Page 92 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 92

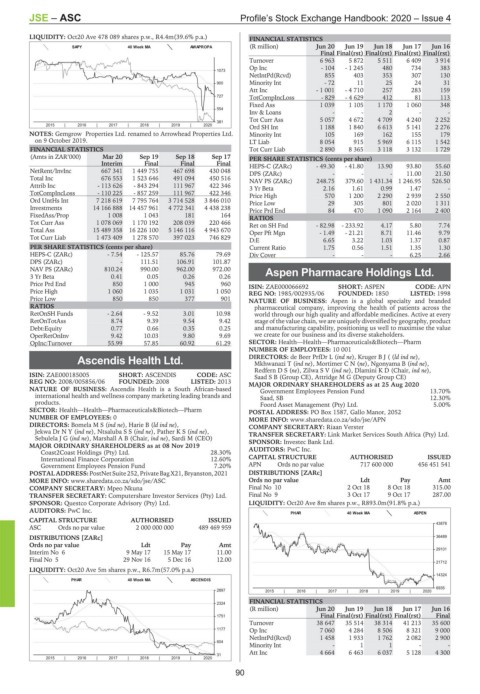

JSE – ASC Profile’s Stock Exchange Handbook: 2020 – Issue 4

LIQUIDITY: Oct20 Ave 478 089 shares p.w., R4.4m(39.6% p.a.) FINANCIAL STATISTICS

SAPY 40 Week MA AWAPROPA (R million) Jun 20 Jun 19 Jun 18 Jun 17 Jun 16

Final Final(rst) Final(rst) Final(rst) Final(rst)

Turnover 6 963 5 872 5 511 6 409 3 914

Op Inc - 104 - 1 245 480 734 383

1073

NetIntPd(Rcvd) 855 403 353 307 130

Minority Int - 72 11 25 24 31

900

Att Inc - 1 001 - 4 710 257 283 159

727 TotCompIncLoss - 829 - 4 629 412 81 113

Fixed Ass 1 039 1 105 1 170 1 060 348

554

Inv & Loans - - 2 - -

Tot Curr Ass 5 057 4 672 4 709 4 240 2 252

381

2015 | 2016 | 2017 | 2018 | 2019 | 2020 Ord SH Int 1 188 1 840 6 613 5 141 2 276

NOTES: Gemgrow Properties Ltd. renamed to Arrowhead Properties Ltd. Minority Int 105 169 162 155 179

on 9 October 2019. LT Liab 8 054 915 5 969 6 115 1 542

FINANCIAL STATISTICS Tot Curr Liab 2 890 8 365 3 118 3 132 1 729

(Amts in ZAR’000) Mar 20 Sep 19 Sep 18 Sep 17 PER SHARE STATISTICS (cents per share)

Interim Final Final Final HEPS-C (ZARc) - 49.30 - 41.80 13.90 93.80 55.60

NetRent/InvInc 667 341 1 449 755 467 698 430 048 DPS (ZARc) - - - 11.00 21.50

Total Inc 676 553 1 523 646 491 094 450 516 NAV PS (ZARc) 248.75 379.60 1 431.34 1 246.95 526.50

Attrib Inc - 113 626 - 843 294 111 967 422 346 3 Yr Beta 2.16 1.61 0.99 1.47 -

TotCompIncLoss - 110 225 - 857 259 111 967 422 346 Price High 570 1 200 2 290 2 939 2 550

Ord UntHs Int 7 218 619 7 795 764 3 714 528 3 846 010 Price Low 29 305 801 2 020 1 311

Investments 14 166 888 14 457 961 4 772 341 4 438 238 Price Prd End 84 470 1 090 2 164 2 400

FixedAss/Prop 1 008 1 043 181 164 RATIOS

Tot Curr Ass 1 078 069 1 170 192 208 039 220 466 Ret on SH Fnd - 82.98 - 233.92 4.17 5.80 7.74

Total Ass 15 489 358 16 226 100 5 146 116 4 943 670 Oper Pft Mgn - 1.49 - 21.21 8.71 11.46 9.79

Tot Curr Liab 1 473 409 1 278 570 397 023 746 829 D:E 6.65 3.22 1.03 1.37 0.87

PER SHARE STATISTICS (cents per share) Current Ratio 1.75 0.56 1.51 1.35 1.30

HEPS-C (ZARc) - 7.54 - 125.57 85.76 79.69 Div Cover - - - 6.25 2.66

DPS (ZARc) - 111.51 106.91 101.87

NAV PS (ZARc) 810.24 990.00 962.00 972.00

3 Yr Beta 0.41 0.05 0.26 0.26 Aspen Pharmacare Holdings Ltd.

Price Prd End 850 1 000 945 960 ISIN: ZAE000066692 SHORT: ASPEN CODE: APN

ASP

Price High 1 060 1 035 1 031 1 050 REG NO: 1985/002935/06 FOUNDED: 1850 LISTED: 1998

Price Low 850 850 377 901 NATURE OF BUSINESS: Aspen is a global specialty and branded

RATIOS pharmaceutical company, improving the health of patients across the

RetOnSH Funds - 2.64 - 9.52 3.01 10.98 world through our high quality and affordable medicines. Active at every

RetOnTotAss 8.74 9.39 9.54 9.42 stage of the value chain, we are uniquely diversified by geography, product

Debt:Equity 0.77 0.66 0.35 0.25 and manufacturing capability, positioning us well to maximise the value

OperRetOnInv 9.42 10.03 9.80 9.69 we create for our business and its diverse stakeholders.

OpInc:Turnover 55.99 57.85 60.92 61.29 SECTOR: Health—Health—Pharmaceuticals&Biotech—Pharm

NUMBER OF EMPLOYEES: 10 001

Ascendis Health Ltd. DIRECTORS: de Beer PrfDr L (ind ne), KrugerBJ((ld ind ne),

Mkhwanazi T (ind ne), MortimerCN(ne), Ngonyama B (ind ne),

ASC RedfernDS(ne), ZilwaSV(ind ne), Dlamini K D (Chair, ind ne),

ISIN: ZAE000185005 SHORT: ASCENDIS CODE: ASC Saad S B (Group CE), Attridge M G (Deputy Group CE)

REG NO: 2008/005856/06 FOUNDED: 2008 LISTED: 2013 MAJOR ORDINARY SHAREHOLDERS as at 25 Aug 2020

NATURE OF BUSINESS: Ascendis Health is a South African-based Government Employees Pension Fund 13.70%

international health and wellness company marketing leading brands and Saad, SB 12.30%

products. Foord Asset Management (Pty) Ltd. 5.00%

SECTOR: Health—Health—Pharmaceuticals&Biotech—Pharm POSTAL ADDRESS: PO Box 1587, Gallo Manor, 2052

NUMBER OF EMPLOYEES: 0 MORE INFO: www.sharedata.co.za/sdo/jse/APN

DIRECTORS: BomelaMS(ind ne), Harie B (ld ind ne), COMPANY SECRETARY: Riaan Verster

Jekwa DrNY(ind ne), NtsalubaSS(ind ne), PatherKS(ind ne), TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

SebulelaJG(ind ne), Marshall A B (Chair, ind ne), Sardi M (CEO)

MAJOR ORDINARY SHAREHOLDERS as at 08 Nov 2019 SPONSOR: Investec Bank Ltd.

AUDITORS: PwC Inc.

Coast2Coast Holdings (Pty) Ltd. 28.30%

International Finance Corporation 12.60% CAPITAL STRUCTURE AUTHORISED ISSUED

Government Employees Pension Fund 7.20% APN Ords no par value 717 600 000 456 451 541

POSTAL ADDRESS:PostNetSuite252, PrivateBagX21,Bryanston,2021 DISTRIBUTIONS [ZARc]

MORE INFO: www.sharedata.co.za/sdo/jse/ASC Ords no par value Ldt Pay Amt

COMPANY SECRETARY: Mpeo Nkuna Final No 10 2 Oct 18 8 Oct 18 315.00

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Final No 9 3 Oct 17 9 Oct 17 287.00

SPONSOR: Questco Corporate Advisory (Pty) Ltd. LIQUIDITY: Oct20 Ave 8m shares p.w., R893.0m(91.8% p.a.)

AUDITORS: PwC Inc. PHAR 40 Week MA ASPEN

CAPITAL STRUCTURE AUTHORISED ISSUED

43878

ASC Ords no par value 2 000 000 000 489 469 959

DISTRIBUTIONS [ZARc] 36489

Ords no par value Ldt Pay Amt

29101

Interim No 6 9 May 17 15 May 17 11.00

Final No 5 29 Nov 16 5 Dec 16 12.00

21712

LIQUIDITY: Oct20 Ave 5m shares p.w., R6.7m(57.0% p.a.)

14324

PHAR 40 Week MA ASCENDIS

6935

2897 2015 | 2016 | 2017 | 2018 | 2019 | 2020

FINANCIAL STATISTICS

2324

(R million) Jun 20 Jun 19 Jun 18 Jun 17 Jun 16

Final Final(rst) Final(rst) Final(rst) Final

1751

Turnover 38 647 35 514 38 314 41 213 35 600

1177 Op Inc 7 060 4 284 8 506 8 321 9 000

NetIntPd(Rcvd) 1 458 1 933 1 762 2 082 2 900

604

Minority Int - 1 1 - -

Att Inc 4 664 6 463 6 037 5 128 4 300

31

2015 | 2016 | 2017 | 2018 | 2019 | 2020

90