Page 74 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 74

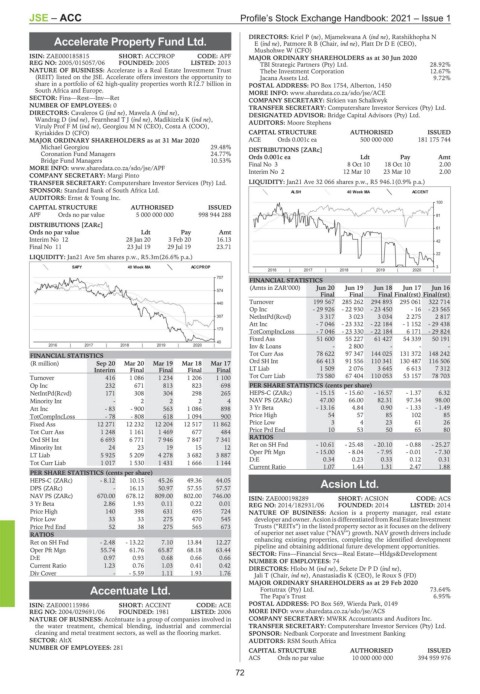

JSE – ACC Profile’s Stock Exchange Handbook: 2021 – Issue 1

DIRECTORS: Kriel P (ne), Mjamekwana A (ind ne), Ratshikhopha N

Accelerate Property Fund Ltd. E(ind ne), Patmore R B (Chair, ind ne), Platt Dr D E (CEO),

Mushohwe W (CFO)

ACC

ISIN: ZAE000185815 SHORT: ACCPROP CODE: APF MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020

REG NO: 2005/015057/06 FOUNDED: 2005 LISTED: 2013 TBI Strategic Partners (Pty) Ltd. 28.92%

NATURE OF BUSINESS: Accelerate is a Real Estate Investment Trust Thebe Investment Corporation 12.67%

(REIT) listed on the JSE. Accelerate offers investors the opportunity to Jacana Assets Ltd. 9.72%

share in a portfolio of 62 high-quality properties worth R12.7 billion in POSTAL ADDRESS: PO Box 1754, Alberton, 1450

South Africa and Europe. MORE INFO: www.sharedata.co.za/sdo/jse/ACE

SECTOR: Fins—Rest—Inv—Ret COMPANY SECRETARY: Sirkien van Schalkwyk

NUMBER OF EMPLOYEES: 0 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DIRECTORS: Cavaleros G (ind ne), Mawela A (ind ne), DESIGNATED ADVISOR: Bridge Capital Advisors (Pty) Ltd.

Wandrag D (ind ne), FearnheadTJ(ind ne), Madikizela K (ind ne), AUDITORS: Moore Stephens

Viruly ProfFM(ind ne), Georgiou M N (CEO), Costa A (COO),

Kyriakides D (CFO) CAPITAL STRUCTURE AUTHORISED ISSUED

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020 ACE Ords 0.001c ea 500 000 000 181 175 744

Michael Georgiou 29.48% DISTRIBUTIONS [ZARc]

Coronation Fund Managers 24.77% Ords 0.001c ea Ldt Pay Amt

Bridge Fund Managers 10.53% Final No 3 8 Oct 10 18 Oct 10 2.00

MORE INFO: www.sharedata.co.za/sdo/jse/APF

COMPANY SECRETARY: Margi Pinto Interim No 2 12 Mar 10 23 Mar 10 2.00

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. LIQUIDITY: Jan21 Ave 32 066 shares p.w., R5 946.1(0.9% p.a.)

SPONSOR: Standard Bank of South Africa Ltd. ALSH 40 Week MA ACCENT

AUDITORS: Ernst & Young Inc.

100

CAPITAL STRUCTURE AUTHORISED ISSUED

APF Ords no par value 5 000 000 000 998 944 288 81

DISTRIBUTIONS [ZARc]

61

Ords no par value Ldt Pay Amt

Interim No 12 28 Jan 20 3 Feb 20 16.13 42

Final No 11 23 Jul 19 29 Jul 19 23.71

22

LIQUIDITY: Jan21 Ave 5m shares p.w., R5.3m(26.6% p.a.)

SAPY 40 Week MA ACCPROP 3

2016 | 2017 | 2018 | 2019 | 2020 |

707

FINANCIAL STATISTICS

(Amts in ZAR’000) Jun 20 Jun 19 Jun 18 Jun 17 Jun 16

574

Final Final Final Final(rst) Final(rst)

Turnover 199 567 285 262 294 893 295 061 322 714

440

Op Inc - 29 926 - 22 930 - 23 450 - 16 - 23 565

307 NetIntPd(Rcvd) 3 317 3 023 3 034 2 275 2 817

Att Inc - 7 046 - 23 332 - 22 184 - 1 152 - 29 438

173

TotCompIncLoss - 7 046 - 23 330 - 22 184 6 171 - 29 824

Fixed Ass 51 600 55 227 61 427 54 339 50 191

40

2016 | 2017 | 2018 | 2019 | 2020 | Inv & Loans - 2 800 - - -

FINANCIAL STATISTICS Tot Curr Ass 78 622 97 347 144 025 131 372 148 242

(R million) Sep 20 Mar 20 Mar 19 Mar 18 Mar 17 Ord SH Int 66 413 91 556 110 341 130 487 116 506

Interim Final Final Final Final LT Liab 1 509 2 076 3 645 6 613 7 312

Turnover 416 1 086 1 234 1 206 1 100 Tot Curr Liab 73 580 67 404 110 053 53 157 78 703

Op Inc 232 671 813 823 698 PER SHARE STATISTICS (cents per share)

NetIntPd(Rcvd) 171 308 304 298 265 HEPS-C (ZARc) - 15.15 - 15.60 - 16.57 - 1.37 6.32

Minority Int - 2 2 2 4 NAV PS (ZARc) 47.00 66.00 82.31 97.34 98.00

Att Inc - 83 - 900 563 1 086 898 3 Yr Beta - 13.16 4.84 0.90 - 1.33 - 1.49

TotCompIncLoss - 78 - 808 618 1 094 900 Price High 54 57 85 102 85

Fixed Ass 12 271 12 232 12 204 12 517 11 862 Price Low 3 4 23 61 26

Tot Curr Ass 1 248 1 161 1 469 677 484 Price Prd End 10 53 50 65 80

Ord SH Int 6 693 6 771 7 946 7 847 7 341 RATIOS

Minority Int 24 23 19 15 12 Ret on SH Fnd - 10.61 - 25.48 - 20.10 - 0.88 - 25.27

LT Liab 5 925 5 209 4 278 3 682 3 887 Oper Pft Mgn - 15.00 - 8.04 - 7.95 - 0.01 - 7.30

Tot Curr Liab 1 017 1 530 1 431 1 666 1 144 D:E 0.34 0.23 0.33 0.12 0.31

Current Ratio 1.07 1.44 1.31 2.47 1.88

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 8.12 10.15 45.26 49.36 44.05 Acsion Ltd.

DPS (ZARc) - 16.13 50.97 57.55 57.57

ACS

NAV PS (ZARc) 670.00 678.12 809.00 802.00 746.00 ISIN: ZAE000198289 SHORT: ACSION CODE: ACS

3 Yr Beta 2.86 1.93 0.11 0.22 0.01 REG NO: 2014/182931/06 FOUNDED: 2014 LISTED: 2014

Price High 140 398 631 695 724 NATURE OF BUSINESS: Acsion is a property manager, real estate

Price Low 33 33 275 470 545 developer and owner. Acsion is differentiated from Real Estate Investment

Price Prd End 52 38 275 565 673 Trusts (“REITs”) in the listed property sector as it focuses on the delivery

RATIOS of superior net asset value (“NAV”) growth. NAV growth drivers include

Ret on SH Fnd - 2.48 - 13.22 7.10 13.84 12.27 enhancing existing properties, completing the identified development

pipeline and obtaining additional future development opportunities.

Oper Pft Mgn 55.74 61.76 65.87 68.18 63.44

SECTOR: Fins—Financial Srvcs—Real Estate—Hldgs&Development

D:E 0.97 0.93 0.68 0.66 0.66 NUMBER OF EMPLOYEES: 74

Current Ratio 1.23 0.76 1.03 0.41 0.42 DIRECTORS: Hlobo M (ind ne), Sekete DrPD(ind ne),

Div Cover - - 5.59 1.11 1.93 1.76 Jali T (Chair, ind ne), Anastasiadis K (CEO), le Roux S (FD)

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2020

Accentuate Ltd. Fortutrax (Pty) Ltd. 73.64%

The Papa’s Trust 6.95%

ACC

ISIN: ZAE000115986 SHORT: ACCENT CODE: ACE POSTAL ADDRESS: PO Box 569, Wierda Park, 0149

REG NO: 2004/029691/06 FOUNDED: 1981 LISTED: 2006 MORE INFO: www.sharedata.co.za/sdo/jse/ACS

NATURE OF BUSINESS: Accéntuate is a group of companies involved in COMPANY SECRETARY: MWRK Accountants and Auditors Inc.

the water treatment, chemical blending, industrial and commercial TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

cleaning and metal treatment sectors, as well as the flooring market. SPONSOR: Nedbank Corporate and Investment Banking

SECTOR: AltX AUDITORS: RSM South Africa

NUMBER OF EMPLOYEES: 281

CAPITAL STRUCTURE AUTHORISED ISSUED

ACS Ords no par value 10 000 000 000 394 959 976

72