Page 82 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 82

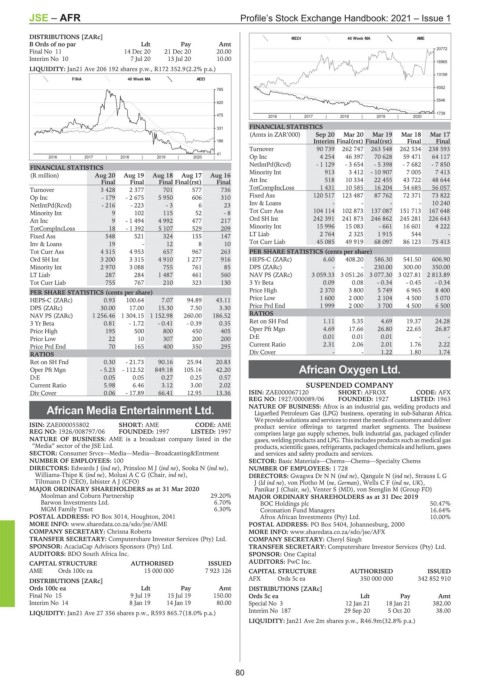

JSE – AFR Profile’s Stock Exchange Handbook: 2021 – Issue 1

DISTRIBUTIONS [ZARc] MEDI 40 Week MA AME

B Ords of no par Ldt Pay Amt

20772

Final No 11 14 Dec 20 21 Dec 20 20.00

Interim No 10 7 Jul 20 13 Jul 20 10.00

16965

LIQUIDITY: Jan21 Ave 206 192 shares p.w., R172 352.9(2.2% p.a.)

13159

FINA 40 Week MA AEEI

9352

765

5546

620

1739

475 2016 | 2017 | 2018 | 2019 | 2020 |

FINANCIAL STATISTICS

331

(Amts in ZAR’000) Sep 20 Mar 20 Mar 19 Mar 18 Mar 17

186 Interim Final(rst) Final(rst) Final Final

Turnover 90 739 262 747 263 548 262 534 238 593

41

2016 | 2017 | 2018 | 2019 | 2020 | Op Inc 4 254 46 397 70 628 59 471 64 117

NetIntPd(Rcvd) - 1 129 - 3 654 - 5 398 - 7 682 - 7 850

FINANCIAL STATISTICS

(R million) Aug 20 Aug 19 Aug 18 Aug 17 Aug 16 Minority Int 913 3 412 - 10 907 7 005 7 413

Final Final Final Final(rst) Final Att Inc 518 10 334 22 455 43 722 48 644

Turnover 3 428 2 377 701 577 736 TotCompIncLoss 1 431 10 585 16 204 54 685 56 057

Op Inc - 179 - 2 675 5 950 606 310 Fixed Ass 120 517 123 487 87 762 72 371 73 822

Inv & Loans - - - - 10 240

NetIntPd(Rcvd) - 216 - 223 - 3 6 23

Minority Int 9 102 115 52 - 8 Tot Curr Ass 104 114 102 873 137 087 151 713 167 648

Att Inc 9 - 1 494 4 992 477 217 Ord SH Int 242 391 241 873 246 862 245 281 226 643

TotCompIncLoss 18 - 1 392 5 107 529 209 Minority Int 15 996 15 083 - 661 16 601 4 222

Fixed Ass 548 521 324 155 147 LT Liab 2 764 2 325 1 915 544 -

Inv & Loans 19 - 12 8 10 Tot Curr Liab 45 085 49 919 68 097 86 123 75 413

Tot Curr Ass 4 515 4 953 657 967 263 PER SHARE STATISTICS (cents per share)

Ord SH Int 3 200 3 315 4 910 1 277 916 HEPS-C (ZARc) 6.60 408.20 586.30 541.50 606.90

Minority Int 2 970 3 088 755 761 85 DPS (ZARc) - - 230.00 300.00 350.00

LT Liab 287 284 1 487 461 560 NAV PS (ZARc) 3 059.33 3 051.26 3 077.30 3 027.81 2 813.89

Tot Curr Liab 755 767 210 323 130 3 Yr Beta 0.09 0.08 - 0.34 - 0.45 - 0.34

PER SHARE STATISTICS (cents per share) Price High 2 370 3 800 5 749 6 965 8 400

HEPS-C (ZARc) 0.93 100.64 7.07 94.89 43.11 Price Low 1 600 2 000 2 104 4 500 5 070

DPS (ZARc) 30.00 17.00 15.30 7.50 3.30 Price Prd End 1 999 2 000 3 700 4 500 6 500

NAV PS (ZARc) 1 256.46 1 304.15 1 152.98 260.00 186.52 RATIOS

3 Yr Beta 0.81 - 1.72 - 0.41 - 0.39 0.35 Ret on SH Fnd 1.11 5.35 4.69 19.37 24.28

Price High 195 500 800 450 405 Oper Pft Mgn 4.69 17.66 26.80 22.65 26.87

Price Low 22 10 307 200 200 D:E 0.01 0.01 0.01 - -

Price Prd End 70 165 400 350 295 Current Ratio 2.31 2.06 2.01 1.76 2.22

RATIOS Div Cover - - 1.22 1.80 1.74

Ret on SH Fnd 0.30 - 21.73 90.16 25.94 20.83

Oper Pft Mgn - 5.23 - 112.52 849.18 105.16 42.20 African Oxygen Ltd.

D:E 0.05 0.05 0.27 0.25 0.57 AFR

Current Ratio 5.98 6.46 3.12 3.00 2.02 SUSPENDED COMPANY

Div Cover 0.06 - 17.89 66.41 12.95 13.36 ISIN: ZAE000067120 SHORT: AFROX CODE: AFX

REG NO: 1927/000089/06 FOUNDED: 1927 LISTED: 1963

African Media Entertainment Ltd. NATURE OF BUSINESS: Afrox is an industrial gas, welding products and

Liquefied Petroleum Gas (LPG) business, operating in sub-Saharan Africa.

AFR We provide solutions and services to meet the needs of customers and deliver

ISIN: ZAE000055802 SHORT: AME CODE: AME product service offerings to targeted market segments. The business

REG NO: 1926/008797/06 FOUNDED: 1997 LISTED: 1997 comprises large gas supply schemes, bulk industrial gas, packaged cylinder

NATURE OF BUSINESS: AME is a broadcast company listed in the gases, welding products and LPG. This includes products such as medical gas

“Media” sector of the JSE Ltd. products, scientific gases, refrigerants, packaged chemicals and helium, gases

SECTOR: Consumer Srvcs—Media—Media—Broadcasting&Entment and services and safety products and services.

NUMBER OF EMPLOYEES: 100 SECTOR: Basic Materials—Chems—Chems—Specialty Chems

DIRECTORS: Edwards J (ind ne), PrinslooMJ(ind ne), Sooka N (ind ne), NUMBER OF EMPLOYEES: 1 728

Williams-Thipe K (ind ne), MolusiACG (Chair, ind ne), DIRECTORS: Gwagwa DrNN(ind ne), Qangule N (ind ne), Strauss L G

Tiltmann D (CEO), Isbister A J (CFO) J(ld ind ne), von Plotho M (ne, German), WellsCF(ind ne, UK),

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020 Panikar J (Chair, ne), Venter S (MD), von Stenglin M (Group FD)

Moolman and Coburn Partnership 29.20% MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019

Barwon Investments Ltd. 6.70% BOC Holdings plc 50.47%

MGM Family Trust 6.30% Coronation Fund Managers 16.64%

POSTAL ADDRESS: PO Box 3014, Houghton, 2041 Afrox African Investments (Pty) Ltd. 10.00%

MORE INFO: www.sharedata.co.za/sdo/jse/AME POSTAL ADDRESS: PO Box 5404, Johannesburg, 2000

COMPANY SECRETARY: Chrisna Roberts MORE INFO: www.sharedata.co.za/sdo/jse/AFX

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. COMPANY SECRETARY: Cheryl Singh

SPONSOR: AcaciaCap Advisors Sponsors (Pty) Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

AUDITORS: BDO South Africa Inc. SPONSOR: One Capital

CAPITAL STRUCTURE AUTHORISED ISSUED AUDITORS: PwC Inc.

AME Ords 100c ea 15 000 000 7 923 126 CAPITAL STRUCTURE AUTHORISED ISSUED

DISTRIBUTIONS [ZARc] AFX Ords 5c ea 350 000 000 342 852 910

Ords 100c ea Ldt Pay Amt DISTRIBUTIONS [ZARc]

Final No 15 9 Jul 19 15 Jul 19 150.00 Ords 5c ea Ldt Pay Amt

Interim No 14 8 Jan 19 14 Jan 19 80.00 Special No 3 12 Jan 21 18 Jan 21 382.00

Interim No 187 29 Sep 20 5 Oct 20 38.00

LIQUIDITY: Jan21 Ave 27 356 shares p.w., R593 865.7(18.0% p.a.)

LIQUIDITY: Jan21 Ave 2m shares p.w., R46.9m(32.8% p.a.)

80