Page 197 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 197

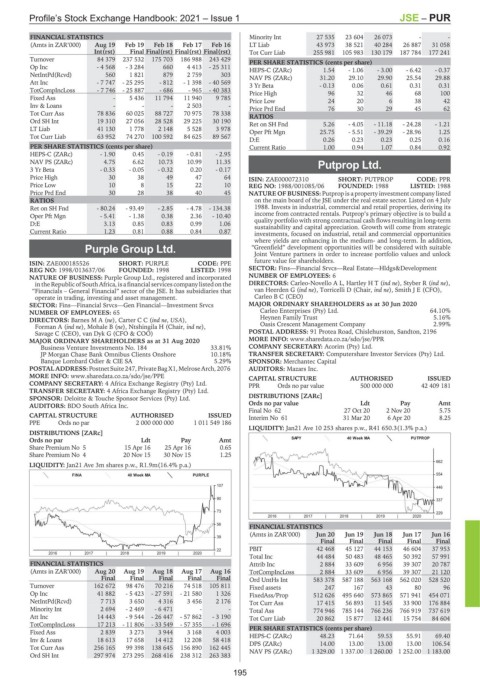

Profile’s Stock Exchange Handbook: 2021 – Issue 1 JSE – PUR

FINANCIAL STATISTICS Minority Int 27 535 23 604 26 073 - -

(Amts in ZAR’000) Aug 19 Feb 19 Feb 18 Feb 17 Feb 16 LT Liab 43 973 38 521 40 284 26 887 31 058

Int(rst) Final Final(rst) Final(rst) Final(rst) Tot Curr Liab 255 981 105 983 130 179 187 784 177 241

Turnover 84 379 237 532 175 703 186 988 243 429 PER SHARE STATISTICS (cents per share)

Op Inc - 4 568 - 3 284 660 4 413 - 25 311 HEPS-C (ZARc) 1.54 - 1.06 - 3.00 - 6.42 - 0.37

NetIntPd(Rcvd) 560 1 821 879 2 759 303 NAV PS (ZARc) 31.20 29.10 29.90 25.54 29.88

Att Inc - 7 747 - 25 295 - 812 - 1 398 - 40 569 3 Yr Beta - 0.13 0.06 0.61 0.31 0.31

TotCompIncLoss - 7 746 - 25 887 - 686 - 965 - 40 383 Price High 96 32 46 68 100

Fixed Ass - 5 436 11 794 11 940 9 785 Price Low 24 20 6 38 42

Inv & Loans - - - 2 503 - Price Prd End 76 30 29 45 62

Tot Curr Ass 78 836 60 025 88 727 70 975 78 338 RATIOS

Ord SH Int 19 310 27 056 28 528 29 225 30 190 Ret on SH Fnd 5.26 - 4.05 - 11.18 - 24.28 - 1.21

LT Liab 41 130 1 778 2 148 5 528 3 978 Oper Pft Mgn 25.75 - 5.51 - 39.29 - 28.96 1.25

Tot Curr Liab 63 952 74 270 100 592 84 625 89 567

D:E 0.26 0.23 0.23 0.25 0.16

PER SHARE STATISTICS (cents per share) Current Ratio 1.00 0.94 1.07 0.84 0.92

HEPS-C (ZARc) - 1.90 0.45 - 0.19 - 0.81 - 2.95

NAV PS (ZARc) 4.75 6.62 10.73 10.99 11.35 Putprop Ltd.

3 Yr Beta - 0.33 - 0.05 - 0.32 0.20 - 0.17

PUT

Price High 30 38 49 47 64 ISIN: ZAE000072310 SHORT: PUTPROP CODE: PPR

Price Low 10 8 15 22 10 REG NO: 1988/001085/06 FOUNDED: 1988 LISTED: 1988

Price Prd End 30 28 38 40 45 NATURE OF BUSINESS: Putprop is a property investment company listed

RATIOS on the main board of the JSE under the real estate sector. Listed on 4 July

Ret on SH Fnd - 80.24 - 93.49 - 2.85 - 4.78 - 134.38 1988. Invests in industrial, commercial and retail properties, deriving its

Oper Pft Mgn - 5.41 - 1.38 0.38 2.36 - 10.40 income from contracted rentals. Putprop’s primary objective is to build a

quality portfolio with strong contractual cash flows resulting in long-term

D:E 3.13 0.85 0.83 0.99 1.06 sustainability and capital appreciation. Growth will come from strategic

Current Ratio 1.23 0.81 0.88 0.84 0.87 investments, focused on industrial, retail and commercial opportunities

where yields are enhancing in the medium- and long-term. In addition,

Purple Group Ltd. “Greenfield” development opportunities will be considered with suitable

Joint Venture partners in order to increase portfolio values and unlock

PUR future value for shareholders.

ISIN: ZAE000185526 SHORT: PURPLE CODE: PPE

REG NO: 1998/013637/06 FOUNDED: 1998 LISTED: 1998 SECTOR: Fins—Financial Srvcs—Real Estate—Hldgs&Development

NATURE OF BUSINESS: Purple Group Ltd., registered and incorporated NUMBER OF EMPLOYEES: 6

in the Republic of South Africa, is a financialservices company listedonthe DIRECTORS: Carleo-Novello A L, HartleyHT(ind ne), Styber R (ind ne),

“Financials – General Financial” sector of the JSE. It has subsidiaries that van Heerden G (ind ne), Torricelli D (Chair, ind ne), Smith J E (CFO),

operate in trading, investing and asset management. Carleo B C (CEO)

SECTOR: Fins—Financial Srvcs—Gen Financial—Investment Srvcs MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020

NUMBER OF EMPLOYEES: 65 Carleo Enterprises (Pty) Ltd. 64.10%

DIRECTORS: BarnesMA(ne), CarterCC(ind ne, USA), Heynen Family Trust 5.16%

Forman A (ind ne), Mohale B (ne), Ntshingila H (Chair, ind ne), Oasis Crescent Management Company 2.99%

Savage C (CEO), van Dyk G (CFO & COO) POSTAL ADDRESS: 91 Protea Road, Chislehurston, Sandton, 2196

MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2020 MORE INFO: www.sharedata.co.za/sdo/jse/PPR

Business Venture Investments No. 184 33.81% COMPANY SECRETARY: Acorim (Pty) Ltd.

JP Morgan Chase Bank Omnibus Clients Onshore 10.18% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Banque Lombard Odier & CIE SA 5.29% SPONSOR: Merchantec Capital

POSTAL ADDRESS:PostnetSuite247, PrivateBagX1,MelroseArch,2076 AUDITORS: Mazars Inc.

MORE INFO: www.sharedata.co.za/sdo/jse/PPE CAPITAL STRUCTURE AUTHORISED ISSUED

COMPANY SECRETARY: 4 Africa Exchange Registry (Pty) Ltd. PPR Ords no par value 500 000 000 42 409 181

TRANSFER SECRETARY: 4 Africa Exchange Registry (Pty) Ltd.

SPONSOR: Deloitte & Touche Sponsor Services (Pty) Ltd. DISTRIBUTIONS [ZARc]

AUDITORS: BDO South Africa Inc. Ords no par value Ldt Pay Amt

Final No 62 27 Oct 20 2 Nov 20 5.75

CAPITAL STRUCTURE AUTHORISED ISSUED Interim No 61 31 Mar 20 6 Apr 20 8.25

PPE Ords no par 2 000 000 000 1 011 549 186

LIQUIDITY: Jan21 Ave 10 253 shares p.w., R41 650.3(1.3% p.a.)

DISTRIBUTIONS [ZARc]

Ords no par Ldt Pay Amt SAPY 40 Week MA PUTPROP

Share Premium No 5 15 Apr 16 25 Apr 16 0.65

Share Premium No 4 20 Nov 15 30 Nov 15 1.25

662

LIQUIDITY: Jan21 Ave 3m shares p.w., R1.9m(16.4% p.a.)

FINA 40 Week MA PURPLE 554

107

446

90

337

73 229

2016 | 2017 | 2018 | 2019 | 2020 |

56

FINANCIAL STATISTICS

(Amts in ZAR’000) Jun 20 Jun 19 Jun 18 Jun 17 Jun 16

39

Final Final Final Final Final

22 PBIT 42 468 45 127 44 153 46 604 37 953

2016 | 2017 | 2018 | 2019 | 2020 |

Total Inc 44 484 50 483 48 465 50 392 57 991

FINANCIAL STATISTICS Attrib Inc 2 884 33 609 6 956 39 307 20 787

(Amts in ZAR’000) Aug 20 Aug 19 Aug 18 Aug 17 Aug 16 TotCompIncLoss 2 884 33 609 6 956 39 307 21 120

Final Final Final Final Final Ord UntHs Int 583 378 587 188 563 168 562 020 528 520

Turnover 162 672 98 476 70 216 74 518 105 811 Fixed assets 247 167 43 80 96

Op Inc 41 882 - 5 423 - 27 591 - 21 580 1 326 FixedAss/Prop 512 626 495 640 573 865 571 941 454 071

NetIntPd(Rcvd) 7 713 3 650 4 316 3 456 2 176 Tot Curr Ass 17 415 56 893 11 545 33 900 176 884

Minority Int 2 694 - 2 469 - 6 471 - - Total Ass 774 946 785 144 766 236 766 919 737 619

Att Inc 14 443 - 9 544 - 26 447 - 57 862 - 3 190 Tot Curr Liab 20 862 15 877 12 441 15 754 84 604

TotCompIncLoss 17 213 - 11 806 - 33 549 - 57 355 - 1 696 PER SHARE STATISTICS (cents per share)

Fixed Ass 2 839 3 273 3 944 3 168 4 003 HEPS-C (ZARc) 48.23 71.64 59.53 55.91 69.40

Inv & Loans 18 613 17 658 14 412 12 208 58 418 DPS (ZARc) 14.00 13.00 13.00 13.00 106.54

Tot Curr Ass 256 165 99 398 138 645 156 890 162 445 NAV PS (ZARc) 1 329.00 1 337.00 1 260.00 1 252.00 1 183.00

Ord SH Int 297 974 273 295 268 416 238 312 263 383

195