Page 77 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 77

Profile’s Stock Exchange Handbook: 2021 – Issue 1 JSE – ADC

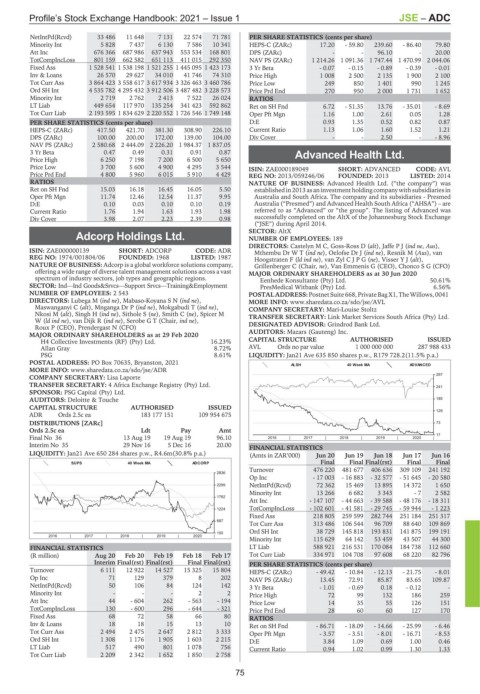

NetIntPd(Rcvd) 33 486 11 648 7 131 22 574 71 781 PER SHARE STATISTICS (cents per share)

Minority Int 5 828 7 437 6 130 7 586 10 341 HEPS-C (ZARc) 17.20 - 59.80 239.60 - 86.40 79.80

Att Inc 676 366 687 986 637 943 553 534 168 801 DPS (ZARc) - - 96.10 - 20.00

TotCompIncLoss 801 159 662 582 651 113 411 015 292 350 NAV PS (ZARc) 1 214.26 1 091.36 1 747.44 1 470.99 2 044.06

Fixed Ass 1 528 541 1 538 198 1 521 255 1 445 095 1 423 173 3 Yr Beta - 0.07 - 0.15 - 0.89 - 0.39 - 0.01

Inv & Loans 26 570 29 627 34 010 41 746 74 310 Price High 1 008 2 500 2 135 1 900 2 100

Tot Curr Ass 3 864 423 3 558 617 3 617 934 3 326 463 3 460 786 Price Low 249 850 1 401 990 1 245

Ord SH Int 4 535 782 4 295 432 3 912 506 3 487 482 3 228 573 Price Prd End 270 950 2 000 1 731 1 652

Minority Int 2 719 2 762 2 413 7 522 26 024 RATIOS

LT Liab 449 654 117 970 135 254 341 423 592 862 Ret on SH Fnd 6.72 - 51.35 13.76 - 35.01 - 8.69

Tot Curr Liab 2 193 595 1 834 629 2 220 552 1 726 546 1 749 148 Oper Pft Mgn 1.16 1.00 2.61 0.05 1.28

PER SHARE STATISTICS (cents per share) D:E 0.93 1.35 0.52 0.82 0.87

HEPS-C (ZARc) 417.50 421.70 381.30 308.90 226.10 Current Ratio 1.13 1.06 1.60 1.52 1.21

DPS (ZARc) 100.00 200.00 172.00 139.00 104.00 Div Cover - - 2.50 - - 8.96

NAV PS (ZARc) 2 580.68 2 444.09 2 226.20 1 984.37 1 837.05

3 Yr Beta 0.47 0.49 0.31 0.91 0.87 Advanced Health Ltd.

Price High 6 250 7 198 7 200 6 500 5 650

ADV

Price Low 3 700 5 600 4 900 4 295 3 544 ISIN: ZAE000189049 SHORT: ADVANCED CODE: AVL

Price Prd End 4 800 5 960 6 015 5 910 4 429 REG NO: 2013/059246/06 FOUNDED: 2013 LISTED: 2014

RATIOS NATURE OF BUSINESS: Advanced Health Ltd. (“the company”) was

Ret on SH Fnd 15.03 16.18 16.45 16.05 5.50 established in2013 asaninvestmentholding company with subsidiaries in

Oper Pft Mgn 11.74 12.46 12.54 11.37 9.95 Australia and South Africa. The company and its subsidiaries - Presmed

D:E 0.10 0.03 0.10 0.10 0.19 Australia (“Presmed”) and Advanced Health South Africa (“AHSA”) – are

Current Ratio 1.76 1.94 1.63 1.93 1.98 referred to as “Advanced” or “the group”. The listing of Advanced was

Div Cover 3.98 2.07 2.23 2.39 0.98 successfully completed on the AltX of the Johannesburg Stock Exchange

(“JSE”) during April 2014.

SECTOR: AltX

Adcorp Holdings Ltd. NUMBER OF EMPLOYEES: 189

ADC DIRECTORS: Castelyn M C, Goss-Ross D (alt), JaffePJ(ind ne, Aus),

ISIN: ZAE000000139 SHORT: ADCORP CODE: ADR Mthembu DrWT(ind ne), Oelofse Dr J (ind ne), Resnik M (Aus), van

REG NO: 1974/001804/06 FOUNDED: 1968 LISTED: 1987 Hoogstraten F (ld ind ne), van ZylCJPG(ne), VisserYJ(alt),

NATURE OF BUSINESS: Adcorp is a global workforce solutions company, Grillenberger C (Chair, ne), Van Emmenis G (CEO), Chonco S G (CFO)

offering a wide range of diverse talent management solutions across a vast MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020

spectrum of industry sectors, job types and geographic regions. Eenhede Konsultante (Pty) Ltd. 50.61%

SECTOR: Ind—Ind Goods&Srvcs—Support Srvcs—Training&Employment PresMedical Witbank (Pty) Ltd. 6.56%

NUMBER OF EMPLOYEES: 2 543 POSTAL ADDRESS:PostnetSuite668, PrivateBagX1,TheWillows,0041

DIRECTORS: Lubega M (ind ne), Mabaso-KoyanaSN(ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/AVL

Maswanganyi C (alt), Mnganga Dr P (ind ne), Mokgabudi T (ind ne), COMPANY SECRETARY: Mari-Louise Stoltz

Nkosi M (alt), Singh H (ind ne), Sithole S (ne), Smith C (ne), Spicer M TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

W(ld ind ne), van Dijk R (ind ne), Serobe G T (Chair, ind ne), DESIGNATED ADVISOR: Grindrod Bank Ltd.

Roux P (CEO), Prendergast N (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2020 AUDITORS: Mazars (Gauteng) Inc.

H4 Collective Investments (RF) (Pty) Ltd. 16.23% CAPITAL STRUCTURE AUTHORISED ISSUED

Allan Gray 8.72% AVL Ords no par value 1 000 000 000 287 988 433

PSG 8.61% LIQUIDITY: Jan21 Ave 635 850 shares p.w., R179 728.2(11.5% p.a.)

POSTAL ADDRESS: PO Box 70635, Bryanston, 2021

ALSH 40 Week MA ADVANCED

MORE INFO: www.sharedata.co.za/sdo/jse/ADR

COMPANY SECRETARY: Lisa Laporte 297

TRANSFER SECRETARY: 4 Africa Exchange Registry (Pty) Ltd. 241

SPONSOR: PSG Capital (Pty) Ltd.

AUDITORS: Deloitte & Touche 185

CAPITAL STRUCTURE AUTHORISED ISSUED

ADR Ords 2.5c ea 183 177 151 109 954 675 129

DISTRIBUTIONS [ZARc] 73

Ords 2.5c ea Ldt Pay Amt

17

Final No 36 13 Aug 19 19 Aug 19 96.10 2016 | 2017 | 2018 | 2019 | 2020 |

Interim No 35 29 Nov 16 5 Dec 16 20.00

FINANCIAL STATISTICS

LIQUIDITY: Jan21 Ave 650 284 shares p.w., R4.6m(30.8% p.a.) (Amts in ZAR’000) Jun 20 Jun 19 Jun 18 Jun 17 Jun 16

SUPS 40 Week MA ADCORP Final Final Final(rst) Final Final

Turnover 476 220 481 677 406 636 309 109 241 192

2836

Op Inc - 17 003 - 16 883 - 32 577 - 51 645 - 20 580

2299 NetIntPd(Rcvd) 72 362 15 469 13 895 14 372 1 650

Minority Int 13 266 6 682 3 343 - 7 2 582

1762

Att Inc - 147 107 - 44 663 - 39 588 - 48 176 - 18 311

1224 TotCompIncLoss - 102 601 - 41 581 - 29 745 - 59 944 - 1 223

Fixed Ass 218 805 259 599 282 744 251 184 251 317

687

Tot Curr Ass 313 486 106 544 96 709 88 640 109 869

150 Ord SH Int 38 729 145 818 193 831 141 875 199 191

2016 | 2017 | 2018 | 2019 | 2020 |

Minority Int 115 629 64 142 53 459 43 507 44 300

FINANCIAL STATISTICS LT Liab 588 921 216 531 170 084 184 738 112 660

(R million) Aug 20 Feb 20 Feb 19 Feb 18 Feb 17 Tot Curr Liab 334 971 104 708 97 608 68 220 82 796

Interim Final(rst) Final(rst) Final Final(rst) PER SHARE STATISTICS (cents per share)

Turnover 6 111 12 922 14 527 15 325 15 804 HEPS-C (ZARc) - 49.42 - 10.84 - 12.13 - 21.75 - 8.01

Op Inc 71 129 379 8 202 NAV PS (ZARc) 13.45 72.91 85.87 83.65 109.87

NetIntPd(Rcvd) 50 106 84 124 142 3 Yr Beta - 1.01 - 0.69 0.18 - 0.12 -

Minority Int - - - 2 2 Price High 72 99 132 186 259

Att Inc 44 - 604 262 - 563 - 194 Price Low 14 35 55 126 151

TotCompIncLoss 130 - 600 296 - 644 - 321 Price Prd End 28 60 60 127 170

Fixed Ass 68 72 58 66 80 RATIOS

Inv & Loans 18 18 15 13 10 Ret on SH Fnd - 86.71 - 18.09 - 14.66 - 25.99 - 6.46

Tot Curr Ass 2 494 2 475 2 647 2 812 3 333 Oper Pft Mgn - 3.57 - 3.51 - 8.01 - 16.71 - 8.53

Ord SH Int 1 308 1 176 1 905 1 603 2 215 D:E 3.84 1.09 0.69 1.00 0.46

LT Liab 517 490 801 1 078 756 Current Ratio 0.94 1.02 0.99 1.30 1.33

Tot Curr Liab 2 209 2 342 1 652 1 850 2 758

75