Page 171 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 171

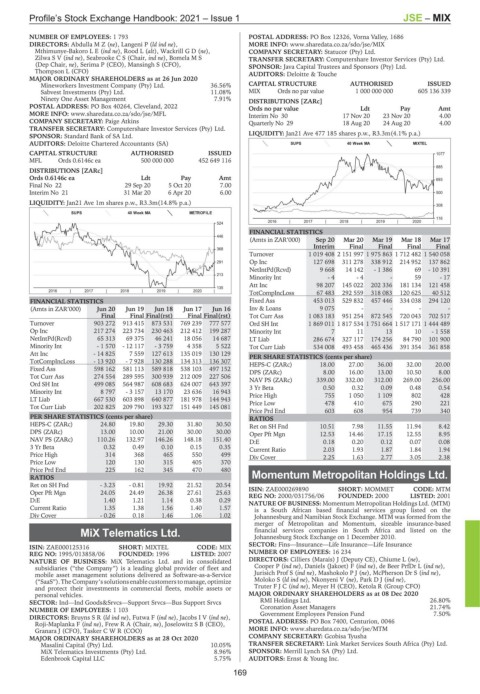

Profile’s Stock Exchange Handbook: 2021 – Issue 1 JSE – MIX

NUMBER OF EMPLOYEES: 1 793 POSTAL ADDRESS: PO Box 12326, Vorna Valley, 1686

DIRECTORS: AbdullaMZ(ne), Langeni P (ld ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/MIX

Mthimunye-BakoroLE(ind ne), Rood L (alt), WackrillGD(ne), COMPANY SECRETARY: Statucor (Pty) Ltd.

ZilwaSV(ind ne), Seabrooke C S (Chair, ind ne), Bomela M S TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

(Dep Chair, ne), Serima P (CEO), Mansingh S (CFO), SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd.

Thompson L (CFO) AUDITORS: Deloitte & Touche

MAJOR ORDINARY SHAREHOLDERS as at 26 Jun 2020

Mineworkers Investment Company (Pty) Ltd. 36.56% CAPITAL STRUCTURE AUTHORISED ISSUED

Sabvest Investments (Pty) Ltd. 11.08% MIX Ords no par value 1 000 000 000 605 136 339

Ninety One Asset Management 7.91% DISTRIBUTIONS [ZARc]

POSTAL ADDRESS: PO Box 40264, Cleveland, 2022 Ords no par value Ldt Pay Amt

MORE INFO: www.sharedata.co.za/sdo/jse/MFL Interim No 30 17 Nov 20 23 Nov 20 4.00

COMPANY SECRETARY: Paige Atkins QuarterlyNo 29 18Aug 20 24 Aug20 4.00

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Standard Bank of SA Ltd. LIQUIDITY: Jan21 Ave 477 185 shares p.w., R3.3m(4.1% p.a.)

AUDITORS: Deloitte Chartered Accountants (SA) SUPS 40 Week MA MIXTEL

CAPITAL STRUCTURE AUTHORISED ISSUED 1077

MFL Ords 0.6146c ea 500 000 000 452 649 116

885

DISTRIBUTIONS [ZARc]

Ords 0.6146c ea Ldt Pay Amt 693

Final No 22 29 Sep 20 5 Oct 20 7.00

Interim No 21 31 Mar 20 6 Apr 20 6.00 500

LIQUIDITY: Jan21 Ave 1m shares p.w., R3.3m(14.8% p.a.) 308

SUPS 40 Week MA METROFILE

116

2016 | 2017 | 2018 | 2019 | 2020 |

524

FINANCIAL STATISTICS

446

(Amts in ZAR’000) Sep 20 Mar 20 Mar 19 Mar 18 Mar 17

Interim Final Final Final Final

368

Turnover 1 019 408 2 151 997 1 975 863 1 712 482 1 540 058

291 Op Inc 127 698 311 278 338 912 214 952 137 862

NetIntPd(Rcvd) 9 668 14 142 - 1 386 69 - 10 391

213

Minority Int - 4 - 4 - 59 - 17

Att Inc 98 207 145 022 202 336 181 134 121 458

135

TotCompIncLoss 67 483 292 559 318 083 120 625 40 512

2016 | 2017 | 2018 | 2019 | 2020 |

FINANCIAL STATISTICS Fixed Ass 453 013 529 832 457 446 334 038 294 120

(Amts in ZAR’000) Jun 20 Jun 19 Jun 18 Jun 17 Jun 16 Inv & Loans 9 075 - - - -

Final Final Final(rst) Final Final(rst) Tot Curr Ass 1 083 183 951 254 872 545 720 043 702 517

Turnover 903 272 913 415 873 531 769 239 777 577 Ord SH Int 1 869 011 1 817 534 1 751 664 1 517 171 1 444 489

Op Inc 217 274 223 734 230 463 212 412 199 287 Minority Int 7 11 13 10 - 1 558

NetIntPd(Rcvd) 65 313 69 375 46 241 18 056 14 687 LT Liab 286 674 327 117 174 256 84 790 101 900

Minority Int - 1 570 - 12 117 - 3 759 4 358 5 522 Tot Curr Liab 534 008 493 458 465 436 391 354 361 858

Att Inc - 14 825 7 559 127 613 135 019 130 129 PER SHARE STATISTICS (cents per share)

TotCompIncLoss - 13 920 - 7 928 130 288 134 313 136 307 HEPS-C (ZARc) 18.00 27.00 36.00 32.00 20.00

Fixed Ass 598 162 581 113 589 818 538 103 497 152 DPS (ZARc) 8.00 16.00 13.00 10.50 8.00

Tot Curr Ass 274 554 289 595 300 939 212 009 227 506 NAV PS (ZARc) 339.00 332.00 312.00 269.00 256.00

Ord SH Int 499 085 564 987 608 683 624 007 643 397 3 Yr Beta 0.50 0.32 0.09 0.48 0.54

Minority Int 8 797 - 3 157 13 170 23 636 16 943 Price High 755 1 050 1 109 802 428

LT Liab 667 530 603 898 640 877 181 978 144 943

Tot Curr Liab 202 825 209 790 193 327 151 449 145 081 Price Low 478 410 675 290 221

Price Prd End 603 608 954 739 340

PER SHARE STATISTICS (cents per share) RATIOS

HEPS-C (ZARc) 24.80 19.80 29.30 31.80 30.50 Ret on SH Fnd 10.51 7.98 11.55 11.94 8.42

DPS (ZARc) 13.00 10.00 21.00 30.00 30.00 Oper Pft Mgn 12.53 14.46 17.15 12.55 8.95

NAV PS (ZARc) 110.26 132.97 146.26 148.18 151.40 D:E 0.18 0.20 0.12 0.07 0.08

3 Yr Beta 0.32 0.49 0.10 0.15 0.35 Current Ratio 2.03 1.93 1.87 1.84 1.94

Price High 314 368 465 550 499 Div Cover 2.25 1.63 2.77 3.05 2.38

Price Low 120 130 315 405 370

Price Prd End 225 162 345 470 480

RATIOS Momentum Metropolitan Holdings Ltd.

Ret on SH Fnd - 3.23 - 0.81 19.92 21.52 20.54 ISIN: ZAE000269890 SHORT: MOMMET CODE: MTM

MOM

Oper Pft Mgn 24.05 24.49 26.38 27.61 25.63 REG NO: 2000/031756/06 FOUNDED: 2000 LISTED: 2001

D:E 1.40 1.21 1.14 0.38 0.29 NATURE OF BUSINESS: Momentum Metropolitan Holdings Ltd. (MTM)

Current Ratio 1.35 1.38 1.56 1.40 1.57 is a South African based financial services group listed on the

Div Cover - 0.26 0.18 1.46 1.06 1.02 Johannesburg and Namibian Stock Exchange. MTM was formed from the

merger of Metropolitan and Momentum, sizeable insurance-based

MiX Telematics Ltd. financial services companies in South Africa and listed on the

Johannesburg Stock Exchange on 1 December 2010.

MIX SECTOR: Fins—Insurance—Life Insurance—Life Insurance

ISIN: ZAE000125316 SHORT: MIXTEL CODE: MIX

REG NO: 1995/013858/06 FOUNDED: 1996 LISTED: 2007 NUMBER OF EMPLOYEES: 16 234

NATURE OF BUSINESS: MiX Telematics Ltd. and its consolidated DIRECTORS: Cilliers (Marais) J (Deputy CE), Chiume L (ne),

subsidiaries (“the Company”) is a leading global provider of fleet and Cooper P (ind ne), Daniels (Jakoet) F (ind ne), de Beer PrfDr L (ind ne),

mobile asset management solutions delivered as Software-as-a-Service Jurisich Prof S (ind ne), MashokoloPJ(ne), McPherson Dr S (ind ne),

(“SaaS”).The Company’ssolutionsenablecustomerstomanage,optimize Moloko S (ld ind ne), Nkonyeni V (ne), ParkDJ(ind ne),

and protect their investments in commercial fleets, mobile assets or TruterFJC(ind ne), Meyer H (CEO), Ketola R (Group CFO)

personal vehicles. MAJOR ORDINARY SHAREHOLDERS as at 08 Dec 2020

SECTOR: Ind—Ind Goods&Srvcs—Support Srvcs—Bus Support Srvcs RMI Holdings Ltd. 26.80%

NUMBER OF EMPLOYEES: 1 103 Coronation Asset Managers 21.74%

Government Employees Pension Fund

7.50%

DIRECTORS: BruynsSR(ld ind ne), Futwa F (ind ne), JacobsIV(ind ne),

Roji-Maplanka F (ind ne), Frew R A (Chair, ne), Joselowitz S B (CEO), POSTAL ADDRESS: PO Box 7400, Centurion, 0046

Granara J (CFO), TaskerCWR (COO) MORE INFO: www.sharedata.co.za/sdo/jse/MTM

MAJOR ORDINARY SHAREHOLDERS as at 28 Oct 2020 COMPANY SECRETARY: Gcobisa Tyusha

Masalini Capital (Pty) Ltd. 10.05% TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

MiX Telematics Investments (Pty) Ltd. 8.96% SPONSOR: Merrill Lynch SA (Pty) Ltd.

Edenbrook Capital LLC 5.75% AUDITORS: Ernst & Young Inc.

169