Page 60 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 60

JSE Dealing Costs Profile’s Stock Exchange Handbook: 2020 – Issue 4

JSE Dealing Costs

JSE Dealing Costs

AstheJSEgrowssothecostofbuyingandsellingsharescontinuestocomedownasthefixedcostsofbrokers

and the exchange are spread out over more transactions.

Brokerage

Brokerage charged by stockbrokers varies from 0.32% to 1.70% of the value of the transaction. There is

also a clear distinction made between the fees of discount brokers and full service stockbrokers. Discount

brokers are usually online brokers and offer clients low brokerage fees and give recommendations on what

shares to buy or sell via their website. Full service stockbrokers have much higher brokerage and administra-

tion fees. They provide advice on what shares to buy or sell via the telephone and usually provide a dedicated

portfolio advisor to their clients.

Somebrokerschargebrokeragefeesasaflatpercentageofthesizeofthetrade.Othersapplyaslidingscalethat

decreases the percentage charged as the value of the deal increases. Most brokerage charges are subject to a

minimumfee(eg.onediscountbrokerchargesR99exclVatwhilstanotherfullservicebrokerchargesaminimum

of R180). Note that brokerage is usually quoted before Vat as there are other transaction costs associated with a

trade that are subject to Vat (see below) and a total Vat amount is calculated on all these charges together.

For equity transactions above R18 000 all inclusive round trip costs are typically below 2% via a discount

broker which is relatively cheap compared to unit trusts, property and many other investment alternatives. For

trading in warrants, where minimum brokerage often applies, the cost effective floor level is obviously lower.

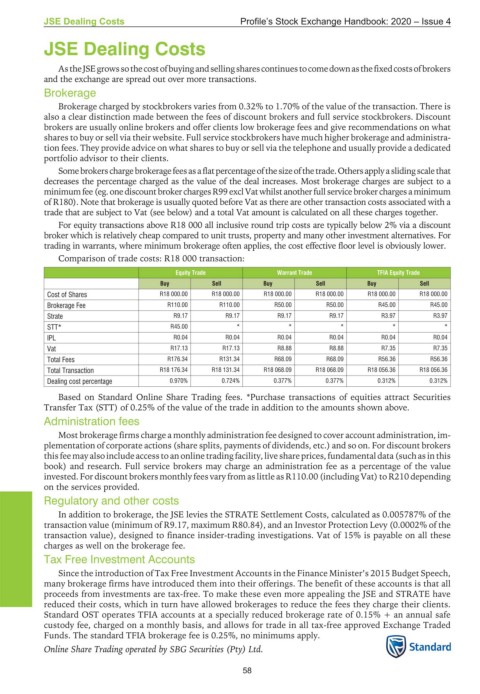

Comparison of trade costs: R18 000 transaction:

Equity Trade Warrant Trade TFIA Equity Trade

Buy Sell Buy Sell Buy Sell

Cost of Shares R18 000.00 R18 000.00 R18 000.00 R18 000.00 R18 000.00 R18 000.00

Brokerage Fee R110.00 R110.00 R50.00 R50.00 R45.00 R45.00

Strate R9.17 R9.17 R9.17 R9.17 R3.97 R3.97

STT* R45.00 * * * * *

IPL R0.04 R0.04 R0.04 R0.04 R0.04 R0.04

Vat R17.13 R17.13 R8.88 R8.88 R7.35 R7.35

Total Fees R176.34 R131.34 R68.09 R68.09 R56.36 R56.36

Total Transaction R18 176.34 R18 131.34 R18 068.09 R18 068.09 R18 056.36 R18 056.36

Dealing cost percentage 0.970% 0.724% 0.377% 0.377% 0.312% 0.312%

Based on Standard Online Share Trading fees. *Purchase transactions of equities attract Securities

Transfer Tax (STT) of 0.25% of the value of the trade in addition to the amounts shown above.

Administration fees

Most brokerage firms charge a monthly administration fee designed to cover account administration, im-

plementation of corporate actions (share splits, payments of dividends, etc.) and so on. For discount brokers

this feemay alsoincludeaccessto an onlinetradingfacility,live shareprices,fundamentaldata (suchas in this

book) and research. Full service brokers may charge an administration fee as a percentage of the value

invested. For discount brokers monthly fees vary from as little as R110.00 (including Vat) to R210 depending

on the services provided.

Regulatory and other costs

In addition to brokerage, the JSE levies the STRATE Settlement Costs, calculated as 0.005787% of the

transaction value (minimum of R9.17, maximum R80.84), and an Investor Protection Levy (0.0002% of the

transaction value), designed to finance insider-trading investigations. Vat of 15% is payable on all these

charges as well on the brokerage fee.

Tax Free Investment Accounts

Since the introduction of Tax Free Investment Accounts in the Finance Minister’s 2015 Budget Speech,

many brokerage firms have introduced them into their offerings. The benefit of these accounts is that all

proceeds from investments are tax-free. To make theseevenmoreappealingthe JSEand STRATE have

reduced their costs, which in turn have allowed brokerages to reduce the fees they charge their clients.

Standard OST operates TFIA accounts at a specially reduced brokerage rate of 0.15% + an annual safe

custody fee, charged on a monthly basis, and allows for trade in all tax-free approved Exchange Traded

Funds. The standard TFIA brokerage fee is 0.25%, no minimums apply.

Online Share Trading operated by SBG Securities (Pty) Ltd.

58