Page 227 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 227

Profile’s Stock Exchange Handbook: 2021 – Issue 1 JSE – SOU

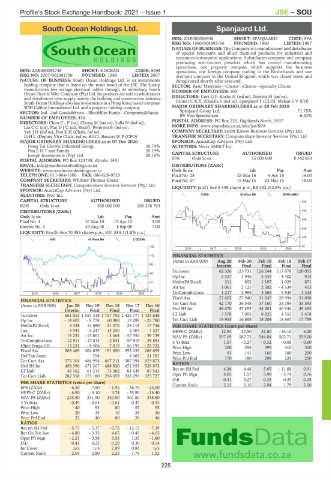

South Ocean Holdings Ltd. Spanjaard Ltd.

SOU SPA

ISIN: ZAE000006938 SHORT: SPANJAARD CODE: SPA

REG NO: 1960/004393/06 FOUNDED: 1960 LISTED: 1987

NATURE OF BUSINESS: The Company is a manufacturer and distributor

of special lubricants and allied chemical products for industrial and

consumer/automotive applications. Subsidiaries comprise one company

producing anti-friction powders which has ceased manufacturing

operations, one property company which supports the business

ISIN: ZAE000092748 SHORT: S.OCEAN CODE: SOH operations, one foreign company trading in the Netherlands and one

REG NO: 2007/002381/06 FOUNDED: 1989 LISTED: 2007 dormant company in the United Kingdom which was closed down and

NATURE OF BUSINESS: South Ocean Holdings Ltd. is an investments deregistered shortly after year-end.

holding company that is listed on the main board of the JSE. The Group SECTOR: Basic Materials—Chems—Chems—Specialty Chems

manufactures low voltage electrical cables through its subsidiary, South NUMBER OF EMPLOYEES: 100

Ocean Electric Wire Company (Pty) Ltd. Its products are sold to wholesalers

and distributors who supply mainly the building and construction industry. DIRECTORS: Cort G F, Kocks H (ind ne), Notrica M (ind ne),

South Ocean Holdings also has investments in a Hong Kong based company PalmerCKT, Zikalala S (ind ne), Spanjaard T (CEO), Makan S V (FD)

SOH Calibre International Ltd. and a property holding company. MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2020

SECTOR: Ind—Ind Goods&Srvcs—Elec&Elec Equip—Componts&Equip Spanjaard Group Ltd. 71.75%

NUMBER OF EMPLOYEES: 456 BV Von Spreckelsen 6.23%

DIRECTORS: ChenC-F(ne), Chong M (ind ne), Lalla N (ind ne), POSTAL ADDRESS: PO Box 225, Highlands North, 2037

LiuCC(alt), PanDJC(alt, Brazil), Petersen B (ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/SPA

YehJH(ind ne), Pon K H (Chair, ind ne), COMPANY SECRETARY: Levitt Kirson Business Services (Pty) Ltd.

Li H L (Deputy Vice Chair, ind ne, ROC), Basson W P (CFO) TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 07 Dec 2020 SPONSOR: AcaciaCap Advisors (Pty) Ltd.

Hong Tai Electric Industrial Group 30.74% AUDITORS: Nexia SAB&T Inc.

PanEHTand Family 20.19%

Joseph Investments (Pty) Ltd. 20.16% CAPITAL STRUCTURE AUTHORISED ISSUED

POSTAL ADDRESS: PO Box 123738, Alrode, 1451 SPA Ords 5c ea 15 000 000 8 142 850

EMAIL: info@southoceanholdings.co.za DISTRIBUTIONS [ZARc]

WEBSITE: www.southoceanholdings.co.za Ords 5c ea Ldt Pay Amt

TELEPHONE: 011-864-1606 FAX: 086-628-9523 Final No 28 23 Mar 16 4 Apr 16 16.00

COMPANY SECRETARY: Whitney Thomas Green Final No 27 15 May 15 25 May 15 18.00

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. LIQUIDITY: Jan21 Ave 4 339 shares p.w., R8 452.2(2.8% p.a.)

SPONSOR: AcaciaCap Advisors (Pty) Ltd.

AUDITORS: PwC Inc. CHES 40 Week MA SPANJAARD

CAPITAL STRUCTURE AUTHORISED ISSUED 548

SOH Ords 1c ea 500 000 000 203 276 794

DISTRIBUTIONS [ZARc] 448

Ords 1c ea Ldt Pay Amt

348

Final No 4 31 Mar 10 12 Apr 10 3.00

Interim No 3 29 Aug 08 8 Sep 08 7.00

248

LIQUIDITY: Nov20 Ave 70 483 shares p.w., R31 885.1(1.8% p.a.)

148

IIND 40 Week MA S.OCEAN

133 48

2016 | 2017 | 2018 | 2019 | 2020 |

110 FINANCIAL STATISTICS

(Amts in ZAR’000) Aug 20 Feb 20 Feb 19 Feb 18 Feb 17

88

Interim Final Final Final Final

Turnover 62 326 123 731 126 244 117 678 120 055

65

Op Inc 2 527 1 946 5 039 - 4 402 914

43 NetIntPd(Rcvd) 311 852 1 197 1 029 871

Att Inc 1 061 2 125 2 502 - 4 534 413

20 TotCompIncLoss 1 217 2 996 3 365 - 4 549 1 445

2015 | 2016 | 2017 | 2018 | 2019 | 2020

Fixed Ass 27 602 27 940 31 047 28 994 31 098

FINANCIAL STATISTICS Tot Curr Ass 42 170 36 548 37 160 33 784 35 595

(Amts in ZAR’000) Jun 20 Dec 19 Dec 18 Dec 17 Dec 16

Interim Final Final Final Final Ord SH Int 48 670 47 453 44 301 40 936 45 485

Turnover 661 053 1 557 318 1 727 792 1 425 777 1 433 648 LT Liab 7 578 7 095 8 025 4 553 5 478

Op Inc - 14 603 - 8 778 60 988 19 299 - 25 780 Tot Curr Liab 19 955 16 888 18 204 18 867 17 789

NetIntPd(Rcvd) 4 338 14 690 21 070 23 118 17 746 PER SHARE STATISTICS (cents per share)

Tax - 4 943 - 6 247 14 250 2 404 - 7 527 HEPS-C (ZARc) 12.94 27.50 31.60 - 54.10 6.20

Att Inc - 13 231 - 15 861 - 3 664 - 57 350 - 39 139 NAV PS (ZARc) 597.69 582.75 544.04 502.71 559.00

TotCompIncLoss - 12 911 - 17 514 - 2 831 - 57 919 - 39 853 3 Yr Beta 1.57 - 0.27 - 0.32 - 0.68 - 0.60

Hline Erngs-CO - 13 231 - 8 406 7 019 - 56 193 - 25 722 Price High 200 298 399 410 500

Fixed Ass 203 469 204 839 191 650 293 035 289 699 Price Low 93 141 166 180 250

Def Tax Asset - 798 - 4 465 21 787 Price Prd End 170 180 298 225 250

Tot Curr Ass 575 164 484 994 667 211 587 394 623 873

Ord SH Int 458 396 471 307 488 820 471 953 529 872 RATIOS

LT Liab 48 162 61 315 73 382 84 648 87 543 Ret on SH Fnd 4.36 4.48 5.65 - 11.08 0.91

Tot Curr Liab 282 558 173 180 296 659 328 293 325 727 Oper Pft Mgn 4.05 1.57 3.99 - 3.74 0.76

D:E 0.31 0.27 0.35 0.29 0.25

PER SHARE STATISTICS (cents per share) Current Ratio 2.11 2.16 2.04 1.79 2.00

EPS (ZARc) - 6.50 - 7.80 - 1.95 - 36.70 - 25.00

HEPS-C (ZARc) - 6.90 - 4.10 3.74 - 35.90 - 16.40

NAV PS (ZARc) 225.50 231.90 240.50 301.80 338.80

3 Yr Beta - 0.49 - 0.64 - 0.61 0.45 0.93

Price High 40 93 80 55 55

Price Low 20 35 10 28 30

Price Prd End 22 40 80 28 46

RATIOS

Ret on SH Fnd - 5.77 - 3.37 - 0.75 - 12.15 - 7.39

Ret On Tot Ass - 4.80 - 3.33 4.65 - 0.43 - 4.65

Oper Pft Mgn - 2.21 - 0.56 3.53 1.35 - 1.80

D:E 0.41 0.23 0.29 0.30 0.54

Int Cover n/a n/a 2.89 0.83 n/a

Current Ratio 2.04 2.80 2.25 1.79 1.92

225