Page 177 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 177

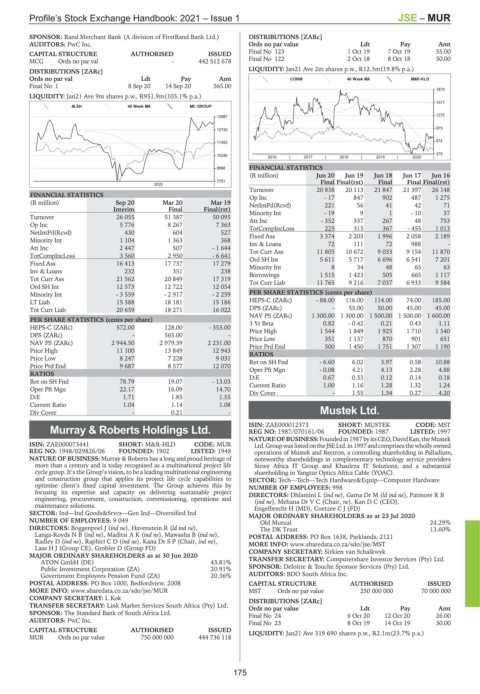

Profile’s Stock Exchange Handbook: 2021 – Issue 1 JSE – MUR

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.) DISTRIBUTIONS [ZARc]

AUDITORS: PwC Inc. Ords no par value Ldt Pay Amt

CAPITAL STRUCTURE AUTHORISED ISSUED Final No 123 1 Oct 19 7 Oct 19 55.00

MCG Ords no par val - 442 512 678 Final No 122 2 Oct 18 8 Oct 18 50.00

DISTRIBUTIONS [ZARc] LIQUIDITY: Jan21 Ave 2m shares p.w., R12.3m(19.8% p.a.)

Ords no par val Ldt Pay Amt CONM 40 Week MA M&R-HLD

Final No 1 8 Sep 20 14 Sep 20 565.00

1870

LIQUIDITY: Jan21 Ave 9m shares p.w., R951.9m(103.1% p.a.)

1571

ALSH 40 Week MA MC GROUP

1272

13987

12740 973

674

11493

375

10246

2016 | 2017 | 2018 | 2019 | 2020 |

8998 FINANCIAL STATISTICS

(R million) Jun 20 Jun 19 Jun 18 Jun 17 Jun 16

7751 Final Final(rst) Final Final Final(rst)

2020 |

Turnover 20 838 20 113 21 847 21 397 26 148

FINANCIAL STATISTICS Op Inc - 17 847 902 487 1 275

(R million) Sep 20 Mar 20 Mar 19 NetIntPd(Rcvd) 221 56 41 42 71

Interim Final Final(rst)

37

- 19

Turnover 26 055 51 387 50 095 Minority Int - 352 337 9 267 1 - 10 753

48

Att Inc

Op Inc 5 776 8 267 7 363 TotCompIncLoss 225 315 367 - 455 1 013

NetIntPd(Rcvd) 430 604 527 Fixed Ass 3 374 2 203 1 996 2 058 2 189

Minority Int 1 104 1 363 368 Inv & Loans 72 111 72 988 -

Att Inc 2 447 507 - 1 644 Tot Curr Ass 11 805 10 672 9 033 9 154 11 870

TotCompIncLoss 3 560 2 950 - 6 641 Ord SH Int 5 611 5 717 6 696 6 541 7 201

Fixed Ass 16 413 17 737 17 279 Minority Int 8 34 48 65 63

Inv & Loans 232 351 238 Borrowings 1 515 1 423 505 665 1 117

Tot Curr Ass 21 562 20 849 17 319 Tot Curr Liab 11 765 9 216 7 037 6 933 9 584

Ord SH Int 12 573 12 722 12 054

Minority Int - 3 559 - 2 917 - 2 259 PER SHARE STATISTICS (cents per share)

LT Liab 15 388 18 181 15 186 HEPS-C (ZARc) - 88.00 116.00 114.00 74.00 185.00

Tot Curr Liab 20 659 18 271 16 022 DPS (ZARc) - 55.00 50.00 45.00 45.00

NAV PS (ZARc) 1 300.00 1 300.00 1 500.00 1 500.00 1 600.00

PER SHARE STATISTICS (cents per share) 3 Yr Beta 0.82 - 0.42 0.21 0.43 1.11

HEPS-C (ZARc) 572.00 128.00 - 353.00 Price High 1 544 1 849 1 925 1 710 1 540

DPS (ZARc) - 565.00 - Price Low 351 1 137 870 901 651

NAV PS (ZARc) 2 944.50 2 979.39 2 231.00 Price Prd End 500 1 450 1 751 1 307 1 190

Price High 11 100 13 849 12 943 RATIOS

Price Low 8 247 7 228 9 031 Ret on SH Fnd - 6.60 6.02 3.97 0.58 10.88

Price Prd End 9 687 8 577 12 070 Oper Pft Mgn - 0.08 4.21 4.13 2.28 4.88

RATIOS

D:E 0.67 0.33 0.12 0.14 0.18

Ret on SH Fnd 78.79 19.07 - 13.03 Current Ratio 1.00 1.16 1.28 1.32 1.24

Oper Pft Mgn 22.17 16.09 14.70 Div Cover - 1.55 1.34 0.27 4.20

D:E 1.71 1.85 1.55

Current Ratio 1.04 1.14 1.08

Div Cover - 0.21 - Mustek Ltd.

MUS

ISIN: ZAE000012373 SHORT: MUSTEK CODE: MST

Murray & Roberts Holdings Ltd. REG NO: 1987/070161/06 FOUNDED: 1987 LISTED: 1997

MUR NATUREOFBUSINESS:Foundedin1987byitsCEO,DavidKan,theMustek

ISIN: ZAE000073441 SHORT: M&R-HLD CODE: MUR Ltd.GroupwaslistedontheJSELtd.in1997andcomprisesthewhollyowned

REG NO: 1948/029826/06 FOUNDED: 1902 LISTED: 1948 operations of Mustek and Rectron, a controlling shareholding in Palladium,

NATURE OF BUSINESS: Murray & Roberts has a long and proud heritage of noteworthy shareholdings in complementary technology service providers

more than a century and is today recognised as a multinational project life Sizwe Africa IT Group and Khauleza IT Solutions, and a substantial

cycle group. It’s the Group’s vision, to be a leading multinational engineering shareholding in Yangtze Optics Africa Cable (YOAC).

and construction group that applies its project life cycle capabilities to SECTOR: Tech—Tech—Tech Hardware&Equip—Computer Hardware

optimise client’s fixed capital investment. The Group achieves this by NUMBER OF EMPLOYEES: 998

focusing its expertise and capacity on delivering sustainable project DIRECTORS: Dhlamini L (ind ne), Gama Dr M (ld ind ne), Patmore R B

engineering, procurement, construction, commissioning, operations and (ind ne), Mehana Dr V C (Chair, ne), Kan D C (CEO),

maintenance solutions. Engelbrecht H (MD), Coetzee C J (FD)

SECTOR: Ind—Ind Goods&Srvcs—Gen Ind—Diversified Ind MAJOR ORDINARY SHAREHOLDERS as at 23 Jul 2020

NUMBER OF EMPLOYEES: 9 049 Old Mutual 24.29%

DIRECTORS: Boggenpoel J (ind ne), Havenstein R (ld ind ne), The DK Trust 13.60%

Langa-RoydsNB(ind ne), MaditsiAK(ind ne), Mawasha B (ind ne), POSTAL ADDRESS: PO Box 1638, Parklands, 2121

Radley D (ind ne), RaphiriCD(ind ne), Kana Dr S P (Chair, ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/MST

Laas H J (Group CE), Grobler D (Group FD) COMPANY SECRETARY: Sirkien van Schalkwyk

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020

ATON GmbH (DE) 43.81% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Public Investment Corporation (ZA) 20.91% SPONSOR: Deloitte & Touche Sponsor Services (Pty) Ltd.

Government Employees Pension Fund (ZA) 20.36% AUDITORS: BDO South Africa Inc.

POSTAL ADDRESS: PO Box 1000, Bedfordview, 2008 CAPITAL STRUCTURE AUTHORISED ISSUED

MORE INFO: www.sharedata.co.za/sdo/jse/MUR MST Ords no par value 250 000 000 70 000 000

COMPANY SECRETARY: LKok DISTRIBUTIONS [ZARc]

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd. Ords no par value Ldt Pay Amt

SPONSOR: The Standard Bank of South Africa Ltd. Final No 24 6 Oct 20 12 Oct 20 26.00

AUDITORS: PwC Inc.

Final No 23 8 Oct 19 14 Oct 19 30.00

CAPITAL STRUCTURE AUTHORISED ISSUED LIQUIDITY: Jan21 Ave 319 690 shares p.w., R2.1m(23.7% p.a.)

MUR Ords no par value 750 000 000 444 736 118

175