Page 209 - SHB 2021 Issue 4

P. 209

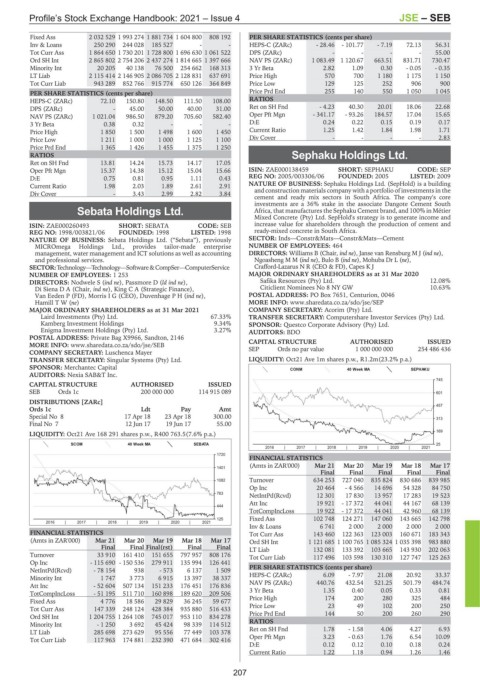

Profile’s Stock Exchange Handbook: 2021 – Issue 4 JSE – SEB

Fixed Ass 2 032 529 1 993 274 1 881 734 1 604 800 808 192 PER SHARE STATISTICS (cents per share)

Inv & Loans 250 290 244 028 185 527 - - HEPS-C (ZARc) - 28.46 - 101.77 - 7.19 72.13 56.31

Tot Curr Ass 1 864 650 1 730 201 1 728 800 1 696 630 1 061 522 DPS (ZARc) - - - - 55.00

Ord SH Int 2 865 802 2 754 206 2 437 274 1 814 665 1 397 666 NAV PS (ZARc) 1 083.49 1 120.67 663.51 831.71 730.47

Minority Int 20 205 40 138 76 500 254 662 168 313 3 Yr Beta 2.82 1.09 0.30 - 0.05 - 0.35

LT Liab 2 115 414 2 146 905 2 086 705 2 128 831 637 691 Price High 570 700 1 180 1 175 1 150

Tot Curr Liab 943 289 852 766 915 774 650 126 364 849 Price Low 129 125 252 906 900

PER SHARE STATISTICS (cents per share) Price Prd End 255 140 550 1 050 1 045

HEPS-C (ZARc) 72.10 150.80 148.50 111.50 108.00 RATIOS

DPS (ZARc) - 45.00 50.00 40.00 31.00 Ret on SH Fnd - 4.23 40.30 20.01 18.06 22.68

NAV PS (ZARc) 1 021.04 986.50 879.20 705.60 582.40 Oper Pft Mgn - 341.17 - 93.26 184.57 17.04 15.65

3 Yr Beta 0.38 0.32 - - - D:E 0.24 0.22 0.15 0.19 0.17

Price High 1 850 1 500 1 498 1 600 1 450 Current Ratio 1.25 1.42 1.84 1.98 1.71

Price Low 1 211 1 000 1 000 1 125 1 100 Div Cover - - - - 2.83

Price Prd End 1 365 1 426 1 455 1 375 1 250

RATIOS Sephaku Holdings Ltd.

Ret on SH Fnd 13.81 14.24 15.73 14.17 17.05 SEP

Oper Pft Mgn 15.37 14.38 15.12 15.04 15.66 ISIN: ZAE000138459 SHORT: SEPHAKU CODE: SEP

D:E 0.75 0.81 0.95 1.11 0.43 REG NO: 2005/003306/06 FOUNDED: 2005 LISTED: 2009

Current Ratio 1.98 2.03 1.89 2.61 2.91 NATURE OF BUSINESS: Sephaku Holdings Ltd. (SepHold) is a building

Div Cover - 3.43 2.99 2.82 3.84 and construction materials company with a portfolio of investments in the

cement and ready mix sectors in South Africa. The company's core

investments are a 36% stake in the associate Dangote Cement South

Sebata Holdings Ltd. Africa, that manufactures the Sephaku Cement brand, and 100% in Métier

Mixed Concrete (Pty) Ltd. SepHold's strategy is to generate income and

SEB

ISIN: ZAE000260493 SHORT: SEBATA CODE: SEB increase value for shareholders through the production of cement and

REG NO: 1998/003821/06 FOUNDED: 1998 LISTED: 1998 ready-mixed concrete in South Africa.

NATURE OF BUSINESS: Sebata Holdings Ltd. (“Sebata”), previously SECTOR: Inds—Constr&Mats—Constr&Mats—Cement

MICROmega Holdings Ltd., provides tailor-made enterprise NUMBER OF EMPLOYEES: 464

management, water management and ICT solutions as well as accounting DIRECTORS: Williams B (Chair, ind ne), Janse van Rensburg M J (ind ne),

and professional services. Ngoasheng M M (ind ne), Bulo B (ind ne), Mohuba Dr L (ne),

SECTOR:Technology—Technology—Software&CompSer—ComputerService Crafford-Lazarus N R (CEO & FD), Capes K J

NUMBER OF EMPLOYEES: 1 253 MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020

DIRECTORS: Nodwele S (ind ne), Passmore D (ld ind ne), Safika Resources (Pty) Ltd. 12.08%

Di Siena D A (Chair, ind ne), King C A (Strategic Finance), Citiclient Nominees No 8 NY GW 10.63%

Van Eeden P (FD), Morris I G (CEO), DuvenhagePH(ind ne), POSTAL ADDRESS: PO Box 7651, Centurion, 0046

HamillTW(ne) MORE INFO: www.sharedata.co.za/sdo/jse/SEP

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2021 COMPANY SECRETARY: Acorim (Pty) Ltd.

Laird Investments (Pty) Ltd. 67.33% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Kamberg Investment Holdings 9.34% SPONSOR: Questco Corporate Advisory (Pty) Ltd.

Enigma Investment Holdings (Pty) Ltd. 3.27% AUDITORS: BDO

POSTAL ADDRESS: Private Bag X9966, Sandton, 2146 CAPITAL STRUCTURE AUTHORISED ISSUED

MORE INFO: www.sharedata.co.za/sdo/jse/SEB

COMPANY SECRETARY: Luschenca Mayer SEP Ords no par value 1 000 000 000 254 486 436

TRANSFER SECRETARY: Singular Systems (Pty) Ltd. LIQUIDITY: Oct21 Ave 1m shares p.w., R1.2m(23.2% p.a.)

SPONSOR: Merchantec Capital CONM 40 Week MA SEPHAKU

AUDITORS: Nexia SAB&T Inc.

745

CAPITAL STRUCTURE AUTHORISED ISSUED

SEB Ords 1c 200 000 000 114 915 089 601

DISTRIBUTIONS [ZARc]

457

Ords 1c Ldt Pay Amt

Special No 8 17 Apr 18 23 Apr 18 300.00

313

Final No 7 12 Jun 17 19 Jun 17 55.00

169

LIQUIDITY: Oct21 Ave 168 291 shares p.w., R400 763.5(7.6% p.a.)

SCOM 40 Week MA SEBATA 25

2016 | 2017 | 2018 | 2019 | 2020 | 2021

1720

FINANCIAL STATISTICS

(Amts in ZAR'000) Mar 21 Mar 20 Mar 19 Mar 18 Mar 17

1401

Final Final Final Final Final

1082 Turnover 634 253 727 040 835 824 830 686 839 985

Op Inc 20 464 - 4 566 14 696 54 328 84 750

763

NetIntPd(Rcvd) 12 301 17 830 13 957 17 283 19 523

Att Inc 19 921 - 17 372 44 041 44 167 68 139

444

TotCompIncLoss 19 922 - 17 372 44 041 42 960 68 139

125 Fixed Ass 102 748 124 271 147 060 143 665 142 798

2016 | 2017 | 2018 | 2019 | 2020 | 2021

Inv & Loans 6 741 2 000 2 000 2 000 2 000

FINANCIAL STATISTICS Tot Curr Ass 143 460 122 363 123 003 160 671 183 343

(Amts in ZAR'000) Mar 21 Mar 20 Mar 19 Mar 18 Mar 17 Ord SH Int 1 121 685 1 100 765 1 085 324 1 035 398 983 880

Final Final Final(rst) Final Final LT Liab 132 081 133 392 103 665 143 930 202 063

Turnover 33 910 161 410 151 655 797 957 808 176 Tot Curr Liab 117 496 103 598 130 310 127 747 125 263

Op Inc - 115 690 - 150 536 279 911 135 994 126 441

NetIntPd(Rcvd) - 78 154 938 - 573 6 137 1 509 PER SHARE STATISTICS (cents per share)

Minority Int 1 747 3 773 6 915 13 397 38 337 HEPS-C (ZARc) 6.09 - 7.97 21.08 20.92 33.37

Att Inc - 52 604 507 134 151 233 176 451 176 836 NAV PS (ZARc) 440.76 432.54 521.25 501.79 484.74

TotCompIncLoss - 51 195 511 710 160 898 189 620 209 506 3 Yr Beta 1.35 0.40 0.05 0.33 0.81

Fixed Ass 4 776 18 586 29 829 36 245 59 677 Price High 174 200 280 325 484

Tot Curr Ass 147 339 248 124 428 384 935 880 516 433 Price Low 23 49 102 200 250

Ord SH Int 1 204 755 1 264 108 745 017 953 110 834 278 Price Prd End 144 50 200 260 290

Minority Int - 1 250 3 692 45 424 98 339 114 512 RATIOS 1.78 - 1.58 4.06 4.27 6.93

Ret on SH Fnd

LT Liab 285 698 273 629 95 556 77 449 103 378

Tot Curr Liab 117 963 174 881 232 390 471 684 302 416 Oper Pft Mgn 3.23 - 0.63 1.76 6.54 10.09

D:E 0.12 0.12 0.10 0.18 0.24

Current Ratio 1.22 1.18 0.94 1.26 1.46

207