Page 212 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 212

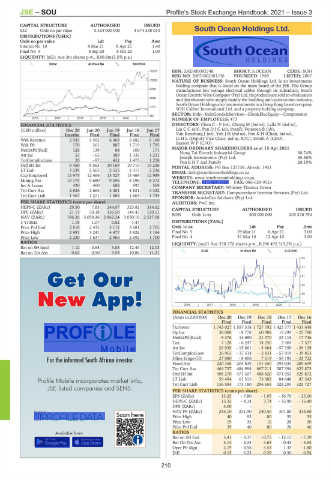

JSE – SOU Profile’s Stock Exchange Handbook: 2021 – Issue 3

CAPITAL STRUCTURE AUTHORISED ISSUED

S32 Ords no par value 5 324 000 000 4 674 538 013 South Ocean Holdings Ltd.

DISTRIBUTIONS [USDc] SOU

Ords no par value Ldt Pay Amt

Interim No 10 9 Mar 21 8 Apr 21 1.40

Final No 9 8 Sep 20 8 Oct 20 1.00

LIQUIDITY: Jul21 Ave 3m shares p.w., R80.8m(3.5% p.a.)

INDM 40 Week MA SOUTH32

15151 ISIN: ZAE000092748 SHORT: S.OCEAN CODE: SOH

REG NO: 2007/002381/06 FOUNDED: 1989 LISTED: 2007

12300 NATURE OF BUSINESS: South Ocean Holdings Ltd. is an investments

holding company that is listed on the main board of the JSE. The Group

9449

manufactures low voltage electrical cables through its subsidiary, South

OceanElectricWireCompany (Pty)Ltd.Itsproductsaresoldtowholesalers

6598

and distributors who supply mainly the building and construction industry.

South Ocean Holdings also has investments in a Hong Kong based company

3747

SOH Calibre International Ltd. and a property holding company.

SECTOR: Inds—IndsGoods&Services—Elec&ElecEquip—Components

897

2016 | 2017 | 2018 | 2019 | 2020 | NUMBER OF EMPLOYEES: 473

FINANCIAL STATISTICS DIRECTORS: ChenC-F(ne), Chong M (ind ne), Lalla N (ind ne),

(USD million) Dec 20 Jun 20 Jun 19 Jun 18 Jun 17 LiuCC(alt),PanDJC(alt, Brazil), Petersen B (alt),

Interim Final Final Final Final Van Rensburg J (ne),YehJH(ind ne), Pon K H (Chair, ind ne),

Wrk Revenue 2 943 5 492 6 468 6 682 6 160 Li H L (Deputy Vice Chair, ind ne, ROC), Smith A (CEO),

Wrk Pft 170 261 887 1 719 1 795 Basson W P (CFO)

NetIntPd(Rcd) 126 139 84 100 171 MAJOR ORDINARY SHAREHOLDERS as at 15 Apr 2021

Att Inc 53 - 65 389 1 332 1 231 Hong Tai Electric Industrial Group 30.74%

TotCompIncLoss 35 - 87 432 1 475 1 258 Joseph Investments (Pty) Ltd. 30.56%

20.19%

PanEHTand Family

Ord SH Int 9 450 9 563 10 169 10 710 10 236 POSTAL ADDRESS: PO Box 123738, Alrode, 1451

LT Liab 3 239 2 565 2 525 2 315 2 236 EMAIL: info@southoceanholdings.co.za

Cap Employed 12 975 12 466 13 027 13 469 12 989 WEBSITE: www.southoceanholdings.co.za

Mining Ass 10 179 9 680 9 596 8 196 8 373 TELEPHONE: 011-864-1606 FAX: 086-628-9523

Inv & Loans 420 460 688 697 569 COMPANY SECRETARY: Whitney Thomas Green

Tot Curr Ass 2 836 2 663 3 401 4 821 4 332 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Tot Curr Liab 1 467 1 271 1 688 1 664 1 744

SPONSOR: AcaciaCap Advisors (Pty) Ltd.

PER SHARE STATISTICS (cents per share) AUDITORS: PwC Inc.

HEPS-C (ZARc) 29.50 7.83 244.07 323.82 314.62 CAPITAL STRUCTURE AUTHORISED ISSUED

DPS (ZARc) 21.11 50.18 136.50 144.47 129.51

NAV (ZARc) 196.26 3 059.26 2 862.24 3 050.16 2 517.08 SOH Ords 1c ea 500 000 000 203 276 794

3 Yr Beta 1.18 1.07 0.82 1.47 - DISTRIBUTIONS [ZARc]

Price Prd End 2 818 2 435 3 112 3 681 2 705 Ords 1c ea Ldt Pay Amt

Price High 2 991 3 241 4 477 3 926 3 164 FinalNo 5 29 Mar21 6 Apr21 3.00

Price Low 2 220 1 637 2 966 2 692 1 700 Final No 4 31 Mar 10 12 Apr 10 3.00

RATIOS LIQUIDITY: Jun21 Ave 358 770 shares p.w., R198 492.5(9.2% p.a.)

Ret on SH fund 1.12 - 0.68 3.83 12.44 12.03

Ret on Tot Ass 0.62 0.90 5.54 10.86 11.21 ELEE 40 Week MA S.OCEAN

93

77

61

44

28

12

2016 | 2017 | 2018 | 2019 | 2020 |

FINANCIAL STATISTICS

(Amts in ZAR'000) Dec 20 Dec 19 Dec 18 Dec 17 Dec 16

Final Final Final Final Final

Turnover 1 743 027 1 557 318 1 727 792 1 425 777 1 433 648

Op Inc 38 088 - 8 778 60 988 19 299 - 25 780

NetIntPd(Rcvd) 9 376 14 690 21 070 23 118 17 746

Tax 7 128 - 6 247 14 250 2 404 - 7 527

Att Inc 26 939 - 15 861 - 3 664 - 57 350 - 39 139

TotCompIncLoss 26 963 - 17 514 - 2 831 - 57 919 - 39 853

Hline Erngs-CO 27 080 - 8 406 7 019 - 56 193 - 25 722

Fixed Ass 220 358 204 839 191 650 293 035 289 699

Tot Curr Ass 464 737 484 994 667 211 587 394 623 873

Ord SH Int 498 270 471 307 488 820 471 953 529 872

LT Liab 59 494 61 315 73 382 84 648 87 543

Tot Curr Liab 136 584 173 180 296 659 328 293 325 727

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 13.25 - 7.80 - 1.95 - 36.70 - 25.00

HEPS-C (ZARc) 13.32 - 4.14 3.74 - 35.90 - 16.40

DPS (ZARc) 3.00 - - - -

NAV PS (ZARc) 245.10 231.90 240.50 301.80 338.80

Price High 40 93 80 55 55

Price Low 19 35 10 28 30

Price Prd End 39 40 80 28 46

RATIOS

Ret on SH Fnd 5.41 - 3.37 - 0.75 - 12.15 - 7.39

Ret On Tot Ass 4.14 - 3.33 4.65 - 0.43 - 4.65

Oper Pft Mgn 2.19 - 0.56 3.53 1.35 - 1.80

D:E 0.15 0.23 0.29 0.30 0.54

210