Page 101 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 101

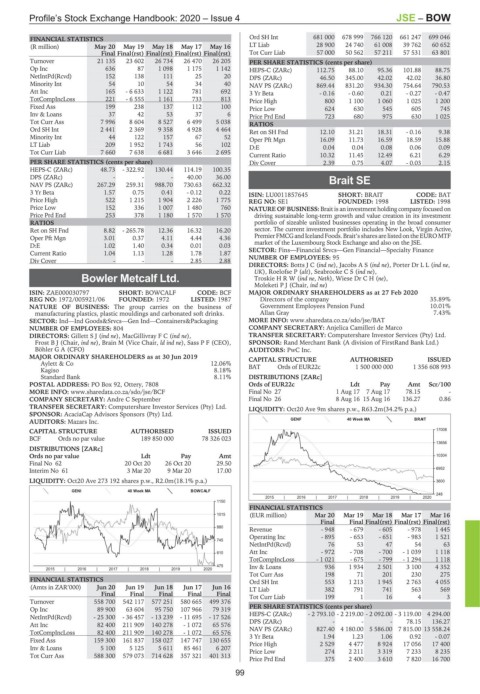

Profile’s Stock Exchange Handbook: 2020 – Issue 4 JSE – BOW

FINANCIAL STATISTICS Ord SH Int 681 000 678 999 766 120 661 247 699 046

(R million) May 20 May 19 May 18 May 17 May 16 LT Liab 28 900 24 740 61 008 39 762 60 652

Final Final(rst) Final(rst) Final(rst) Final(rst) Tot Curr Liab 57 000 50 562 57 211 57 531 63 801

Turnover 21 135 23 602 26 734 26 470 26 205 PER SHARE STATISTICS (cents per share)

Op Inc 636 87 1 098 1 175 1 142 HEPS-C (ZARc) 112.75 88.10 95.36 101.88 88.75

NetIntPd(Rcvd) 152 138 111 25 20 DPS (ZARc) 46.50 345.00 42.02 42.02 36.80

Minority Int 54 10 54 34 40 NAV PS (ZARc) 869.44 831.20 934.30 754.64 790.53

Att Inc 165 - 6 633 1 122 781 692 3 Yr Beta - 0.16 - 0.60 0.21 - 0.27 - 0.47

TotCompIncLoss 221 - 6 555 1 161 733 813 Price High 800 1 100 1 060 1 025 1 200

Fixed Ass 199 238 137 112 100 Price Low 624 630 545 605 745

Inv & Loans 37 42 53 37 6 Price Prd End 723 680 975 630 1 025

Tot Curr Ass 7 996 8 604 8 527 6 499 5 038 RATIOS

Ord SH Int 2 441 2 369 9 358 4 928 4 464 Ret on SH Fnd 12.10 31.21 18.31 - 0.16 9.38

Minority Int 44 122 157 67 52 Oper Pft Mgn 16.09 11.73 16.59 18.59 15.88

LT Liab 209 1 952 1 743 56 102 D:E 0.04 0.04 0.08 0.06 0.09

Tot Curr Liab 7 660 7 638 6 681 3 646 2 695

Current Ratio 10.32 11.45 12.49 6.21 6.29

PER SHARE STATISTICS (cents per share) Div Cover 2.39 0.75 4.07 - 0.03 2.15

HEPS-C (ZARc) 48.73 - 322.92 130.44 114.19 100.35

DPS (ZARc) - - - 40.00 36.00 Brait SE

NAV PS (ZARc) 267.29 259.31 988.70 730.63 662.32

BRA

3 Yr Beta 1.57 0.75 0.41 - 0.12 0.22 ISIN: LU0011857645 SHORT: BRAIT CODE: BAT

Price High 522 1 215 1 904 2 226 1 775 REG NO: SE1 FOUNDED: 1998 LISTED: 1998

Price Low 152 336 1 007 1 480 760 NATURE OF BUSINESS: Brait is an investment holding company focused on

Price Prd End 253 378 1 180 1 570 1 570 driving sustainable long-term growth and value creation in its investment

RATIOS portfolio of sizeable unlisted businesses operating in the broad consumer

Ret on SH Fnd 8.82 - 265.78 12.36 16.32 16.20 sector. The current investment portfolio includes New Look, Virgin Active,

Oper Pft Mgn 3.01 0.37 4.11 4.44 4.36 PremierFMCGandIcelandFoods.Brait’ssharesarelistedontheEUROMTF

market of the Luxembourg Stock Exchange and also on the JSE.

D:E 1.02 1.40 0.34 0.01 0.03 SECTOR: Fins—Financial Srvcs—Gen Financial—Specialty Finance

Current Ratio 1.04 1.13 1.28 1.78 1.87

Div Cover - - - 2.85 2.88 NUMBER OF EMPLOYEES: 95

DIRECTORS: BottsJC(ind ne), JacobsAS(ind ne), Porter DrLL(ind ne,

UK), Roelofse P (alt), SeabrookeCS(ind ne),

Bowler Metcalf Ltd. TroskieHRW(ind ne, Neth), Wiese DrCH(ne),

Moleketi P J (Chair, ind ne)

BOW

ISIN: ZAE000030797 SHORT: BOWCALF CODE: BCF MAJOR ORDINARY SHAREHOLDERS as at 27 Feb 2020

REG NO: 1972/005921/06 FOUNDED: 1972 LISTED: 1987 Directors of the company 35.89%

NATURE OF BUSINESS: The group carries on the business of Government Employees Pension Fund 10.01%

manufacturing plastics, plastic mouldings and carbonated soft drinks. Allan Gray 7.43%

SECTOR: Ind—Ind Goods&Srvcs—Gen Ind—Containers&Packaging MORE INFO: www.sharedata.co.za/sdo/jse/BAT

NUMBER OF EMPLOYEES: 804 COMPANY SECRETARY: Anjelica Camilleri de Marco

DIRECTORS: GillettSJ(ind ne), MacGillivrayFC(ind ne), TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Frost B J (Chair, ind ne), Brain M (Vice Chair, ld ind ne), Sass P F (CEO), SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

Böhler G A (CFO) AUDITORS: PwC Inc.

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019 CAPITAL STRUCTURE AUTHORISED ISSUED

Aylett & Co 12.06% BAT Ords of EUR22c 1 500 000 000 1 356 608 993

Kagiso 8.18%

Standard Bank 8.11% DISTRIBUTIONS [ZARc]

POSTAL ADDRESS: PO Box 92, Ottery, 7808 Ords of EUR22c Ldt Pay Amt Scr/100

MORE INFO: www.sharedata.co.za/sdo/jse/BCF Final No 27 1 Aug 17 7 Aug 17 78.15 -

COMPANY SECRETARY: Andre C September Final No 26 8 Aug 16 15 Aug 16 136.27 0.86

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. LIQUIDITY: Oct20 Ave 9m shares p.w., R63.2m(34.2% p.a.)

SPONSOR: AcaciaCap Advisors Sponsors (Pty) Ltd.

GENF 40 Week MA BRAIT

AUDITORS: Mazars Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED 17008

BCF Ords no par value 189 850 000 78 326 023

13656

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt 10304

Final No 62 20 Oct 20 26 Oct 20 29.50

Interim No 61 3 Mar 20 9 Mar 20 17.00 6952

LIQUIDITY: Oct20 Ave 273 192 shares p.w., R2.0m(18.1% p.a.) 3600

GENI 40 Week MA BOWCALF

248

2015 | 2016 | 2017 | 2018 | 2019 | 2020

1150

FINANCIAL STATISTICS

1015 (EUR million) Mar 20 Mar 19 Mar 18 Mar 17 Mar 16

Final Final Final(rst) Final(rst) Final(rst)

880

Revenue - 948 - 679 - 605 - 978 1 445

Operating Inc - 895 - 653 - 651 - 983 1 521

745

NetIntPd(Rcvd) 76 53 47 54 63

610 Att Inc - 972 - 708 - 700 - 1 039 1 118

TotCompIncLoss - 1 021 - 675 - 799 - 1 294 1 118

475 Inv & Loans 936 1 934 2 501 3 100 4 352

2015 | 2016 | 2017 | 2018 | 2019 | 2020

Tot Curr Ass 198 71 201 230 275

FINANCIAL STATISTICS Ord SH Int 553 1 213 1 945 2 763 4 055

(Amts in ZAR’000) Jun 20 Jun 19 Jun 18 Jun 17 Jun 16 LT Liab 382 791 741 563 569

Final Final Final Final Final Tot Curr Liab 199 1 16 4 3

Turnover 558 700 542 117 577 251 580 665 499 376

Op Inc 89 900 63 604 95 750 107 966 79 319 PER SHARE STATISTICS (cents per share)

NetIntPd(Rcvd) - 25 300 - 36 457 - 13 239 - 11 695 - 17 526 HEPS-C (ZARc) - 2 793.10 - 2 219.00 - 2 092.00 - 3 119.00 4 294.00

-

-

136.27

78.15

-

Att Inc 82 400 211 909 140 278 - 1 072 65 576 DPS (ZARc) 827.40 4 180.00 5 586.00 7 815.00 13 558.24

NAV PS (ZARc)

TotCompIncLoss 82 400 211 909 140 278 - 1 072 65 576

3 Yr Beta 1.94 1.23 1.06 0.92 - 0.07

Fixed Ass 159 300 161 837 158 027 147 747 130 655 Price High 2 529 4 477 8 924 17 056 17 400

Inv & Loans 5 100 5 125 5 611 85 461 6 207 Price Low 274 2 211 3 319 7 233 8 235

Tot Curr Ass 588 300 579 073 714 628 357 321 401 313

Price Prd End 375 2 400 3 610 7 820 16 700

99