Page 172 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 172

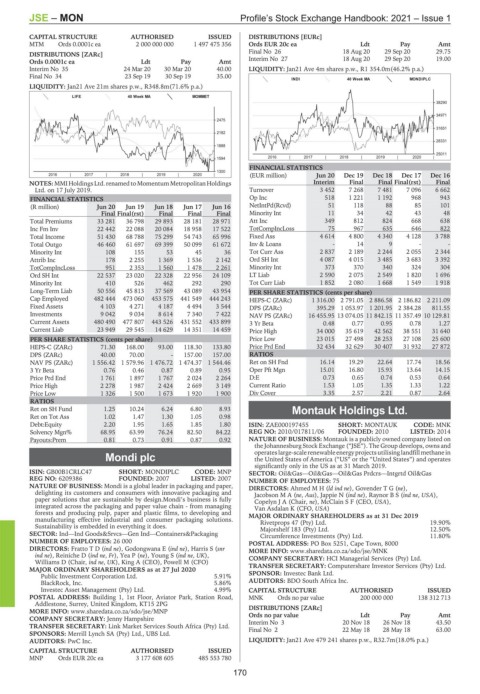

JSE – MON Profile’s Stock Exchange Handbook: 2021 – Issue 1

CAPITAL STRUCTURE AUTHORISED ISSUED DISTRIBUTIONS [EURc]

MTM Ords 0.0001c ea 2 000 000 000 1 497 475 356 Ords EUR 20c ea Ldt Pay Amt

DISTRIBUTIONS [ZARc] Final No 26 18 Aug 20 29 Sep 20 29.75

Ords 0.0001c ea Ldt Pay Amt Interim No 27 18 Aug 20 29 Sep 20 19.00

Interim No 35 24 Mar 20 30 Mar 20 40.00 LIQUIDITY: Jan21 Ave 4m shares p.w., R1 354.0m(46.2% p.a.)

Final No 34 23 Sep 19 30 Sep 19 35.00

INDI 40 Week MA MONDIPLC

LIQUIDITY: Jan21 Ave 21m shares p.w., R348.8m(71.6% p.a.)

LIFE 40 Week MA MOMMET

38290

34971

2475

31651

2182

28331

1888

25011

1594 2016 | 2017 | 2018 | 2019 | 2020 |

FINANCIAL STATISTICS

1300

2016 | 2017 | 2018 | 2019 | 2020 | (EUR million) Jun 20 Dec 19 Dec 18 Dec 17 Dec 16

NOTES: MMI Holdings Ltd. renamed to Momentum Metropolitan Holdings Interim Final Final Final(rst) Final

Ltd. on 17 July 2019. Turnover 3 452 7 268 7 481 7 096 6 662

FINANCIAL STATISTICS Op Inc 518 1 221 1 192 968 943

(R million) Jun 20 Jun 19 Jun 18 Jun 17 Jun 16 NetIntPd(Rcvd) 51 118 88 85 101

Final Final(rst) Final Final Final Minority Int 11 34 42 43 48

Total Premiums 33 281 36 798 29 893 28 181 28 971 Att Inc 349 812 824 668 638

Inc Fm Inv 22 442 22 088 20 084 18 958 17 522 TotCompIncLoss 75 967 635 646 822

Total Income 51 430 68 788 75 299 54 743 65 996 Fixed Ass 4 614 4 800 4 340 4 128 3 788

Total Outgo 46 460 61 697 69 399 50 099 61 672 Inv & Loans - 14 9 - -

Minority Int 108 155 53 45 36 Tot Curr Ass 2 837 2 189 2 244 2 055 2 344

Attrib Inc 178 2 255 1 369 1 536 2 142 Ord SH Int 4 087 4 015 3 485 3 683 3 392

TotCompIncLoss 951 2 353 1 560 1 478 2 261 Minority Int 373 370 340 324 304

Ord SH Int 22 537 23 020 22 328 22 956 24 109 LT Liab 2 590 2 075 2 549 1 820 1 696

Minority Int 410 526 462 292 290 Tot Curr Liab 1 852 2 080 1 668 1 549 1 918

Long-Term Liab 50 556 45 813 37 569 43 089 43 954 PER SHARE STATISTICS (cents per share)

Cap Employed 482 444 473 060 453 575 441 549 444 243 HEPS-C (ZARc) 1 316.00 2 791.05 2 886.58 2 186.82 2 211.09

Fixed Assets 4 103 4 271 4 187 4 494 3 544 DPS (ZARc) 395.29 1 053.97 1 201.95 2 384.28 811.55

Investments 9 042 9 034 8 614 7 340 7 422 NAV PS (ZARc) 16 455.95 13 074.05 11 842.15 11 357.49 10 129.81

Current Assets 480 490 477 807 443 526 431 552 433 899 3 Yr Beta 0.48 0.77 0.95 0.78 1.27

Current Liab 23 949 29 545 14 629 14 351 14 459 Price High 34 000 35 619 42 562 38 551 31 640

PER SHARE STATISTICS (cents per share) Price Low 23 015 27 498 28 253 27 108 25 600

HEPS-C (ZARc) 71.30 168.00 93.00 118.30 133.80 Price Prd End 32 434 32 629 30 407 31 932 27 872

DPS (ZARc) 40.00 70.00 - 157.00 157.00 RATIOS

NAV PS (ZARc) 1 556.42 1 579.96 1 476.72 1 474.37 1 544.46 Ret on SH Fnd 16.14 19.29 22.64 17.74 18.56

3 Yr Beta 0.76 0.46 0.87 0.89 0.95 Oper Pft Mgn 15.01 16.80 15.93 13.64 14.15

Price Prd End 1 761 1 897 1 767 2 024 2 264 D:E 0.73 0.65 0.74 0.53 0.64

Price High 2 278 1 987 2 424 2 669 3 149 Current Ratio 1.53 1.05 1.35 1.33 1.22

Price Low 1 326 1 500 1 673 1 920 1 900 Div Cover 3.35 2.57 2.21 0.87 2.64

RATIOS

Ret on SH Fund 1.25 10.24 6.24 6.80 8.93 Montauk Holdings Ltd.

Ret on Tot Ass 1.02 1.47 1.30 1.05 0.98

MON

Debt:Equity 2.20 1.95 1.65 1.85 1.80 ISIN: ZAE000197455 SHORT: MONTAUK CODE: MNK

Solvency Mgn% 68.95 63.99 76.24 82.50 84.22 REG NO: 2010/017811/06 FOUNDED: 2010 LISTED: 2014

Payouts:Prem 0.81 0.73 0.91 0.87 0.92 NATURE OF BUSINESS: Montauk is a publicly owned company listed on

the Johannesburg Stock Exchange (“JSE”). The Group develops, owns and

operateslarge-scalerenewableenergy projectsutilisinglandfillmethanein

Mondi plc the United States of America (“US” or the “United States”) and operates

significantly only in the US as at 31 March 2019.

MON

ISIN: GB00B1CRLC47 SHORT: MONDIPLC CODE: MNP SECTOR: Oil&Gas—Oil&Gas—Oil&Gas Prdcrs—Intgrtd Oil&Gas

REG NO: 6209386 FOUNDED: 2007 LISTED: 2007 NUMBER OF EMPLOYEES: 75

NATURE OF BUSINESS: Mondi is a global leader in packaging and paper, DIRECTORS: AhmedMH(ld ind ne), GovenderTG(ne),

delighting its customers and consumers with innovative packaging and JacobsonMA(ne, Aus), Jappie N (ind ne), RaynorBS(ind ne, USA),

paper solutions that are sustainable by design.Mondi’s business is fully Copelyn J A (Chair, ne), McClain S F (CEO, USA),

integrated across the packaging and paper value chain - from managing Van Asdalan K (CFO, USA)

forests and producing pulp, paper and plastic films, to developing and MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019

manufacturing effective industrial and consumer packaging solutions. Rivetprops 47 (Pty) Ltd. 19.90%

Sustainability is embedded in everything it does. Majorshelf 183 (Pty) Ltd. 12.50%

SECTOR: Ind—Ind Goods&Srvcs—Gen Ind—Containers&Packaging Circumference Investments (Pty) Ltd. 11.80%

NUMBER OF EMPLOYEES: 26 000 POSTAL ADDRESS: PO Box 5251, Cape Town, 8000

DIRECTORS: FrattoTD(ind ne), Godongwana E (ind ne), Harris S (snr MORE INFO: www.sharedata.co.za/sdo/jse/MNK

ind ne), Reiniche D (ind ne, Fr), Yea P (ne), Young S (ind ne, UK), COMPANY SECRETARY: HCI Managerial Services (Pty) Ltd.

Williams D (Chair, ind ne, UK), King A (CEO), Powell M (CFO) TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 27 Jul 2020

Public Investment Corporation Ltd. 5.91% SPONSOR: Investec Bank Ltd.

BlackRock, Inc. 5.86% AUDITORS: BDO South Africa Inc.

Investec Asset Management (Pty) Ltd. 4.99% CAPITAL STRUCTURE AUTHORISED ISSUED

POSTAL ADDRESS: Building 1, 1st Floor, Aviator Park, Station Road, MNK Ords no par value 200 000 000 138 312 713

Addlestone, Surrey, United Kingdom, KT15 2PG

MORE INFO: www.sharedata.co.za/sdo/jse/MNP DISTRIBUTIONS [ZARc]

Pay

Ldt

Amt

COMPANY SECRETARY: Jenny Hampshire Ords no par value 20 Nov 18 26 Nov 18 43.50

Interim No 3

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd. Final No 2 22 May 18 28 May 18 63.00

SPONSORS: Merrill Lynch SA (Pty) Ltd., UBS Ltd.

AUDITORS: PwC Inc. LIQUIDITY: Jan21 Ave 479 241 shares p.w., R32.7m(18.0% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED

MNP Ords EUR 20c ea 3 177 608 605 485 553 780

170