Page 61 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 61

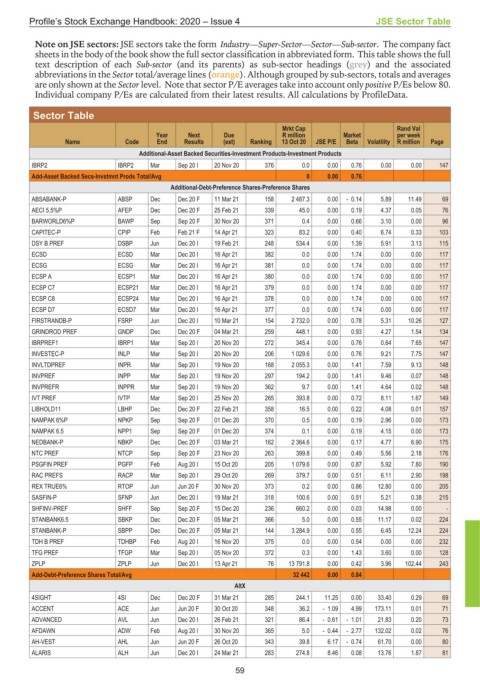

Profile’s Stock Exchange Handbook: 2020 – Issue 4 JSE Sector Table

JSE Sector Table

Note on JSE sectors: JSE sectors take the form Industry—Super-Sector—Sector—Sub-sector. The company fact

sheets in the body of the book show the full sector classification in abbreviated form. This table shows the full

text description of each Sub-sector (and its parents) as sub-sector headings (grey) and the associated

abbreviations in the Sector total/average lines (orange). Although grouped by sub-sectors, totals and averages

are only shown at the Sector level. Note that sector P/E averages take into account only positive P/Es below 80.

Individual company P/Es are calculated from their latest results. All calculations by ProfileData.

Sector Table

Mrkt Cap Rand Val

Year Next Due R million Market per week

Name Code End Results (est) Ranking 13 Oct 20 JSE P/E Beta Volatility R million Page

Additional-Asset Backed Securities-Investment Products-Investment Products

IBRP2 IBRP2 Mar Sep 20 I 20 Nov 20 376 0.0 0.00 0.76 0.00 0.00 147

Add-Asset Backed Secs-Invstmnt Prods Total/Avg 0 0.00 0.76

Additional-Debt-Preference Shares-Preference Shares

ABSABANK-P ABSP Dec Dec 20 F 11 Mar 21 158 2 487.3 0.00 - 0.14 5.89 11.49 69

AECI 5.5%P AFEP Dec Dec 20 F 25 Feb 21 339 45.0 0.00 0.19 4.37 0.05 76

BARWORLD6%P BAWP Sep Sep 20 F 30 Nov 20 371 0.4 0.00 0.66 3.10 0.00 96

CAPITEC-P CPIP Feb Feb 21 F 14 Apr 21 323 83.2 0.00 0.40 6.74 0.33 103

DSY B PREF DSBP Jun Dec 20 I 19 Feb 21 248 534.4 0.00 1.39 5.91 3.13 115

ECSD ECSD Mar Dec 20 I 16 Apr 21 382 0.0 0.00 1.74 0.00 0.00 117

ECSG ECSG Mar Dec 20 I 16 Apr 21 381 0.0 0.00 1.74 0.00 0.00 117

ECSP A ECSP1 Mar Dec 20 I 16 Apr 21 380 0.0 0.00 1.74 0.00 0.00 117

ECSP C7 ECSP21 Mar Dec 20 I 16 Apr 21 379 0.0 0.00 1.74 0.00 0.00 117

ECSP C8 ECSP24 Mar Dec 20 I 16 Apr 21 378 0.0 0.00 1.74 0.00 0.00 117

ECSP D7 ECSD7 Mar Dec 20 I 16 Apr 21 377 0.0 0.00 1.74 0.00 0.00 117

FIRSTRANDB-P FSRP Jun Dec 20 I 10 Mar 21 154 2 732.0 0.00 0.78 5.31 10.26 127

GRINDROD PREF GNDP Dec Dec 20 F 04 Mar 21 259 448.1 0.00 0.93 4.27 1.54 134

IBRPREF1 IBRP1 Mar Sep 20 I 20 Nov 20 272 345.4 0.00 0.76 0.64 7.65 147

INVESTEC-P INLP Mar Sep 20 I 20 Nov 20 206 1 029.6 0.00 0.76 9.21 7.75 147

INVLTDPREF INPR Mar Sep 20 I 19 Nov 20 168 2 055.3 0.00 1.41 7.59 9.13 148

INVPREF INPP Mar Sep 20 I 19 Nov 20 297 194.2 0.00 1.41 9.46 0.07 148

INVPREFR INPPR Mar Sep 20 I 19 Nov 20 362 9.7 0.00 1.41 4.64 0.02 148

IVT PREF IVTP Mar Sep 20 I 25 Nov 20 265 393.8 0.00 0.72 8.11 1.67 149

LIBHOLD11 LBHP Dec Dec 20 F 22 Feb 21 358 16.5 0.00 0.22 4.08 0.01 157

NAMPAK 6%P NPKP Sep Sep 20 F 01 Dec 20 370 0.5 0.00 0.19 2.96 0.00 173

NAMPAK 6.5 NPP1 Sep Sep 20 F 01 Dec 20 374 0.1 0.00 0.19 4.15 0.00 173

NEDBANK-P NBKP Dec Dec 20 F 03 Mar 21 162 2 364.6 0.00 0.17 4.77 6.90 175

NTC PREF NTCP Sep Sep 20 F 23 Nov 20 263 399.8 0.00 0.49 5.56 2.18 176

PSGFIN PREF PGFP Feb Aug 20 I 15 Oct 20 205 1 079.6 0.00 0.87 5.92 7.80 190

RAC PREFS RACP Mar Sep 20 I 29 Oct 20 269 379.7 0.00 0.51 6.11 2.90 198

REX TRUE6% RTOP Jun Jun 20 F 30 Nov 20 373 0.2 0.00 0.86 12.80 0.00 205

SASFIN-P SFNP Jun Dec 20 I 19 Mar 21 318 100.6 0.00 0.51 5.21 0.38 215

SHFINV-PREF SHFF Sep Sep 20 F 15 Dec 20 236 660.2 0.00 0.03 14.98 0.00 -

STANBANK6.5 SBKP Dec Dec 20 F 05 Mar 21 366 5.0 0.00 0.55 11.17 0.02 224

STANBANK-P SBPP Dec Dec 20 F 05 Mar 21 144 3 284.9 0.00 0.55 6.45 12.24 224

TDH B PREF TDHBP Feb Aug 20 I 16 Nov 20 375 0.0 0.00 0.54 0.00 0.00 232

TFG PREF TFGP Mar Sep 20 I 05 Nov 20 372 0.3 0.00 1.43 3.60 0.00 128

ZPLP ZPLP Jun Dec 20 I 13 Apr 21 76 13 791.8 0.00 0.42 3.96 102.44 243

Add-Debt-Preference Shares Total/Avg 32 442 0.00 0.84

AltX

4SIGHT 4SI Dec Dec 20 F 31 Mar 21 285 244.1 11.25 0.00 33.40 0.29 69

ACCENT ACE Jun Jun 20 F 30 Oct 20 348 36.2 - 1.09 4.99 173.11 0.01 71

ADVANCED AVL Jun Dec 20 I 26 Feb 21 321 86.4 - 0.61 - 1.01 21.83 0.20 73

AFDAWN ADW Feb Aug 20 I 30 Nov 20 365 5.0 - 0.44 - 2.77 132.02 0.02 76

AH-VEST AHL Jun Jun 20 F 26 Oct 20 343 39.8 6.17 - 0.74 61.70 0.00 80

ALARIS ALH Jun Dec 20 I 24 Mar 21 283 274.8 8.46 0.08 13.76 1.87 81

59