Page 74 - 2021 Issue 2

P. 74

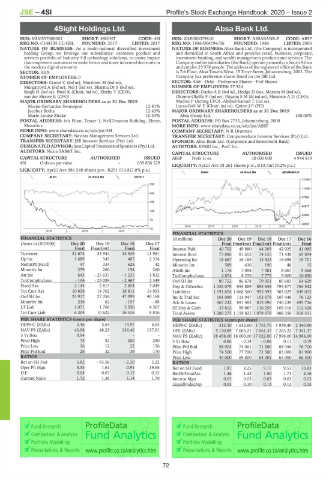

JSE – 4SI Profile’s Stock Exchange Handbook: 2020 – Issue 2

4Sight Holdings Ltd. Absa Bank Ltd.

4SI ABS

ISIN: MU0557S00001 SHORT: 4SIGHT CODE: 4SI ISIN: ZAE000079810 SHORT: ABSABANK-P CODE: ABSP

REG NO: C148335 C1/GBL FOUNDED: 2017 LISTED: 2017 REG NO: 1986/004794/06 FOUNDED: 1986 LISTED: 2006

NATURE OF BUSINESS: As a multi-national diversified investment NATURE OF BUSINESS: Absa Bank Ltd. (the Company) is incorporated

holding Group, we leverage our subsidiaries’ extensive product and and domiciled in South Africa and provides retail, business, corporate,

services portfolio of Industry 4.0 technology solutions, to create impact investment banking, and wealth management products and services. The

that empowers customers to make better and more informed decisions in Company and its subsidiaries (the Bank) operate primarily in South Africa

the modern digital economy. and employ 25 978 people. The address of the registered office of the Bank

SECTOR: AltX is 7th Floor, Absa Towers West, 15 Troye Street, Johannesburg, 2001. The

NUMBER OF EMPLOYEES: 0 Company has preference shares listed on the JSE Ltd.

DIRECTORS: Crowe C (ind ne), Mortimer M (ind ne), SECTOR: Add—Debt—Preference Shares—Pref Shares

Murgatroyd A (ind ne), Nel J (ind ne), Sharma Dr S (ind ne), NUMBER OF EMPLOYEES: 27 324

Singh H (ind ne), Patel K (Chair, ind ne), Zitzke T (CEO), DIRECTORS: DarkoAB(ind ne), Hodge D (ne), Merson M (ind ne),

van der Merwe E (CFO) Okomo-Okello F (ind ne), PityanaSM(ld ind ne), Mminele A D (CEO),

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019 Modise P (Acting CFO), Abdool-Samad T (ind ne),

Morne Gerhardus Swanepoel 12.91% Lucas-Bull W E (Chair, ind ne), Quinn J P (FD)

Jacobus Botha 12.43% MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019

Marie-Louise Zitzke 10.33% Absa Group Ltd. 100.00%

POSTAL ADDRESS: 6th Floor, Tower 1, NeXTeracom Building, Ebene, POSTAL ADDRESS: PO Box 7735, Johannesburg, 2000

Mauritius MORE INFO: www.sharedata.co.za/sdo/jse/ABSP

MORE INFO: www.sharedata.co.za/sdo/jse/4SI COMPANY SECRETARY: N R Drutman

COMPANY SECRETARY: Navitas Management Services Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. SPONSOR: Absa Bank Ltd. (Corporate and Investment Bank)

DESIGNATEDADVISOR:JavaCapitalTrusteesandSponsors(Pty)Ltd. AUDITORS: KPMG Inc., PwC Inc.

AUDITORS: Nexia SAB&T Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

CAPITAL STRUCTURE AUTHORISED ISSUED ABSP Prefs 1c ea 30 000 000 4 944 839

4SI Ords no par value - 659 856 529

LIQUIDITY: Apr21 Ave 18 261 shares p.w., R10.7m(19.2% p.a.)

LIQUIDITY: Apr21 Ave 986 548 shares p.w., R291 013.8(7.8% p.a.)

BANK 40 Week MA ABSABANK-P

ALSH 40 Week MA 4SIGHT

131843

298

114854

242

97866

185

80877

128

63889

72

46900

2016 | 2017 | 2018 | 2019 | 2020 |

15

2018 | 2019 | 2020 |

FINANCIAL STATISTICS

FINANCIAL STATISTICS (R million) Dec 20 Dec 19 Dec 18 Dec 17 Dec 16

(Amts in USD'000) Dec 20 Dec 19 Dec 18 Dec 17 Final Final(rst) Final(rst) Final(rst) Final

Final Final(rst) Final Final Interest Paid 40 702 49 880 44 203 42 025 41 085

Turnover 31 674 33 944 44 539 11 981 Interest Rcvd 73 886 81 652 74 155 71 438 69 894

Op Inc 1 689 545 407 2 354 Operating Inc 18 687 16 185 15 923 16 698 19 701

NetIntPd(Rcvd) 47 334 628 42 Minority Int 589 436 190 48 15

Minority Int 279 260 154 260 Attrib Inc 1 176 7 098 7 481 8 067 9 568

Att Inc 643 - 25 637 - 1 235 1 832 TotCompIncLoss 4 874 8 276 7 775 9 000 10 850

TotCompIncLoss - 104 - 25 089 - 2 467 2 349 Ord SH Int 89 752 86 678 79 051 80 683 64 629

Fixed Ass 2 144 2 815 2 854 3 049 Dep & OtherAcc 1 035 079 954 889 893 648 795 877 764 542

Tot Curr Ass 10 858 14 702 18 811 14 953 Liabilities 1 191 876 1 068 500 995 993 903 029 849 012

Ord SH Int 23 917 27 056 47 099 40 168 Inv & Trad Sec 101 090 114 947 103 678 107 448 76 123

Minority Int 236 62 - 157 - 88 Adv & Loans 967 232 891 483 813 096 740 239 695 736

LT Liab 1 071 1 768 5 550 4 567 ST Dep & Cash 33 812 99 067 116 255 105 316 112 426

Tot Curr Liab 6 304 10 622 16 536 8 816 Total Assets 1 286 275 1 159 825 1 079 679 988 358 918 311

PER SHARE STATISTICS (cents per share) PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 3.46 5.64 14.97 6.65 HEPS-C (ZARc) 312.50 1 632.60 1 751.70 1 939.40 2 340.90

NAV PS (ZARc) 43.98 48.23 136.46 137.91 DPS (ZARc) 5 170.89 7 065.21 7 061.37 7 263.22 7 341.37

3 Yr Beta 0.94 - - - NAV PS (ZARc) 18 458.00 18 000.00 17 022.00 17 998.00 14 984.00

Price High 75 52 200 290 3 Yr Beta 0.86 - 0.14 - 0.08 0.11 0.19

Price Low 16 12 22 156 Price Prd End 58 903 74 001 71 500 68 456 76 700

Price Prd End 28 32 39 170 Price High 74 500 77 700 72 500 83 000 81 900

RATIOS Price Low 45 000 69 800 64 001 65 000 66 500

Ret on SH Fnd 3.82 - 93.58 - 2.30 5.22 RATIOS

Oper Pft Mgn 5.33 1.61 0.91 19.65 Ret on SH Fund 1.87 8.25 9.17 9.51 13.83

D:E 0.04 0.07 0.12 0.12 RetOnTotalAss 1.46 1.43 1.50 1.71 2.16

Current Ratio 1.72 1.38 1.14 1.70 Interest Mgn 0.03 0.03 0.03 0.03 0.03

LiquidFnds:Dep 0.03 0.10 0.13 0.13 0.15

Fund Research Fund Research

Comparison & Analysis Comparison & Analysis

Portfolio Modelling Portfolio Modelling

Presentations & Reports www.profile.co.za/analytics.htm Presentations & Reports www.profile.co.za/analytics.htm

72