Page 200 - SHB 2021 Issue 4

P. 200

JSE – ROY Profile’s Stock Exchange Handbook: 2021 – Issue 4

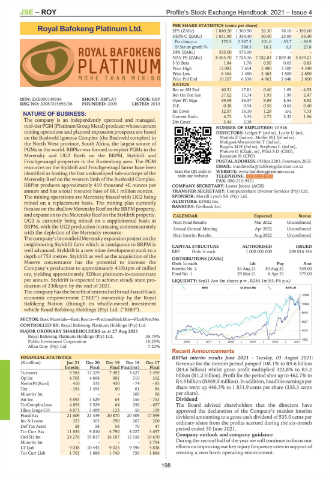

PER SHARE STATISTICS (cents per share)

Royal Bafokeng Platinum Ltd. EPS (ZARc) 1 840.20 1 369.90 26.30 78.10 - 390.60

HEPS-C (ZARc) 1 831.90 1 354.40 50.40 25.00 56.40

ROY

Pct chng p.a. 170.5 2 587.3 101.6 - 55.7 - 34.9

Tr 5yr av grwth % - 560.5 16.1 3.3 27.8

DPS (ZARc) 535.00 575.00 - - -

NAV PS (ZARc) 8 465.70 7 724.36 7 782.03 7 859.38 5 549.21

3 Yr Beta 1.84 1.76 0.50 0.03 0.83

Price High 12 083 7 654 5 400 3 500 4 340

Price Low 6 364 1 450 2 463 1 500 2 650

Price Prd End 10 207 6 538 4 962 2 648 2 800

RATIOS

Ret on SH Fnd 40.31 17.81 0.40 1.69 - 4.55

Ret On Tot Ass 27.02 15.74 1.93 1.99 2.47

ISIN: ZAE000149936 SHORT: RBPLAT CODE: RBP Oper Pft Mgn 49.09 36.37 9.09 8.54 8.92

REG NO: 2008/015696/06 FOUNDED: 2009 LISTED: 2010

D:E 0.38 0.54 0.56 0.64 0.40

Int Cover 12.57 16.10 1.29 n/a 7.73

NATURE OF BUSINESS: Current Ratio 6.72 5.35 2.75 5.32 1.96

The company is an independently operated and managed, Div Cover 3.44 2.38 - - -

mid-tierPGM(PlatinumGroupMetal)producerwhosecurrent NUMBER OF EMPLOYEES: 10 546

mining operations and planned expansion prospects are based DIRECTORS: Ledger P (ind ne), Lucht U (ne),

on the Bushveld Igneous Complex (the Bushveld complex) in Matlala Z (ind ne), MoffetMJ(ld ind ne),

the North West province, South Africa, the largest source of Mokgosi-Mwantembe T (ind ne),

RogersMH(ind ne), Stephens L (ind ne),

PGMs in the world. RBPlat was formed to exploit PGMs in the Phetwe O (Chair, ne), Phiri S D (CEO),

Merensky and UG2 Reefs on the BRPM, Styldrift and Rossouw H (CFO)

Frischgewaagd properties in the Rustenburg area. The PGM POSTALADDRESS:POBox2283,Fourways,2055

resources on the Styldrift and Frischgewaagd farms have been EMAIL: irandmedia@bafokengplatinum.co.za

identified as hosting the last undeveloped sub-outcrops of the Scan the QR code to WEBSITE: www.bafokengplatinum.co.za

visit our website

TELEPHONE: 010-590-4510

Merensky Reef on the western limb of the Bushveld Complex. FAX: 086-210-9421

RBPlat produces approximately 419 thousand 4E ounces per COMPANY SECRETARY: Lester Jooste (ACIS)

annum and has a total resource base of 68.1 million ounces. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

The mining operations are Merensky biased with UG2 being SPONSOR: Merrill Lynch SA (Pty) Ltd.

mined on a replacement basis. The mining plan currently AUDITORS: KPMG Inc.

focuses on the shallow Merensky Reef on the BRPM property, BANKERS: Nedbank Ltd.

and expansion to the Merensky Reef on the Styldrift property. CALENDAR Expected Status

UG2 is currently being mined on a supplemental basis at Next Final Results Mar 2022 Unconfirmed

BRPM, with the UG2 production increasing commensurately

Annual General Meeting Apr 2022 Unconfirmed

with the depletion of the Merensky resource. Next Interim Results Aug 2022 Unconfirmed

Thecompany’s brownfieldMerenskyexpansionprojectonthe

neighbouring Styldrift farm which is contiguous to BRPM is CAPITAL STRUCTURE AUTHORISED ISSUED

well advanced. Styldrift is a new mine development sunk to a RBP Ords 1c each 1 000 000 000 289 016 546

depth of 753 metres. Styldrift as well as the acquisition of the

DISTRIBUTIONS [ZARc]

Maseve concentrator has the potential to increase the Ords 1c each Ldt Pay Amt

Company’s production to approximately 410ktpm of milled Interim No 2 24 Aug 21 30 Aug 21 535.00

ore, yielding approximately 320koz platinum-in-concentrate Final No 1 29 Mar 21 6 Apr 21 575.00

per annum. Styldrift is expected to achieve steady state pro- LIQUIDITY: Sep21 Ave 4m shares p.w., R284.1m(63.4% p.a.)

duction of 230ktpm by the end of 2021.

MINI 40 Week MA RBPLAT

The company has the benefit of entrenched broad-based black

12080

economic empowerment (“BEE”) ownership by the Royal

Bafokeng Nation (through its wholly-owned investment 10062

vehicle Royal Bafokeng Holdings (Pty) Ltd. (“RBH”).

8045

SECTOR:BasicMaterials—BasicResrcs—PreciousMet&Min—Plat&PrecMet

6027

CONTROLLED BY: Royal Bafokeng Platinum Holdings (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 27 Aug 2021 4010

Royal Bafokeng Platinum Holdings (Pty) Ltd. 35.79%

Public Investment Corporation 10.29% 2016 | 2017 | 2018 | 2019 | 2020 | 2021 1992

Allan Gray (Pty) Ltd. 7.22%

Recent Announcements

FINANCIAL STATISTICS RBPlat interim results June 2021 - Tuesday, 03 August 2021:

(R million) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17 Revenue for the interim period jumped 108.1% to R9.6 billion

Interim Final Final Final(rst) Final (R4.6 billion) whilst gross profit multiplied 322.8% to R5.2

Turnover 9 584 13 379 7 492 3 627 3 499 billion (R1.2 billion). Profit for the period shot up to 462.7% to

Op Inc 4 705 4 866 681 310 312

NetIntPd(Rcvd) 410 333 430 - 74 - 85 R4.9billion(R869.5million).Inaddition,headlineearningsper

Tax - 154 1 494 60 61 84 share went up 446.3% to 1 831.9 cents per share (335.3 cents

Minority Int - - - 100 96 per share).

Att Inc 4 893 3 529 64 156 - 753 Dividend

TotCompIncLoss 4 893 3 529 64 256 - 657 The Board advised shareholders that the directors have

Hline Erngs-CO 4 871 3 489 123 50 109 approved the declaration of the Company’s maiden interim

Fixed Ass 21 609 21 439 20 870 20 309 17 599 dividend amounting to a gross cash dividend of 535.0 cents per

Inv & Loans 323 303 290 267 200 ordinary share from the profits accrued during the six-month

Def Tax Asset 58 58 58 70 47 period ended 30 June 2021.

Tot Curr Ass 11 834 9 010 4 790 4 027 3 697 Company outlook and company guidance

Ord SH Int 24 276 19 817 16 187 15 158 10 670

Minority Int - - - - 3 754 During the second half of the year we will continue to focus our

LT Liab 9 038 10 442 9 025 9 596 5 838 efforts on improving our key injury frequency rates in support of

Tot Curr Liab 1 761 1 686 1 740 756 1 884 creating a zero harm operating environment.

198