Page 166 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 166

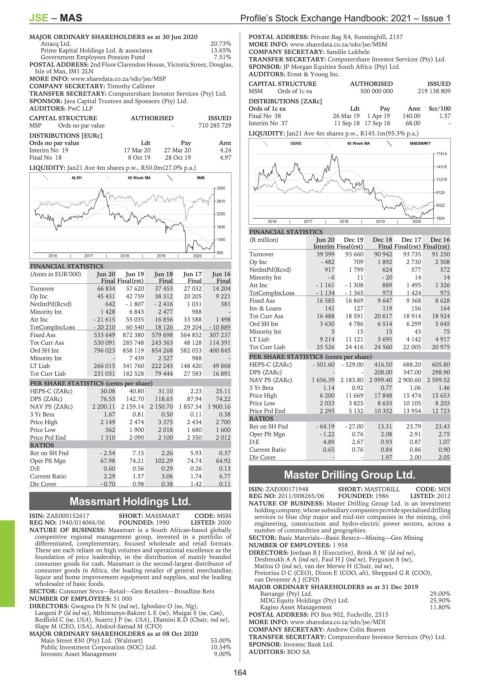

JSE – MAS Profile’s Stock Exchange Handbook: 2021 – Issue 1

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020 POSTAL ADDRESS: Private Bag X4, Sunninghill, 2157

Attacq Ltd. 20.73% MORE INFO: www.sharedata.co.za/sdo/jse/MSM

Prime Kapital Holdings Ltd. & associates 13.65% COMPANY SECRETARY: Sandile Lukhele

Government Employees Pension Fund 7.51% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

POSTAL ADDRESS: 2nd Floor Clarendon House, Victoria Street, Douglas, SPONSOR: JP Morgan Equities South Africa (Pty) Ltd.

Isle of Man, IM1 2LN AUDITORS: Ernst & Young Inc.

MORE INFO: www.sharedata.co.za/sdo/jse/MSP

COMPANY SECRETARY: Timothy Callister CAPITAL STRUCTURE AUTHORISED ISSUED

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. MSM Ords of 1c ea 500 000 000 219 138 809

SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd. DISTRIBUTIONS [ZARc]

AUDITORS: PwC LLP Ords of 1c ea Ldt Pay Amt Scr/100

CAPITAL STRUCTURE AUTHORISED ISSUED Final No 38 26 Mar 19 1 Apr 19 140.00 1.57

MSP Ords no par value - 710 285 729 Interim No 37 11 Sep 18 17 Sep 18 68.00 -

DISTRIBUTIONS [EURc] LIQUIDITY: Jan21 Ave 4m shares p.w., R145.1m(95.3% p.a.)

Ords no par value Ldt Pay Amt GERE 40 Week MA MASSMART

Interim No 19 17 Mar 20 27 Mar 20 4.24

17414

Final No 18 8 Oct 19 28 Oct 19 4.97

LIQUIDITY: Jan21 Ave 4m shares p.w., R50.0m(27.0% p.a.) 14316

ALSH 40 Week MA MAS

11218

3300

8120

2810

5022

2320

1924

2016 | 2017 | 2018 | 2019 | 2020 |

1830

FINANCIAL STATISTICS

1340 (R million) Jun 20 Dec 19 Dec 18 Dec 17 Dec 16

Interim Final(rst) Final Final(rst) Final(rst)

850 Turnover 39 599 93 660 90 942 93 735 91 250

2016 | 2017 | 2018 | 2019 | 2020 |

Op Inc - 482 709 1 892 2 730 2 508

FINANCIAL STATISTICS NetIntPd(Rcvd) 917 1 799 624 577 572

(Amts in EUR’000) Jun 20 Jun 19 Jun 18 Jun 17 Jun 16 Minority Int - 6 11 - 20 14 14

Final Final(rst) Final Final Final

Turnover 66 834 57 620 37 453 27 032 14 204 Att Inc - 1 161 - 1 308 889 1 495 1 326

1 424

973

- 1 365

TotCompIncLoss

- 1 134

975

Op Inc 45 431 42 759 38 312 20 205 9 221

NetIntPd(Rcvd) 642 - 1 807 - 2 416 1 031 381 Fixed Ass 16 585 16 869 9 647 9 368 8 628

164

119

156

127

141

Minority Int 1 428 6 843 2 477 988 - Inv & Loans 16 488 18 591 20 617 18 914 18 924

Tot Curr Ass

Att Inc - 21 615 55 035 16 856 33 588 1 498

TotCompIncLoss - 20 210 60 540 18 126 29 204 - 10 889 Ord SH Int 3 630 5 4 786 6 514 6 299 5 645

43

Minority Int

15

15

75

Fixed Ass 533 649 872 380 579 698 564 852 307 237

Tot Curr Ass 530 091 285 748 243 363 48 128 114 391 LT Liab 9 214 11 121 3 695 4 142 4 917

Ord SH Int 796 023 858 119 854 268 582 053 400 845 Tot Curr Liab 25 526 24 416 24 560 22 005 20 975

Minority Int - 7 439 2 527 988 - PER SHARE STATISTICS (cents per share)

LT Liab 266 015 341 760 222 243 148 420 49 868 HEPS-C (ZARc) - 501.60 - 529.00 416.50 688.20 605.80

Tot Curr Liab 231 031 182 528 79 444 27 583 16 891 DPS (ZARc) - - 208.00 347.00 298.90

NAV PS (ZARc) 1 656.39 2 183.80 2 999.40 2 900.60 2 599.52

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 30.08 40.80 31.10 2.23 25.11 3 Yr Beta 1.14 0.92 0.77 1.06 1.46

DPS (ZARc) 76.55 142.70 118.63 87.94 74.22 Price High 6 200 11 669 17 848 15 474 15 653

8 203

8 635

NAV PS (ZARc) 2 200.11 2 159.14 2 150.70 1 857.54 1 900.16 Price Low 2 033 3 825 10 352 10 105 12 723

5 132

2 295

Price Prd End

13 954

3 Yr Beta 1.67 0.81 0.50 0.11 0.38

Price High 2 149 2 474 3 375 2 434 2 700 RATIOS

Price Low 562 1 900 2 018 1 680 1 600 Ret on SH Fnd - 64.19 - 27.00 13.31 23.79 23.43

Price Prd End 1 310 2 090 2 100 2 350 2 012 Oper Pft Mgn - 1.22 0.76 2.08 2.91 2.75

RATIOS D:E 4.89 2.67 0.93 0.87 1.07

0.90

Current Ratio

0.84

0.86

0.65

0.76

Ret on SH Fnd - 2.54 7.15 2.26 5.93 0.37

Oper Pft Mgn 67.98 74.21 102.29 74.74 64.92 Div Cover - - 1.97 2.00 2.05

D:E 0.60 0.56 0.29 0.26 0.13

Current Ratio 2.29 1.57 3.06 1.74 6.77 Master Drilling Group Ltd.

Div Cover - 0.70 0.98 0.38 1.42 0.11 MAS

ISIN: ZAE000171948 SHORT: MASTDRILL CODE: MDI

REG NO: 2011/008265/06 FOUNDED: 1986 LISTED: 2012

Massmart Holdings Ltd. NATURE OF BUSINESS: Master Drilling Group Ltd. is an investment

MAS holdingcompany,whosesubsidiarycompaniesprovidespecialiseddrilling

ISIN: ZAE000152617 SHORT: MASSMART CODE: MSM services to blue chip major and mid-tier companies in the mining, civil

REG NO: 1940/014066/06 FOUNDED: 1990 LISTED: 2000 engineering, construction and hydro-electric power sectors, across a

NATURE OF BUSINESS: Massmart is a South African-based globally number of commodities and geographies.

competitive regional management group, invested in a portfolio of SECTOR: Basic Materials—Basic Resrcs—Mining—Gen Mining

differentiated, complementary, focused wholesale and retail formats. NUMBER OF EMPLOYEES: 1 958

These are each reliant on high volumes and operational excellence as the DIRECTORS: Jordaan B J (Executive), BrinkAW(ld ind ne),

foundation of price leadership, in the distribution of mainly branded DeshmukhAA(ind ne), FaulHJ(ind ne), Ferguson S (ne),

consumer goods for cash. Massmart is the second-largest distributor of Matloa O (ind ne), van der Merwe H (Chair, ind ne),

consumer goods in Africa, the leading retailer of general merchandise, Pretorius D C (CEO), Dixon E (COO, alt), Sheppard G R (COO),

liquor and home improvement equipment and supplies, and the leading van Deventer A J (CFO)

wholesaler of basic foods. MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019

SECTOR: Consumer Srvcs—Retail—Gen Retailers—Broadline Rets Barrange (Pty) Ltd. 29.00%

NUMBER OF EMPLOYEES: 51 000 MDG Equity Holdings (Pty) Ltd. 25.90%

DIRECTORS: Gwagwa DrNN(ind ne), Ighodaro O (ne, Nig), Kagiso Asset Management 11.80%

Langeni P (ld ind ne), Mthimunye-BakoroLE(ne), Muigai S (ne, Can), POSTAL ADDRESS: PO Box 902, Fochville, 2515

Redfield C (ne, USA), SuarezJP(ne, USA), Dlamini K D (Chair, ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/MDI

Slape M (CEO, USA), Abdool-Samad M (CFO) COMPANY SECRETARY: Andrew Colin Beaven

MAJOR ORDINARY SHAREHOLDERS as at 08 Oct 2020 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Main Street 830 (Pty) Ltd. (Walmart) 53.00% SPONSOR: Investec Bank Ltd.

Public Investment Corporation (SOC) Ltd. 10.34%

Investec Asset Management 9.00% AUDITORS: BDO SA

164