Page 230 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 230

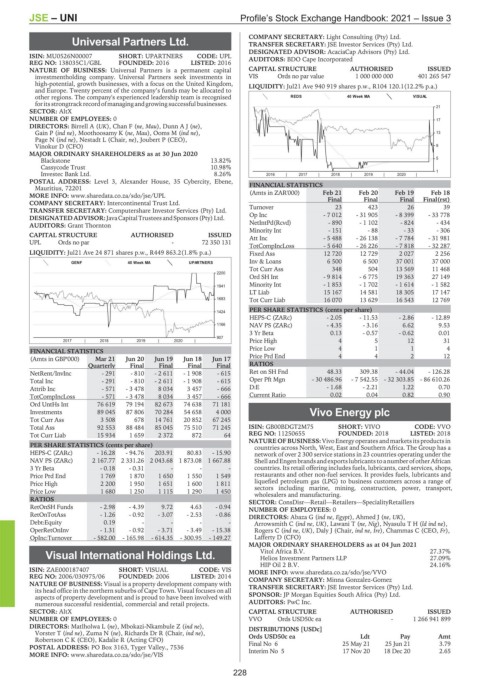

JSE – UNI Profile’s Stock Exchange Handbook: 2021 – Issue 3

COMPANY SECRETARY: Light Consulting (Pty) Ltd.

Universal Partners Ltd. TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

UNI DESIGNATED ADVISOR: AcaciaCap Advisors (Pty) Ltd.

ISIN: MU0526N00007 SHORT: UPARTNERS CODE: UPL AUDITORS: BDO Cape Incorporated

REG NO: 138035C1/GBL FOUNDED: 2016 LISTED: 2016

NATURE OF BUSINESS: Universal Partners is a permanent capital CAPITAL STRUCTURE AUTHORISED ISSUED

investmentholding company. Universal Partners seek investments in VIS Ords no par value 1 000 000 000 401 265 547

high-potential, growth businesses, with a focus on the United Kingdom, LIQUIDITY: Jul21 Ave 940 919 shares p.w., R104 120.1(12.2% p.a.)

and Europe. Twenty percent of the company’s funds may be allocated to

other regions. The company's experienced leadership team is recognised REDS 40 Week MA VISUAL

foritsstrongtrackrecordofmanagingandgrowingsuccessfulbusinesses.

SECTOR: AltX 21

NUMBER OF EMPLOYEES: 0 17

DIRECTORS: Birrell A (UK), Chan F (ne, Mau), DunnAJ(ne),

Gain P (ind ne), Moothoosamy K (ne, Mau), Ooms M (ind ne), 13

Page N (ind ne), Nestadt L (Chair, ne), Joubert P (CEO),

Vinokur D (CFO) 9

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020

Blackstone 13.82% 5

Cassycode Trust 10.98%

Investec Bank Ltd. 8.26% 2016 | 2017 | 2018 | 2019 | 2020 | 1

POSTAL ADDRESS: Level 3, Alexander House, 35 Cybercity, Ebene,

Mauritius, 72201 FINANCIAL STATISTICS

MORE INFO: www.sharedata.co.za/sdo/jse/UPL (Amts in ZAR'000) Feb 21 Feb 20 Feb 19 Feb 18

COMPANY SECRETARY: Intercontinental Trust Ltd. Turnover Final Final Final Final(rst)

23

39

423

26

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DESIGNATEDADVISOR:JavaCapitalTrusteesandSponsors(Pty)Ltd. Op Inc - 7 012 - 31 905 - 8 399 - 33 778

AUDITORS: Grant Thornton NetIntPd(Rcvd) - 890 - 1 102 - 824 - 434

Minority Int - 151 - 88 - 33 - 306

CAPITAL STRUCTURE AUTHORISED ISSUED Att Inc - 5 488 - 26 138 - 7 784 - 31 981

UPL Ords no par - 72 350 131

TotCompIncLoss - 5 640 - 26 226 - 7 818 - 32 287

LIQUIDITY: Jul21 Ave 24 871 shares p.w., R449 863.2(1.8% p.a.) Fixed Ass 12 720 12 729 2 027 2 256

GENF 40 Week MA UPARTNERS Inv & Loans 6 500 6 500 37 001 37 000

Tot Curr Ass 348 504 13 569 11 468

2200

Ord SH Int - 9 814 - 6 775 19 363 27 149

Minority Int - 1 853 - 1 702 - 1 614 - 1 582

1941

LT Liab 15 167 14 581 18 305 17 147

1683 Tot Curr Liab 16 070 13 629 16 543 12 769

PER SHARE STATISTICS (cents per share)

1424

HEPS-C (ZARc) - 2.05 - 11.53 - 2.86 - 12.89

1166 NAV PS (ZARc) - 4.35 - 3.16 6.62 9.53

3 Yr Beta 0.13 - 0.57 - 0.62 0.01

907

2017 | 2018 | 2019 | 2020 | Price High 4 5 12 31

Price Low 4 1 1 4

FINANCIAL STATISTICS

(Amts in GBP'000) Mar 21 Jun 20 Jun 19 Jun 18 Jun 17 Price Prd End 4 4 2 12

Quarterly Final Final Final Final RATIOS

NetRent/InvInc - 291 - 810 - 2 611 - 1 908 - 615 Ret on SH Fnd 48.33 309.38 - 44.04 - 126.28

Total Inc - 291 - 810 - 2 611 - 1 908 - 615 Oper Pft Mgn - 30 486.96 - 7 542.55 - 32 303.85 - 86 610.26

Attrib Inc - 571 - 3 478 8 034 3 457 - 666 D:E - 1.68 - 2.21 1.22 0.70

TotCompIncLoss - 571 - 3 478 8 034 3 457 - 666 Current Ratio 0.02 0.04 0.82 0.90

Ord UntHs Int 76 619 79 194 82 673 74 638 71 181

Investments 89 045 87 806 70 284 54 658 4 000 Vivo Energy plc

Tot Curr Ass 3 508 678 14 761 20 852 67 245 VIV

Total Ass 92 553 88 484 85 045 75 510 71 245 ISIN: GB00BDGT2M75 SHORT: VIVO CODE: VVO

Tot Curr Liab 15 934 1 659 2 372 872 64 REG NO: 11250655 FOUNDED: 2018 LISTED: 2018

NATUREOF BUSINESS:Vivo Energy operatesandmarkets its products in

PER SHARE STATISTICS (cents per share) countries across North, West, East and Southern Africa. The Group has a

HEPS-C (ZARc) - 16.28 - 94.76 203.91 80.83 - 15.90 network of over 2 300 service stations in 23 countries operating under the

NAV PS (ZARc) 2 167.77 2 331.26 2 043.68 1 873.08 1 667.88 ShellandEngenbrandsandexportslubricantstoanumberofother African

3 Yr Beta - 0.18 - 0.31 - - - countries. Its retail offering includes fuels, lubricants, card services, shops,

Price Prd End 1 769 1 870 1 650 1 550 1 549 restaurants and other non-fuel services. It provides fuels, lubricants and

Price High 2 200 1 950 1 651 1 600 1 811 liquefied petroleum gas (LPG) to business customers across a range of

Price Low 1 680 1 250 1 115 1 290 1 450 sectors including marine, mining, construction, power, transport,

wholesalers and manufacturing.

RATIOS SECTOR: ConsDisr—Retail—Retailers—SpecialityRetaillers

RetOnSH Funds - 2.98 - 4.39 9.72 4.63 - 0.94 NUMBER OF EMPLOYEES: 0

RetOnTotAss - 1.26 - 0.92 - 3.07 - 2.53 - 0.86 DIRECTORS: Abaza G (ind ne, Egypt), Ahmed J (ne, UK),

Debt:Equity 0.19 - - - - Arrowsmith C (ind ne, UK), Lawani T (ne, Nig), NyasuluTH(ld ind ne),

OperRetOnInv - 1.31 - 0.92 - 3.71 - 3.49 - 15.38 Rogers C (ind ne, UK), Daly J (Chair, ind ne, Ire), Chammas C (CEO, Fr),

OpInc:Turnover - 582.00 - 165.98 - 614.35 - 300.95 - 149.27 Lafferty D (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 04 Jun 2021

Visual International Holdings Ltd. Vitol Africa B.V. 27.37%

27.09%

Helios Investment Partners LLP

VIS HIP Oil 2 B.V. 24.16%

ISIN: ZAE000187407 SHORT: VISUAL CODE: VIS MORE INFO: www.sharedata.co.za/sdo/jse/VVO

REG NO: 2006/030975/06 FOUNDED: 2006 LISTED: 2014 COMPANY SECRETARY: Minna Gonzalez-Gomez

NATURE OF BUSINESS: Visual is a property development company with TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

its head office in the northern suburbs of Cape Town. Visual focuses on all

aspects of property development and is proud to have been involved with SPONSOR: JP Morgan Equities South Africa (Pty) Ltd.

numerous successful residential, commercial and retail projects. AUDITORS: PwC Inc.

SECTOR: AltX CAPITAL STRUCTURE AUTHORISED ISSUED

NUMBER OF EMPLOYEES: 0 VVO Ords USD50c ea - 1 266 941 899

DIRECTORS: Matlholwa L (ne), Mbokazi-Nkambule Z (ind ne), DISTRIBUTIONS [USDc]

Vorster T (ind ne), Zuma N (ne), Richards Dr R (Chair, ind ne),

Robertson C K (CEO), Kadalie R (Acting CFO) Ords USD50c ea Ldt Pay Amt

25 Jun 21

POSTAL ADDRESS: PO Box 3163, Tyger Valley., 7536 Final No 6 25 May 21 18 Dec 20 3.79

Interim No 5

2.65

17 Nov 20

MORE INFO: www.sharedata.co.za/sdo/jse/VIS

228