISTICS

(Amts in ZAR'000) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17

4351

Interim Final Final Final(rst) Final(rst)

2683 Turnover 1 645 032 2 778 034 3 227 054 3 014 446 2 807 890

2016 | 2017 | 2018 | 2019 | 2020 | 2021

Op Inc 29 808 29 281 99 905 131 667 107 859

FINANCIAL STATISTICS NetIntPd(Rcvd) 10 030 17 758 30 979 26 908 21 874

(R million) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17 Minority Int 2 460 4 126 2 361 - 1 348 - 1 738

Final Final Final Final(rst) Final(rst) Att Inc 25 178 31 244 95 769 104 253 98 542

Revenue 80 942 74 058 75 179 70 572 69 230 TotCompIncLoss 28 286 33 230 97 277 103 283 97 265

Op Inc 6 732 4 726 5 121 5 259 6 206 Fixed Ass 20 796 20 651 20 642 20 266 23 559

NetIntPd(Rcvd) 2 419 2 626 1 063 1 053 1 160 Tot Curr Ass 880 889 851 308 892 530 783 521 744 246

Minority Int 2 2 2 1 2 Ord SH Int 757 619 730 564 695 325 601 273 540 914

Att Inc 4 161 557 - 1 086 - 3 550 5 446 Minority Int 6 138 3 678 - 448 - 2 809 - 1 461

70 730

65 113

57 022

TotCompIncLoss 2 748 2 018 - 1 230 - 3 103 2 253 LT Liab 110 479 494 861 527 570 128 867 427 961

438 118

516 917

Tot Curr Liab

Fixed Ass 9 315 15 134 14 295 13 959 13 846

Inv & Loans 100 84 56 56 42 PER SHARE STATISTICS (cents per share)

Tot Curr Ass 15 454 16 034 11 897 11 497 10 287 HEPS-C (ZARc) 11.20 12.00 42.40 44.70 42.80

Ord SH Int 9 571 6 489 9 428 13 113 19 038 DPS (ZARc) - - - 1.50 -

Minority Int 23 21 15 13 28 NAV PS (ZARc) 336.10 323.99 308.00 264.00 235.86

3 Yr Beta

0.30

0.19

0.31

0.06

- 0.37

LT Liab 31 305 42 746 15 850 15 076 15 336 Price High 144 173 180 170 250

Tot Curr Liab 14 955 15 810 10 636 11 945 10 591

Price Low 91 76 110 100 125

PER SHARE STATISTICS (cents per share) Price Prd End 132 98 150 170 131

HEPS-C (ZARc) 374.40 119.80 342.90 346.30 420.90 RATIOS

DPS (ZARc) 66.00 89.00 190.50 239.00 313.00 Ret on SH Fnd 7.24 4.82 14.12 17.19 17.94

NAV PS (ZARc) 1 000.00 679.00 985.00 1 365.00 1 980.00 Oper Pft Mgn 1.81 1.05 3.10 4.37 3.84

3 Yr Beta 0.94 0.92 0.49 0.80 1.09 D:E 0.16 0.12 0.11 0.24 0.14

Price High 5 700 6 151 5 842 6 857 9 614 Current Ratio 1.70 1.72 1.69 1.79 1.74

Price Low 2 940 2 401 4 305 5 226 6 033 Div Cover - - - 30.67 -

Price Prd End 5 391 3 310 4 888 5 415 6 289

RATIOS YeboYethu Ltd.

Ret on SH Fnd 43.39 8.59 - 11.48 - 27.04 28.57 YEB

Oper Pft Mgn 8.32 6.38 6.81 7.45 8.96 ISIN: ZAE000218483 SHORT: YEBOYETHU CODE: YYLBEE

D:E 3.33 6.73 1.80 1.31 0.87 REG NO: 2008/014734/06 FOUNDED: 2008 LISTED: 2016

Current Ratio 1.03 1.01 1.12 0.96 0.97 NATURE OF BUSINESS: The company was incorporated for the specific

purpose of acquiring an interest in Vodacom SA. YeboYethu is a ring-fenced

Div Cover 6.59 0.65 - 0.60 - 1.55 1.81

limited purpose vehicle whose sole purpose is to buy and hold Vodacom SA

ordinary shares and Vodacom SA A shares for the benefit of shareholders.

Workforce Holdings Ltd. SECTOR:Fins—FinServcs—OpEnd&MiscelInvVeh—OpEnd&MiscelInvVeh

NUMBER OF EMPLOYEES: 0

WOR

ISIN: ZAE000087847 SHORT: WORKFORCE CODE: WKF DIRECTORS: ConradABA(ind ne), Fuchs O (ne), Hall A (ind ne),

REG NO: 2006/018145/06 FOUNDED: 1972 LISTED: 2006 Kobue K (ne), Lucht U (ne), Mbungela M (ne), Roji-Maplanka F (ind ne),

NATURE OF BUSINESS: Workforce is a holding company. Its subsidiaries Silwanyana B (ind ne), Mokgatlha T V (Chair, ind ne)

provide human capital solutions that include temporary employment MAJOR ORDINARY SHAREHOLDERS as at 01 Sep 2021

services, permanent placement recruitment, training and skills Royal Bafokeng Resources Holding (Pty) Ltd. 28.56%

development, contractor on-boarding, healthcare and wellness, disability Vodacom Siyanda Employee Trust 21.83%

solutions, financial services, lifestyle benefits and business process The Innovator Trust 2.27%

outsourcing solutions. POSTAL ADDRESS: Private Bag X9904, Sandton, 2146

SECTOR: AltX MORE INFO: www.sharedata.co.za/sdo/jse/YYLBEE

NUMBER OF EMPLOYEES: 1 259 COMPANY SECRETARY: Vodacom Group Ltd.

DIRECTORS: Naidoo S (ne), Ross I (ne), Thomas S (ind ne), TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

Vundla K (ind ne), Katz R S (Interim CEO), Macey J (Chair, ld ind ne), SPONSOR: UBS South Africa (Pty) Ltd.

van Wyk W O (FD) AUDITORS: Ernst & Young

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2020

Force Holdings (Pty) Ltd. 40.17% CAPITAL STRUCTURE AUTHORISED ISSUED

Little Kittens (Pty) Ltd. 27.02% YYLBEE Ords no par 100 000 000 52 915 960

Vebicept (Pty) Ltd. 17.60% DISTRIBUTIONS [ZARc]

POSTAL ADDRESS: PO Box 11137, Johannesburg, 2000 Ords no par Ldt Pay Amt

MORE INFO: www.sharedata.co.za/sdo/jse/WKF Final No 17 29 Jun 21 5 Jul 21 100.00

COMPANY SECRETARY: Sirkien van Schalkwyk Interim No 16 8 Dec 20 14 Dec 20 111.00

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

DESIGNATED ADVISOR: Merchantec Capital LIQUIDITY: Oct21 Ave 12 405 shares p.w., R448 937.5(1.2% p.a.)

AUDITORS: Crowe JHB FINA 40 Week MA YEBOYETHU

CAPITAL STRUCTURE AUTHORISED ISSUED 12501

WKF Ords no par 1 000 000 000 243 731 343

10321

DISTRIBUTIONS [ZARc]

Ords no par Ldt Pay Amt 8141

Final No 2 6 May 19 13 May 19 1.50

Final No 1 9 May 08 19 May 08 4.50 5960

LIQUIDITY: Oct21 Ave 71 939 shares p.w., R72 244.5(1.5% p.a.) 3780

1600

2017 | 2018 | 2019 | 2020 | 2021

232