Page 98 - Stock Exchange Handbook 2020 - Issue 3

P. 98

JSE – BAR Profile’s Stock Exchange Handbook: 2020 – Issue 3

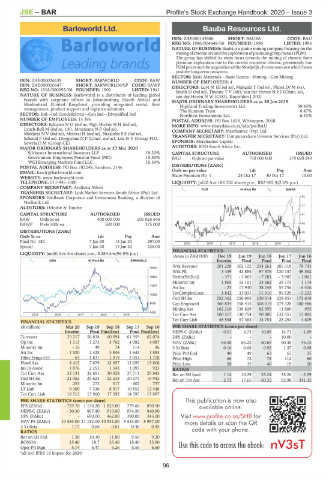

Barloworld Ltd. Bauba Resources Ltd.

BAR BAU

ISIN: ZAE000145686 SHORT: BAUBA CODE: BAU

REG NO: 1986/004649/06 FOUNDED: 1996 LISTED: 1996

NATURE OF BUSINESS: Bauba is a junior mining company focusing on the

miningofchromeoreandtheexplorationofplatinumgroupmetals(PGM).

The group has shifted its main focus towards the mining of chrome from

platinum exploration due to the current economic climate, persistently low

PGMpricesandtheacquisitionoftheMoeijelijkchromeresourcewhichbears

positive long-term prospects.

SECTOR: Basic Materials—Basic Resrcs—Mining—Gen Mining

ISIN: ZAE000026639 SHORT: BARWORLD CODE: BAW NUMBER OF EMPLOYEES: 4

ISIN: ZAE000026647 SHORT: BARWORLD6%P CODE: BAWP DIRECTORS: Luyt M (ld ind ne), Makgala T (ind ne), Phosa Dr M (ne),

REG NO: 1918/000095/06 FOUNDED: 1902 LISTED: 1941 Smith D (ind ne), ThulareTV(alt), van der HovenNPJ (Chair, ne),

NATURE OF BUSINESS: Barloworld is a distributor of leading global van der Hoven N W (CEO), Knowlden J (FD)

brands with corporate offices in Johannesburg (South Africa) and

Maidenhead (United Kingdom), providing integrated rental, fleet MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019 59.93%

Highland Trading Investments Ltd.

management, product support and logistics solutions. The Kumane Trust 6.47%

SECTOR: Ind—Ind Goods&Srvcs—Gen Ind—Diversified Ind Northlew Investments Ltd. 6.33%

NUMBER OF EMPLOYEES: 15 396 POSTAL ADDRESS: PO Box 1658, Witkoppen, 2068

DIRECTORS: EdozienNO(ind ne, Nig), HickeyHH(ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/BAU

Lynch-Bell M (ind ne, UK), MnxasanaNP(ind ne), COMPANY SECRETARY: Merchantec (Pty) Ltd.

MokhesiNV(ind ne), Molotsi H (ind ne), NtsalubaSS(ind ne), TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Schmid P (ind ne), Dongwana N P (Chair, ind ne), Lila N V (Group FD),

Sewela D M (Group CE) SPONSOR: Merchantec Capital

AUDITORS: BDO South Africa Inc.

MAJOR ORDINARY SHAREHOLDERS as at 27 Mar 2020

Silchester International Investors LLP 18.20% CAPITAL STRUCTURE AUTHORISED ISSUED

Government Employees Pension Fund (PIC) 15.50% BAU Ords no par value 750 000 000 379 020 249

WGI Emerging Markets Fund LLC 10.30%

POSTAL ADDRESS: PO Box 782248, Sandton, 2146 DISTRIBUTIONS [ZARc]

EMAIL: bawir@barloworld.com Ords no par value Ldt Pay Amt

WEBSITE: www.barloworld.com Share Premium No 1 24 Oct 17 30 Oct 17 10.00

TELEPHONE: 011-445-1000 LIQUIDITY: Jul20 Ave 188 702 shares p.w., R82 905.4(2.6% p.a.)

COMPANY SECRETARY: Andiswa Ndoni

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd. PLAT 40 Week MA BAUBA

SPONSORS: Nedbank Corporate and Investment Banking, a division of 93

Nedbank Ltd.

77

AUDITORS: Deloitte & Touche

61

CAPITAL STRUCTURE AUTHORISED ISSUED

BAW Ords 5c ea 400 000 000 201 025 646

BAWP Prefs 200c ea 500 000 375 000 45

30

DISTRIBUTIONS [ZARc]

Ords 5c ea Ldt Pay Amt

Final No 182 7 Jan 20 13 Jan 20 297.00 14

2015 | 2016 | 2017 | 2018 | 2019 |

Special 7 Jan 20 13 Jan 20 228.00

LIQUIDITY: Jun20 Ave 4m shares p.w., R389.4m(96.9% p.a.) FINANCIAL STATISTICS

(Amts in ZAR’000) Dec 19 Jun 19 Jun 18 Jun 17 Jun 16

GENI 40 Week MA BARWORLD

Interim Final Final Final Final

Wrk Revenue 201 228 302 122 234 261 205 318 78 743

18451

Wrk Pft 3 439 43 884 97 576 130 157 49 552

15851 NetIntPd(Rcd) - 371 - 3 865 - 7 281 - 3 987 - 1 061

Minority Int 1 865 15 101 33 662 39 773 1 174

13251

Att Inc - 23 17 930 38 248 55 756 - 6 406

TotCompIncLoss 1 842 33 031 71 910 95 529 - 5 232

10650

Ord SH Int 252 362 250 995 230 014 228 851 172 618

8050 Cap Employed 366 834 358 415 308 019 274 328 180 486

Mining Ass 162 210 139 829 82 955 11 880 955

5450

2015 | 2016 | 2017 | 2018 | 2019 | Tot Curr Ass 100 517 130 754 90 805 132 351 13 885

Tot Curr Liab 48 558 57 483 14 751 28 254 4 809

FINANCIAL STATISTICS

(R million) Mar 20 Sep 19 Sep 18 Sep 17 Sep 16 PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 0.01 4.73 10.09 14.71 - 1.69

Interim Final Final(rst) Final Final(rst)

Turnover 25 217 56 834 60 094 61 959 62 074 DPS (ZARc) - - - 10.00 -

Op Inc 1 113 3 273 3 762 4 082 4 087 NAV (ZARc) 66.58 66.22 60.69 60.38 46.15

Minority Int - 16 49 74 114 96 3 Yr Beta 0.16 0.68 0.92 1.37 0.98

Att Inc - 1 520 2 428 3 846 1 643 1 883 Price Prd End 40 49 63 65 25

Hline Erngs-CO - 63 1 831 1 919 2 053 1 778 Price High 66 72 78 112 60

Fixed Ass 8 415 7 879 12 657 12 659 13 806 Price Low 28 35 40 19 20

Inv in Assoc 1 876 2 253 1 343 1 093 923

RATIOS

Tot Curr Ass 32 131 32 651 30 028 27 711 25 843 Ret on SH fund 1.14 10.29 25.24 35.26 - 2.99

Ord SH Int 21 062 23 623 22 233 20 275 18 942 Ret on Tot Ass 2.72 17.65 60.35 92.98 241.35

Minority Int 253 272 517 602 737

LT Liab 9 300 7 336 8 917 10 852 12 446

Tot Curr Liab 16 512 15 960 17 592 14 595 13 897

This publication is now also

PER SHARE STATISTICS (cents per share)

EPS (ZARc) - 729.70 1 150.20 1 823.80 779.60 890.50 available online.

HEPS-C (ZARc) - 30.30 867.40 910.00 974.50 840.90

DPS (ZARc) - 690.00 462.00 390.00 345.00 Visit www.profile.co.za/SHB for

NAV PS (ZARc) 10 584.00 11 182.00 10 531.00 9 533.00 8 997.00 more details or scan the QR

3 Yr Beta 1.17 0.66 0.81 0.46 0.45

code with your phone.

RATIOS

Ret on SH Fnd 1.30 10.10 11.80 9.50 9.20

RONOA 15.40 18.7 25.40 18.40 15.90 Usethiscodetoaccess theebook:

Oper Pft Mgn 5.14 6.47 6.26 6.59 6.60

*all incl IFRS 16 impact for 2020

96