Page 135 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 135

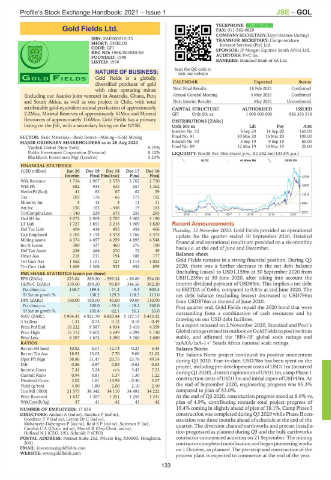

Profile’s Stock Exchange Handbook: 2021 – Issue 1 JSE – GOL

TELEPHONE: 011-562-9700

Gold Fields Ltd. FAX: 011-562-9829

GOL COMPANY SECRETARY: TarynHarmse(Acting)

ISIN: ZAE000018123 TRANSFER SECRETARY: Computershare

SHORT: GFIELDS Investor Services (Pty) Ltd.

CODE: GFI SPONSOR: JP Morgan Equities South Africa Ltd.

REG NO: 1968/004880/06

FOUNDED: 1998 AUDITORS: PwC Inc.

LISTED: 1998 BANKERS: Standard Bank of SA Ltd.

Scan the QR code to

NATURE OF BUSINESS: visit our website

Gold Fields is a globally

diversified producer of gold CALENDAR Expected Status

with nine operating mines Next Final Results 18 Feb 2021 Confirmed

(including our Asanko joint venture) in Australia, Ghana, Peru Annual General Meeting 4 May 2021 Confirmed

and South Africa, as well as one project in Chile, with total Next Interim Results May 2021 Unconfirmed

attributable gold-equivalent annual production of approximately CAPITAL STRUCTURE AUTHORISED ISSUED

2.2Moz, Mineral Reserves of approximately 51Moz and Mineral GFI Ords 50c ea 1 000 000 000 883 333 518

Resources of approximately 116Moz. Gold Fields has a primary DISTRIBUTIONS [ZARc]

listing on the JSE, with a secondary listing on the NYSE. Ords 50c ea Ldt Pay Amt

Interim No 92 8 Sep 20 14 Sep 20 160.00

SECTOR: Basic Materials—Basic Resrcs—Mining—Gold Mining Final No 91 10 Mar 20 16 Mar 20 100.00

MAJOR ORDINARY SHAREHOLDERS as at 28 Aug 2020 Interim No 90 3 Sep 19 9 Sep 19 60.00

VanEck Global (New York) 9.79% Final No 89 12 Mar 19 18 Mar 19 20.00

Public Investment Corporation (Pretoria) 8.10% LIQUIDITY: Nov20 Ave 18m shares p.w., R2 282.5m(103.8% p.a.)

BlackRock Investment Mgt (London) 5.23%

GLDX 40 Week MA GFIELDS

FINANCIAL STATISTICS

(USD million) Jun 20 Dec 19 Dec 18 Dec 17 Dec 16

Interim Final Final(rst) Final Final 23759

Wrk Revenue 1 754 2 967 2 578 2 762 2 750

Wrk Pft 682 934 535 657 1 362 18637

NetIntPd(Rcd) 41 82 67 62 59

13516

Tax 103 176 - 66 173 192

Minority Int 5 13 3 11 11 8394

Att Inc 156 162 - 348 - 19 163

TotCompIncLoss - 140 229 675 255 295 2015 | 2016 | 2017 | 2018 | 2019 | 2020 3272

Ord SH Int 2 972 2 909 2 707 3 403 3 190

LT Liab 1 727 1 851 2 216 1 909 1 820 Recent Announcements

Def Tax Liab 404 434 455 454 466 Thursday, 12 November 2020: Gold Fields provided an operational

Cap Employed 5 103 5 194 5 378 5 766 5 475 update for the quarter ended 30 September 2020. Detailed

Mining assets 4 374 4 657 4 259 4 893 4 548 financial and operational results are provided on a six-monthly

Inv & Loans 380 327 460 276 190 basis i.e. at the end of June and December.

Def Tax Asset 238 266 270 72 49

Other Ass 218 211 194 188 177 Balance sheet

Tot Curr Ass 1 562 1 101 727 1 114 1 053 Gold Fields remains in a strong financial position. During Q3

Tot Curr Liab 1 669 1 368 532 854 859 2020, there was a further decrease in the net debt balance

PER SHARE STATISTICS (cents per share) (including leases) to USD1,159m at 30 September 2020 from

EPS (ZARc) 323.64 289.20 - 599.34 - 26.66 294.00 USD1,239m at 30 June 2020, after taking into account the

HEPS-C (ZARc) 359.60 289.20 99.89 346.58 382.20 interim dividend payment of USD85m. This implies a net debt

Pct chng p.a. 148.7 189.5 - 71.2 - 9.3 803.3 to EBITDA of 0.68x, compared to 0.84x at end June 2020. The

Tr 5yr av grwth % - 138.2 129.3 118.5 113.0 net debt balance (excluding leases) decreased to USD796m

DPS (ZARc) 160.00 160.00 40.00 90.00 110.00 from USD876m at the end of June 2020.

Pct chng p.a. - 300.0 - 55.6 - 18.2 340.0 Post quarter end, Gold Fields repaid the 2020 bond that were

Tr 5yr av grwth % - 105.8 62.1 55.1 53.0 outstanding from a combination of cash resources and by

NAV (ZARc) 5 904.35 4 921.70 4 820.44 5 127.13 5 453.32

3 Yr Beta 1.31 0.73 0.12 0.18 - 0.49 drawing on our USD debt facilities.

Price Prd End 16 222 9 587 4 934 5 410 4 359 In a report released on 2 November 2020, Standard and Poor’s

Price High 16 312 9 602 5 649 6 094 9 130 GlobalratingsreviseditsoutlookonGoldFieldstopositivefrom

Price Low 6 397 4 672 3 290 3 760 3 680 stable, and affirmed the ‘BB+/B’ global scale ratings and

RATIOS ‘zaAAA/zaA-1+’ South Africa national scale ratings.

Ret on SH fund 10.82 6.01 - 12.74 - 0.23 5.45 Salares Norte

Ret on Tot Ass 18.92 13.03 7.70 9.06 21.62 The Salares Norte project continued its positive momentum

Oper Pft Mgn 38.86 31.47 20.75 23.78 49.54 during Q3 2020. Year-to-date, USD78m has been spent on the

D:E 0.86 0.87 0.85 0.62 0.63 project, including pre-development costs of USD11m (incurred

Interest Cover 7.41 5.24 n/a 3.47 7.23 during Q12020),district explorationofUSD11m,campPhase 1

Current Ratio 0.94 0.81 1.37 1.30 1.22

Dividend Cover 2.02 1.81 - 14.98 - 0.30 2.67 construction costs of USD13m and initial capex of USD43m. At

Yield (g/ton) 4.90 1.80 2.00 2.10 2.10 the end of September 2020, engineering progress was 85.3%

Ton Mll (‘000) 21 573 38 342 34 110 34 492 34 222 compared to plan of 83.0%.

Price Received 1 637 1 387 1 251 1 255 1 241 At the end of Q3 2020, construction progress stood at 8.8% vs.

WrkCost(R/kg) 37 41 42 43 42 plan of 4.9%, contributing towards total project progress of

NUMBER OF EMPLOYEES: 17 656 19.4% coming in slightly ahead of plan of 18.1%. Camp Phase I

DIRECTORS: Andani A (ind ne), Bacchus P (ind ne), construction was completed during Q3 2020 while Phase II con-

GoodlaceTP(ind ne), Letton Dr C (ind ne), struction was three months ahead of schedule at the end of the

Mahanyele-Dabengwa P (ind ne), ReidSP(ind ne), Suleman Y (ne), quarter. The diversion channel earthworks and precast installa-

Carolus C A (Chair, ind ne), Menell R (Dep Chair, ind ne),

Holland N J (CEO, UK), Schmidt P (CFO) tion progressed as planned during Q3 and the bulk earthworks

POSTAL ADDRESS: Postnet Suite 252, Private Bag X30500, Houghton, contractor commenced activities on 21 September. The mining

2041 contractor completed mobilisation and began pioneering works

EMAIL: investors@goldfields.com on 1 October, as planned. The pre-strip and construction of the

WEBSITE: www.goldfields.com

process plant is expected to commence at the end of the year.

133