Page 206 - SHB 2021 Issue 4

P. 206

JSE – SAN Profile’s Stock Exchange Handbook: 2021 – Issue 4

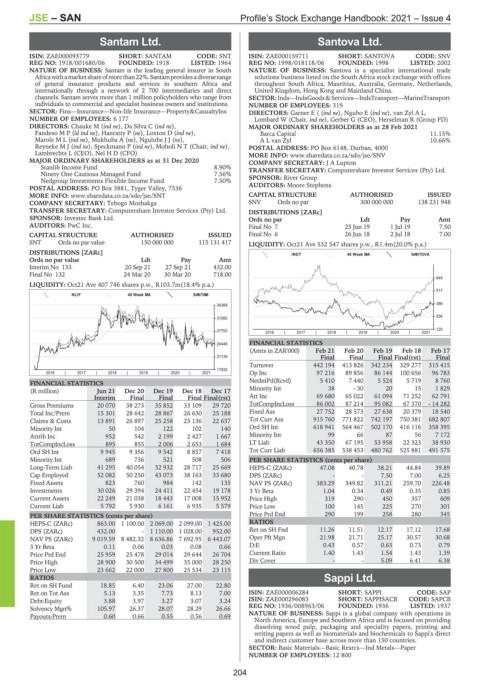

Santam Ltd. Santova Ltd.

SAN SAN

ISIN: ZAE000093779 SHORT: SANTAM CODE: SNT ISIN: ZAE000159711 SHORT: SANTOVA CODE: SNV

REG NO: 1918/001680/06 FOUNDED: 1918 LISTED: 1964 REG NO: 1998/018118/06 FOUNDED: 1998 LISTED: 2002

NATURE OF BUSINESS: Santam is the leading general insurer in South NATURE OF BUSINESS: Santova is a specialist international trade

Africawithamarketshareofmorethan22%.Santamprovidesadiverserange solutions business listed on the South Africa stock exchange with offices

of general insurance products and services in southern Africa and throughout South Africa, Mauritius, Australia, Germany, Netherlands,

internationally through a network of 2 700 intermediaries and direct United Kingdom, Hong Kong and Mainland China.

channels. Santam serves more than 1 million policyholders who range from SECTOR:Inds—IndsGoods&Services—IndsTransport—MarineTransport

individuals to commercial and specialist business owners and institutions. NUMBER OF EMPLOYEES: 319

SECTOR: Fins—Insurance—Non-life Insurance—Property&CasualtyIns DIRECTORS: GarnerE((ind ne), Ngubo E (ind ne), van Zyl A L,

NUMBER OF EMPLOYEES: 6 177 Lombard W (Chair, ind ne), Gerber G (CEO), Herselman R (Group FD)

DIRECTORS: Chauke M (ind ne), Da Silva C (ind ne), MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2021

FandesoMP(ld ind ne), Hanratty P (ne), Loxton D (ind ne), Barca Capital 11.15%

MaroleML(ind ne), Mukhuba A (ne), NgulubeJJ(ne), A L van Zyl 10.66%

ReynekeMJ(ind ne), Speckmann P (ind ne), Moholi N T (Chair, ind ne), POSTAL ADDRESS: PO Box 6148, Durban, 4000

Lambrechts L (CEO), Nel H D (CFO) MORE INFO: www.sharedata.co.za/sdo/jse/SNV

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2020 COMPANY SECRETARY: J A Lupton

Stanlib Income Fund 8.90% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Ninety One Cautious Managed Fund 7.56% SPONSOR: River Group

Nedgroup Investments Flexible Income Fund 7.50%

POSTAL ADDRESS: PO Box 3881, Tyger Valley, 7536 AUDITORS: Moore Stephens

MORE INFO: www.sharedata.co.za/sdo/jse/SNT CAPITAL STRUCTURE AUTHORISED ISSUED

COMPANY SECRETARY: Tebogo Moshakga SNV Ords no par 300 000 000 138 231 948

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. DISTRIBUTIONS [ZARc]

SPONSOR: Investec Bank Ltd. Ords no par Ldt Pay Amt

AUDITORS: PwC Inc. Final No 7 25 Jun 19 1 Jul 19 7.50

CAPITAL STRUCTURE AUTHORISED ISSUED Final No 6 26 Jun 18 2 Jul 18 7.00

SNT Ords no par value 150 000 000 115 131 417 LIQUIDITY: Oct21 Ave 532 547 shares p.w., R1.4m(20.0% p.a.)

DISTRIBUTIONS [ZARc]

INDT 40 Week MA SANTOVA

Ords no par value Ldt Pay Amt

Interim No 133 20 Sep 21 27 Sep 21 432.00

Final No 132 24 Mar 20 30 Mar 20 718.00

648

LIQUIDITY: Oct21 Ave 407 746 shares p.w., R103.7m(18.4% p.a.)

517

NLIF 40 Week MA SANTAM

34368 386

256

31060

125

27753 2016 | 2017 | 2018 | 2019 | 2020 | 2021

24446 FINANCIAL STATISTICS

(Amts in ZAR'000) Feb 21 Feb 20 Feb 19 Feb 18 Feb 17

21139 Final Final Final Final(rst) Final

Turnover 442 194 413 826 342 234 329 277 315 415

17832

2016 | 2017 | 2018 | 2019 | 2020 | 2021 Op Inc 97 216 89 856 86 144 100 656 96 783

FINANCIAL STATISTICS NetIntPd(Rcvd) 5 410 7 440 5 524 5 719 8 760

(R million) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17 Minority Int 38 - 30 20 15 1 829

Interim Final Final Final Final(rst) Att Inc 69 680 65 022 61 094 71 252 62 791

Gross Premiums 20 070 38 273 35 852 33 109 29 720 TotCompIncLoss 86 002 87 214 95 082 67 370 - 14 282

Total Inc/Prem 15 301 28 642 28 867 26 630 25 188 Fixed Ass 27 752 28 573 27 638 20 379 18 540

Claims & Costs 13 891 26 897 25 258 23 136 22 637 Tot Curr Ass 915 760 771 822 742 197 750 381 682 807

Minority Int 50 104 122 102 140 Ord SH Int 618 941 564 467 502 170 416 116 358 395

Attrib Inc 952 542 2 199 2 427 1 667 Minority Int 99 66 87 56 7 172

TotCompIncLoss 895 855 2 006 2 653 1 684 LT Liab 43 350 67 195 53 958 22 323 38 930

Ord SH Int 9 945 9 356 9 542 8 857 7 418 Tot Curr Liab 656 385 538 453 480 762 525 881 491 575

Minority Int 689 736 521 508 506 PER SHARE STATISTICS (cents per share)

Long-Term Liab 41 295 40 054 32 932 28 717 25 669 HEPS-C (ZARc) 47.08 40.78 38.21 44.84 39.89

Cap Employed 52 082 50 250 43 073 38 163 33 680 DPS (ZARc) - - 7.50 7.00 6.25

Fixed Assets 823 760 984 142 135 NAV PS (ZARc) 383.29 349.82 311.21 259.70 226.48

Investments 30 026 29 394 24 411 22 454 19 178 3 Yr Beta 1.04 0.34 0.49 0.35 0.85

Current Assets 22 249 21 038 18 443 17 008 15 952 Price High 319 290 450 357 609

Current Liab 5 792 5 930 6 161 6 935 5 579 Price Low 100 145 225 270 301

PER SHARE STATISTICS (cents per share) Price Prd End 290 199 258 280 345

HEPS-C (ZARc) 863.00 1 100.00 2 069.00 2 099.00 1 425.00 RATIOS

DPS (ZARc) 432.00 - 1 110.00 1 028.00 952.00 Ret on SH Fnd 11.26 11.51 12.17 17.12 17.68

NAV PS (ZARc) 9 019.59 8 482.32 8 636.86 7 692.95 6 443.07 Oper Pft Mgn 21.98 21.71 25.17 30.57 30.68

3 Yr Beta 0.11 0.06 0.03 0.08 0.66 D:E 0.43 0.57 0.63 0.73 0.79

Price Prd End 25 959 25 478 29 014 29 644 26 704 Current Ratio 1.40 1.43 1.54 1.43 1.39

Price High 28 900 30 500 34 499 35 000 28 250 Div Cover - - 5.09 6.41 6.38

Price Low 23 662 22 000 27 800 25 534 23 115

RATIOS Sappi Ltd.

Ret on SH Fund 18.85 6.40 23.06 27.00 22.80 SAP

Ret on Tot Ass 5.13 3.35 7.73 8.13 7.00 ISIN: ZAE000006284 SHORT: SAPPI CODE: SAP

Debt:Equity 3.88 3.97 3.27 3.07 3.24 ISIN: ZAE000296083 SHORT: SAPPISACB CODE: SAPCB

Solvency Mgn% 105.97 26.37 28.07 28.29 26.66 REG NO: 1936/008963/06 FOUNDED: 1936 LISTED: 1937

Payouts:Prem 0.60 0.66 0.55 0.56 0.69 NATURE OF BUSINESS: Sappi is a global company with operations in

North America, Europe and Southern Africa and is focused on providing

dissolving wood pulp, packaging and speciality papers, printing and

writing papers as well as biomaterials and biochemicals to Sappi's direct

and indirect customer base across more than 150 countries.

SECTOR: Basic Materials—Basic Resrcs—Ind Metals—Paper

NUMBER OF EMPLOYEES: 12 800

204