Page 161 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 161

Profile’s Stock Exchange Handbook: 2021 – Issue 1 JSE – LIB

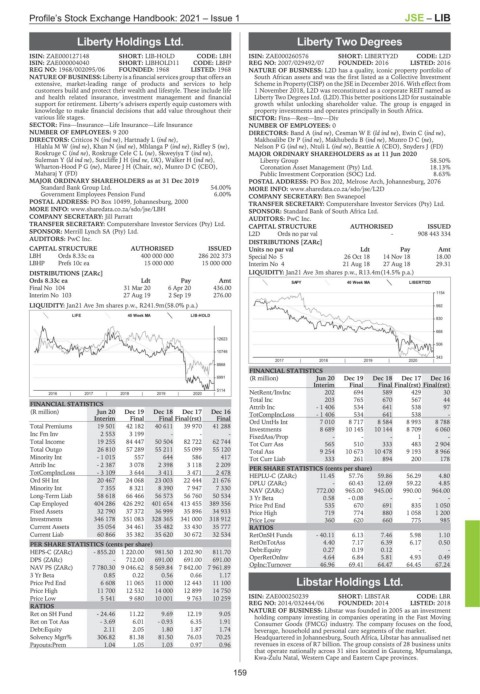

Liberty Holdings Ltd. Liberty Two Degrees

LIB LIB

ISIN: ZAE000127148 SHORT: LIB-HOLD CODE: LBH ISIN: ZAE000260576 SHORT: LIBERTY2D CODE: L2D

ISIN: ZAE000004040 SHORT: LIBHOLD11 CODE: LBHP REG NO: 2007/029492/07 FOUNDED: 2016 LISTED: 2016

REG NO: 1968/002095/06 FOUNDED: 1968 LISTED: 1968 NATURE OF BUSINESS: L2D has a quality, iconic property portfolio of

NATURE OF BUSINESS: Liberty is a financial services group that offers an South African assets and was the first listed as a Collective Investment

extensive, market-leading range of products and services to help Scheme in Property(CISP) on the JSE in December 2016. With effect from

customers build and protect their wealth and lifestyle. These include life 1 November 2018, L2D was reconstituted as a corporate REIT named as

and health related insurance, investment management and financial Liberty Two Degrees Ltd. (L2D).This better positions L2D for sustainable

support for retirement. Liberty’s advisers expertly equip customers with growth whilst unlocking shareholder value. The group is engaged in

knowledge to make financial decisions that add value throughout their property investments and operates principally in South Africa.

various life stages. SECTOR: Fins—Rest—Inv—Div

SECTOR: Fins—Insurance—Life Insurance—Life Insurance NUMBER OF EMPLOYEES: 0

NUMBER OF EMPLOYEES: 9 200 DIRECTORS: Band A (ind ne), CesmanWE(ld ind ne), Ewin C (ind ne),

DIRECTORS: Criticos N (ind ne), Hartnady L (ind ne), Makhoalibe Dr P (ind ne), Makhubedu B (ind ne), MunroDC(ne),

HlahlaMW(ind ne), Khan N (ind ne), Mhlanga P (ind ne), Ridley S (ne), NelsonPG(ind ne), Ntuli L (ind ne), Beattie A (CEO), Snyders J (FD)

Roskruge C (ind ne), Roskruge CeleCL(ne), Skweyiya T (ind ne), MAJOR ORDINARY SHAREHOLDERS as at 11 Jun 2020

Suleman Y (ld ind ne), SutcliffeJH(ind ne, UK), Walker H (ind ne), Liberty Group 58.50%

Wharton-HoodPG(ne), Maree J H (Chair, ne), Munro D C (CEO), Coronation Asset Management (Pty) Ltd. 18.13%

Maharaj Y (FD) Public Investment Corporation (SOC) Ltd. 8.63%

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019 POSTAL ADDRESS: PO Box 202, Melrose Arch, Johannesburg, 2076

Standard Bank Group Ltd. 54.00% MORE INFO: www.sharedata.co.za/sdo/jse/L2D

Government Employees Pension Fund 6.00% COMPANY SECRETARY: Ben Swanepoel

POSTAL ADDRESS: PO Box 10499, Johannesburg, 2000 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/LBH SPONSOR: Standard Bank of South Africa Ltd.

COMPANY SECRETARY: Jill Parratt AUDITORS: PwC Inc.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

SPONSOR: Merrill Lynch SA (Pty) Ltd. L2D Ords no par val - 908 443 334

AUDITORS: PwC Inc.

DISTRIBUTIONS [ZARc]

CAPITAL STRUCTURE AUTHORISED ISSUED Units no par val Ldt Pay Amt

LBH Ords 8.33c ea 400 000 000 286 202 373 Special No 5 26 Oct 18 14 Nov 18 18.00

LBHP Prefs 10c ea 15 000 000 15 000 000 Interim No 4 21 Aug 18 27 Aug 18 29.31

DISTRIBUTIONS [ZARc] LIQUIDITY: Jan21 Ave 3m shares p.w., R13.4m(14.5% p.a.)

Ords 8.33c ea Ldt Pay Amt SAPY 40 Week MA LIBERTY2D

Final No 104 31 Mar 20 6 Apr 20 436.00

1154

Interim No 103 27 Aug 19 2 Sep 19 276.00

LIQUIDITY: Jan21 Ave 3m shares p.w., R241.9m(58.0% p.a.) 992

LIFE 40 Week MA LIB-HOLD

830

668

12623

506

10746

343

2017 | 2018 | 2019 | 2020 |

8868

FINANCIAL STATISTICS

6991 (R million) Jun 20 Dec 19 Dec 18 Dec 17 Dec 16

Interim Final Final Final(rst) Final(rst)

5114 NetRent/InvInc 202 694 589 429 30

2016 | 2017 | 2018 | 2019 | 2020 |

Total Inc 203 765 670 567 44

FINANCIAL STATISTICS Attrib Inc - 1 406 534 641 538 97

(R million) Jun 20 Dec 19 Dec 18 Dec 17 Dec 16 TotCompIncLoss - 1 406 534 641 538 -

Interim Final Final Final(rst) Final Ord UntHs Int 7 010 8 717 8 584 8 993 8 788

Total Premiums 19 501 42 182 40 611 39 970 41 288 Investments 8 689 10 145 10 144 8 709 6 060

Inc Fm Inv 2 553 3 199 - - - FixedAss/Prop - - - 1 -

Total Income 19 255 84 447 50 504 82 722 62 744 Tot Curr Ass 565 510 333 483 2 904

Total Outgo 26 810 57 289 55 211 55 099 55 120 Total Ass 9 254 10 673 10 478 9 193 8 966

Minority Int - 1 015 557 644 586 417 Tot Curr Liab 333 261 894 200 178

Attrib Inc - 2 387 3 078 2 398 3 118 2 209 PER SHARE STATISTICS (cents per share)

TotCompIncLoss - 3 109 3 644 3 411 3 471 2 478

HEPLU-C (ZARc) 11.45 57.76 59.86 56.29 4.80

Ord SH Int 20 467 24 068 23 003 22 444 21 676 DPLU (ZARc) - 60.43 12.69 59.22 4.85

Minority Int 7 355 8 321 8 390 7 947 7 330 NAV (ZARc) 772.00 965.00 945.00 990.00 964.00

Long-Term Liab 58 618 66 466 56 573 56 760 50 534 3 Yr Beta 0.58 - 0.08 - - -

Cap Employed 404 286 426 292 401 654 413 455 389 356 Price Prd End 535 670 691 835 1 050

Fixed Assets 32 790 37 372 36 999 35 896 34 933 Price High 719 774 880 1 058 1 200

Investments 346 178 351 083 328 365 341 000 318 912 Price Low 360 620 660 775 985

Current Assets 35 054 34 461 35 482 33 430 35 777 RATIOS

Current Liab 60 866 35 382 35 620 30 672 32 534 RetOnSH Funds - 40.11 6.13 7.46 5.98 1.10

PER SHARE STATISTICS (cents per share) RetOnTotAss 4.40 7.17 6.39 6.17 0.50

HEPS-C (ZARc) - 855.20 1 220.00 981.50 1 202.90 811.70 Debt:Equity 0.27 0.19 0.12 - -

DPS (ZARc) - 712.00 691.00 691.00 691.00 OperRetOnInv 4.64 6.84 5.81 4.93 0.49

NAV PS (ZARc) 7 780.30 9 046.62 8 569.84 7 842.00 7 961.89 OpInc:Turnover 46.96 69.41 64.47 64.45 67.24

3 Yr Beta 0.85 0.22 0.56 0.66 1.17

Price Prd End 6 608 11 065 11 000 12 443 11 100 Libstar Holdings Ltd.

Price High 11 700 12 532 14 000 12 899 14 750 LIB

Price Low 5 541 9 680 10 001 9 763 10 259 ISIN: ZAE000250239 SHORT: LIBSTAR CODE: LBR

RATIOS REG NO: 2014/032444/06 FOUNDED: 2014 LISTED: 2018

NATURE OF BUSINESS: Libstar was founded in 2005 as an investment

Ret on SH Fund - 24.46 11.22 9.69 12.19 9.05 holding company investing in companies operating in the Fast Moving

Ret on Tot Ass - 3.69 6.01 - 0.93 6.35 1.91 Consumer Goods (FMCG) industry. The company focuses on the food,

Debt:Equity 2.11 2.05 1.80 1.87 1.74 beverage, household and personal care segments of the market.

Solvency Mgn% 306.82 81.38 81.50 76.03 70.25 Headquartered in Johannesburg, South Africa, Libstar has annualised net

Payouts:Prem 1.04 1.05 1.03 0.97 0.96 revenues in excess of R7 billion. The group consists of 28 business units

that operate nationally across 31 sites located in Gauteng, Mpumalanga,

Kwa-Zulu Natal, Western Cape and Eastern Cape provinces.

159