Page 131 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 131

Profile’s Stock Exchange Handbook: 2021 – Issue 3 JSE – GRI

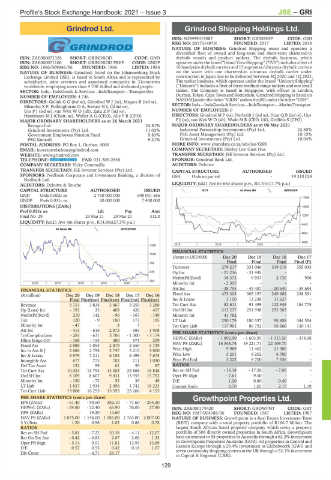

Grindrod Ltd. Grindrod Shipping Holdings Ltd.

GRI GRI

ISIN: SG9999019087 SHORT: GRINSHIP CODE: GSH

REG NO: 201731497H FOUNDED: 2017 LISTED: 2018

NATURE OF BUSINESS: Grindrod Shipping owns and operates a

diversified fleet of owned and long-term and short-term chartered-in

ISIN: ZAE000072328 SHORT: GRINDROD CODE: GND drybulk vessels and product tankers. The drybulk business, which

ISIN: ZAE000071106 SHORT: GRINDROD PREF CODE: GNDP operatesunderthebrand“IslandViewShipping”(“IVS”)includesafleetof

REG NO: 1966/009846/06 FOUNDED: 1966 LISTED: 1986 16 handysize drybulk carriers and 15 supramax/ultramax drybulk carriers

NATURE OF BUSINESS: Grindrod, listed on the Johannesburg Stock on the water with one chartered-in ultramax drybulk carrier under

Exchange Limited (JSE), is based in South Africa and is represented by construction in Japan due to be delivered between 3Q 2020 and 1Q 2021.

subsidiaries, joint ventures and associated companies in 31countries The tanker business, which operates under the brand “Unicorn Shipping”

worldwide, employing more than 4 700 skilled and dedicated people. (“Unicorn”) includes a fleet of three medium range tankers and one small

SECTOR: Inds—IndsGoods & Services—IndsTransport—TransportSer tanker. The Company is based in Singapore, with offices in London,

NUMBER OF EMPLOYEES: 4 746 Durban, Tokyo, Cape Town and Rotterdam. Grindrod Shipping is listed on

DIRECTORS: GelinkGG(ind ne), GrindrodWJ(ne), Magara B (ind ne), NASDAQundertheticker“GRIN”andontheJSEundertheticker“GSH”.

Mbambo X F, Polkinghorne D A, SowaziNL(ld ind ne), SECTOR:Inds—IndsGoods&Services—IndsTransport—MarineTransport

UysPJ(ind ne), van WykWO(alt), ZatuZP(ind ne), NUMBER OF EMPLOYEES: 0

Hankinson M J (Chair, ne), Waller A G (CEO), Ally F B (CFO) DIRECTORS: Grindrod M P (ne), Herholdt J (ind ne), Huat QB(ind ne), Uys

MAJOR ORDINARY SHAREHOLDERS as at 26 March 2021 PJ(ne), van Wyk W O (alt), Wade M R (CEO, UK), Griffiths S (CFO)

Remgro Ltd. 24.81% MAJOR ORDINARY SHAREHOLDERS as at 06 May 2021

Grindrod Investments (Pty) Ltd. 11.02% Industrial Partnership Investments (Pty) Ltd. 22.80%

Government Employees Pension Fund 9.83% PSG Asset Management (Pty) Ltd. 10.70%

PSG Konsult 9.21% Grindrod Investments (Pty) Ltd. 10.04%

POSTAL ADDRESS: PO Box 1, Durban, 4000 MORE INFO: www.sharedata.co.za/sdo/jse/GSH

EMAIL: investorrelations@grindrod.com COMPANY SECRETARY: Shirley Lim Guat Hua

WEBSITE: www.grindrod.com TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

TELEPHONE: 031-304-1451 FAX: 031-305-2848 SPONSOR: Grindrod Bank Ltd.

COMPANY SECRETARY: Vicky Commaille AUDITORS: Deloitte

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

SPONSORS: Nedbank Corporate and Investment Banking, a division of GSH Ords no par val - 19 310 024

Nedbank Ltd.

AUDITORS: Deloitte & Touche LIQUIDITY: Jul21 Ave 65 663 shares p.w., R5.7m(17.7% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED INDT 40 Week MA GRINSHIP

GND Ords 0.002c ea 2 750 000 000 698 031 586

17899

GNDP Prefs 0.031c ea 20 000 000 7 400 000

DISTRIBUTIONS [ZARc] 15080

Pref 0.031c ea Ldt Pay Amt

Final No 29 23 Mar 21 29 Mar 21 312.0 12261

LIQUIDITY: Jun21 Ave 4m shares p.w., R14.9m(27.3% p.a.)

9443

40 Week MA GRINDROD

6624

3805

1299 2018 | 2019 | 2020 |

FINANCIAL STATISTICS

1048

(Amts in USD'000) Dec 20 Dec 19 Dec 18 Dec 17

Final Final Final Final (P)

796

Turnover 279 217 331 046 319 018 355 035

545 Op Inc - 21 236 - 31 445 - -

NetIntPd(Rcvd) 16 373 9 937 2 730 906

294

2016 | 2017 | 2018 | 2019 | 2020 | Minority Int - 2 305 - - -

Att Inc - 38 795 - 43 487 - 20 640 - 59 684

FINANCIAL STATISTICS

(R million) Dec 20 Dec 19 Dec 18 Dec 17 Dec 16 Fixed Ass 475 303 305 197 249 602 238 591

Final Final(rst) Final(rst) Final(rst) Final(rst) Inv & Loans 3 150 12 238 11 627 -

Revenue 3 751 3 834 3 467 3 059 3 288 Tot Curr Ass 82 611 91 499 122 949 154 775

Op (Loss) Inc - 193 35 409 426 457 Ord SH Int 212 237 251 938 292 503 -

NetIntPd(Rcvd) 210 142 - 96 - 167 - 149 Minority Int 41 782 - - -

Tax 120 - 9 180 173 195 LT Liab 250 179 180 337 98 458 344 554

Minority Int - 47 - 8 7 - Tot Curr Liab 117 901 86 792 56 666 130 141

Att Inc - 415 - 616 2 873 - 583 - 1 908 PER SHARE STATISTICS (cents per share)

TotCompIncLoss - 281 - 631 3 786 - 1 300 - 3 174

Hline Erngs-CO - 168 - 153 480 571 209 HEPS-C (ZARc) - 1 892.90 - 1 603.95 - 1 315.50 - 374.08

Fixed Ass 2 888 3 054 2 879 2 650 5 739 NAV PS (ZARc) 16 348.74 19 221.71 22 109.70 -

Inv in Ass & J 2 886 2 794 3 747 3 215 4 800 Price High 9 989 11 462 21 900 -

Inv & Loans 6 979 7 211 6 183 6 499 7 675 Price Low 3 201 6 202 6 780 -

Intangible Ass 677 773 702 711 1 030 Price Prd End 5 222 9 700 7 536 -

Def Tax Asset 152 99 61 59 87 RATIOS

Tot Curr Ass 10 024 13 794 14 003 25 868 16 848 Ret on SH Fnd - 16.18 - 17.26 - 7.06 -

Ord SH Int 8 109 8 607 9 431 13 955 15 752 Oper Pft Mgn - 7.61 - 9.50 - -

Minority Int - 150 - 72 52 39 49 D:E 1.20 0.80 0.40 -

LT Liab 1 837 2 934 2 496 1 742 16 223 Current Ratio 0.70 1.05 2.17 1.19

Tot Curr Liab 13 808 16 255 15 595 23 266 4 155

PER SHARE STATISTICS (cents per share) Growthpoint Properties Ltd.

EPS (ZARc) - 61.40 - 90.50 382.10 - 77.60 - 254.20

GRO

HEPS-C (ZARc) - 24.80 - 22.40 63.90 76.00 27.80 ISIN: ZAE000179420 SHORT: GROWPNT CODE: GRT

DPS (ZARc) - 19.20 14.60 - - REG NO: 1987/004988/06 FOUNDED: 1987 LISTED: 1987

NAV PS (ZARc) 1 075.00 1 146.00 1 285.00 1 763.00 2 007.00 NATURE OF BUSINESS: Growthpoint is a Real Estate Investment Trust

3 Yr Beta 1.20 0.96 1.02 0.86 0.78 (REIT) company with a total property portfolio of R166.7 billion. The

RATIOS largest South African listed property company which owns a property

Ret on SH Fnd - 5.81 - 7.22 30.38 - 4.11 - 12.07 portfolio of 506 directly owned properties in South Africa. Growthpoint

Ret On Tot Ass - 0.42 - 0.83 2.67 2.00 1.33 have an interest in 58 properties in Australia through a 62.2% investment

Oper Pft Mgn - 5.14 0.91 11.81 13.93 13.89 in Growthpoint Properties Australia (GOZ), 62 properties in Central and

D:E 0.57 0.53 0.42 0.18 1.07 Eastern Europe through a 29.4% investment in Globalworth (GWI) and

seven community shopping centres in the UK through a 52.1% investment

Div Cover - - 4.71 26.17 - -

in Capital & Regional (C&R).

129