Page 100 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 100

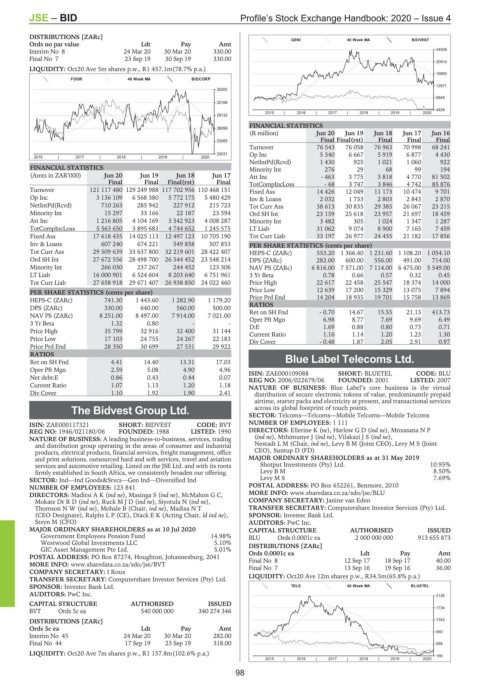

JSE – BID Profile’s Stock Exchange Handbook: 2020 – Issue 4

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt GENI 40 Week MA BIDVEST

Interim No 8 24 Mar 20 30 Mar 20 330.00 24936

Final No 7 23 Sep 19 30 Sep 19 330.00

20914

LIQUIDITY: Oct20 Ave 5m shares p.w., R1 457.1m(78.7% p.a.)

16893

FOOR 40 Week MA BIDCORP

12871

35200

8849

32166

4828

2015 | 2016 | 2017 | 2018 | 2019 | 2020

29132

FINANCIAL STATISTICS

26099

(R million) Jun 20 Jun 19 Jun 18 Jun 17 Jun 16

23065 Final Final(rst) Final Final Final

Turnover 76 543 76 058 76 963 70 998 68 241

20031 Op Inc 5 340 6 667 5 919 6 877 4 430

2016 | 2017 | 2018 | 2019 | 2020

NetIntPd(Rcvd) 1 430 925 1 021 1 060 922

FINANCIAL STATISTICS Minority Int 276 29 68 99 194

(Amts in ZAR’000) Jun 20 Jun 19 Jun 18 Jun 17 Att Inc - 463 3 775 3 818 4 770 81 502

Final Final Final(rst) Final TotCompIncLoss - 68 3 747 3 846 4 742 85 876

Turnover 121 117 480 129 249 988 117 702 956 110 468 151 Fixed Ass 14 426 12 049 11 173 10 474 9 701

Op Inc 3 136 109 6 568 380 5 772 175 5 480 429 Inv & Loans 2 032 1 733 2 803 2 843 2 870

NetIntPd(Rcvd) 710 263 285 942 227 912 215 723 Tot Curr Ass 38 613 30 835 29 385 26 067 23 215

Minority Int 15 297 33 166 22 187 23 594 Ord SH Int 23 159 25 618 23 957 21 697 18 459

Att Inc 1 216 805 4 104 169 3 542 923 4 008 287 Minority Int 3 482 305 1 024 1 347 1 287

TotCompIncLoss 5 563 650 3 895 683 4 744 652 1 245 575 LT Liab 31 062 9 074 8 900 7 165 7 459

Fixed Ass 17 618 435 14 025 113 12 497 123 10 705 190 Tot Curr Liab 33 197 26 977 24 455 21 182 17 856

Inv & Loans 607 240 674 221 549 858 507 853 PER SHARE STATISTICS (cents per share)

Tot Curr Ass 29 509 639 33 637 800 32 219 601 28 422 407 HEPS-C (ZARc) 553.20 1 366.40 1 231.60 1 108.20 1 054.10

Ord SH Int 27 672 556 28 498 700 26 544 452 23 548 214 DPS (ZARc) 282.00 600.00 556.00 491.00 714.00

Minority Int 266 030 237 267 244 452 123 306 NAV PS (ZARc) 6 816.00 7 571.00 7 114.00 6 475.00 5 549.00

LT Liab 16 000 901 6 524 604 8 203 640 6 751 961 3 Yr Beta 0.78 0.66 0.57 0.32 0.45

Tot Curr Liab 27 658 918 29 671 407 26 938 850 24 022 460 Price High 22 617 22 458 25 547 18 374 14 000

PER SHARE STATISTICS (cents per share) Price Low 12 639 17 200 15 329 13 075 7 894

HEPS-C (ZARc) 741.30 1 443.60 1 282.90 1 179.20 Price Prd End 14 204 18 935 19 701 15 758 13 869

DPS (ZARc) 330.00 640.00 560.00 500.00 RATIOS - 0.70 14.67 15.55 21.13 413.73

Ret on SH Fnd

NAV PS (ZARc) 8 251.00 8 497.00 7 914.00 7 021.00

3 Yr Beta 1.32 0.80 - - Oper Pft Mgn 6.98 8.77 7.69 9.69 6.49

0.73

0.71

0.80

D:E

1.69

0.88

Price High 35 799 32 916 32 400 31 144 Current Ratio 1.16 1.14 1.20 1.23 1.30

Price Low 17 103 24 755 24 267 22 183 Div Cover - 0.48 1.87 2.05 2.91 0.97

Price Prd End 28 350 30 699 27 531 29 922

RATIOS

Ret on SH Fnd 4.41 14.40 13.31 17.03 Blue Label Telecoms Ltd.

Oper Pft Mgn 2.59 5.08 4.90 4.96 ISIN: ZAE000109088 SHORT: BLUETEL CODE: BLU

BLU

Net debt:E 0.86 0.43 0.44 0.07 REG NO: 2006/022679/06 FOUNDED: 2001 LISTED: 2007

Current Ratio 1.07 1.13 1.20 1.18 NATURE OF BUSINESS: Blue Label’s core business is the virtual

Div Cover 1.10 1.92 1.90 2.41 distribution of secure electronic tokens of value, predominantly prepaid

airtime, starter packs and electricity at present, and transactional services

The Bidvest Group Ltd. across its global footprint of touch points.

SECTOR: Telcoms—Telcoms—Mobile Telcoms—Mobile Telcoms

BID

ISIN: ZAE000117321 SHORT: BIDVEST CODE: BVT NUMBER OF EMPLOYEES: 1 111

REG NO: 1946/021180/06 FOUNDED: 1988 LISTED: 1990 DIRECTORS: Ellerine K (ne), HarlowGD(ind ne), Mnxasana N P

NATURE OF BUSINESS: A leading business-to-business, services, trading (ind ne), Mthimunye J (ind ne), VilakaziJS(ind ne),

and distribution group operating in the areas of consumer and industrial Nestadt L M (Chair, ind ne), Levy B M (Joint CEO), Levy M S (Joint

products, electrical products, financial services, freight management, office CEO), Suntup D (FD)

and print solutions, outsourced hard and soft services, travel and aviation MAJOR ORDINARY SHAREHOLDERS as at 31 May 2019

services and automotive retailing. Listed on the JSE Ltd. and with its roots Shotput Investments (Pty) Ltd. 10.95%

firmly established in South Africa, we consistently broaden our offering. Levy B M 8.50%

SECTOR: Ind—Ind Goods&Srvcs—Gen Ind—Diversified Ind Levy M S 7.69%

NUMBER OF EMPLOYEES: 123 841 POSTAL ADDRESS: PO Box 652261, Benmore, 2010

DIRECTORS: MaditsiAK(ind ne), Masinga S (ind ne), McMahon G C, MORE INFO: www.sharedata.co.za/sdo/jse/BLU

Mokate DrRD(ind ne), RuckMJD(ind ne), Siyotula N (ind ne), COMPANY SECRETARY: Janine van Eden

ThomsonNW(ind ne), Mohale B (Chair, ind ne), Madisa N T TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

(CEO Designate), Ralphs L P (CE), Diack E K (Acting Chair, ld ind ne), SPONSOR: Investec Bank Ltd.

Steyn M (CFO) AUDITORS: PwC Inc.

MAJOR ORDINARY SHAREHOLDERS as at 10 Jul 2020 CAPITAL STRUCTURE AUTHORISED ISSUED

Government Employees Pension Fund 14.98% BLU Ords 0.0001c ea 2 000 000 000 913 655 873

Westwood Global Investments LLC 5.10% DISTRIBUTIONS [ZARc]

GIC Asset Management Pte Ltd. 5.01%

Amt

Ldt

Pay

POSTAL ADDRESS: PO Box 87274, Houghton, Johannesburg, 2041 Ords 0.0001c ea 12 Sep 17 18 Sep 17 40.00

Final No 8

MORE INFO: www.sharedata.co.za/sdo/jse/BVT Final No 7 13 Sep 16 19 Sep 16 36.00

COMPANY SECRETARY: I Roux

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. LIQUIDITY: Oct20 Ave 12m shares p.w., R34.5m(65.8% p.a.)

SPONSOR: Investec Bank Ltd. TELE 40 Week MA BLUETEL

AUDITORS: PwC Inc. 2126

CAPITAL STRUCTURE AUTHORISED ISSUED

1734

BVT Ords 5c ea 540 000 000 340 274 346

DISTRIBUTIONS [ZARc] 1342

Ords 5c ea Ldt Pay Amt

Interim No 45 24 Mar 20 30 Mar 20 282.00 950

Final No 44 17 Sep 19 23 Sep 19 318.00 558

LIQUIDITY: Oct20 Ave 7m shares p.w., R1 157.8m(102.6% p.a.) 166

2015 | 2016 | 2017 | 2018 | 2019 | 2020

98