Page 94 - Stock Exchange Handbook 2020 - Issue 3

P. 94

JSE – ATT Profile’s Stock Exchange Handbook: 2020 – Issue 3

POPULAR BRAND NAMES: Brooklyn Bridge,

Attacq Ltd. Brooklyn Mall, Eikestad Precinct, Glenfair Boulevard,

Lynnwood Bridge, Mall of Africa, MooiRivier Mall,

ATT

Waterfall Corner Shopping Centre, Waterfall

Distribution Campus, Waterfall Lifestyle Centre

POSTAL ADDRESS: PostNet Suite 016, Private

Bag X81, Halfway House, 1685

EMAIL: brenda@attacq.co.za

WEBSITE: www.attacq.co.za

Scan the QR code to TELEPHONE: 010-549-1050

visit our website COMPANY SECRETARY: Anda Matwa

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

ISIN: ZAE000177218 SHORT: ATTACQ CODE: ATT SPONSOR: Java Capital (Pty) Ltd.

REG NO: 1997/000543/06 FOUNDED: 2005 LISTED: 2013 AUDITORS: Deloitte

BANKERS: Nedbank Ltd., Standard Bank of South Africa Ltd.

NATURE OF BUSINESS:

Expected

Status

Attacq is a South African-based REIT, with a vision of deliver- CALENDAR 22 Sep 2020 Confirmed

Next Final Results

ing sustainable income and long-term capital growth through Annual General Meeting 12 Nov 2020 Unconfirmed

a focused approach in real estate investments and develop- Next Interim Results Mar 2021 Unconfirmed

ments. The quality South African portfolio is dominant in its

ISSUED

respective nodes, ensuring its defensiveness in a subdued CAPITAL STRUCTURE AUTHORISED 750 334 130

Ords no par value

2 000 000 000

ATT

economy and sets Attacq apart.

DISTRIBUTIONS [ZARc]

The group’s business model is based on four key drivers,

Ords no par value Ldt Pay Amt

namely the South African portfolio, Developments at Interim No 4 17 Mar 20 23 Mar 20 45.00

Waterfall, Investment in MAS Real Estate Inc. and the Rest of Final No 3 1 Oct 19 7 Oct 19 41.00

Africa retail investments. Attacq’s strategy is to exit the Rest Interim No 2 26 Mar 19 1 Apr 19 40.50

of Africa retail investments in an orderly manner. Final No 1 2 Oct 18 8 Oct 18 74.00

LIQUIDITY: Jun20 Ave 6m shares p.w., R64.9m(41.4% p.a.)

Attacq is listed on the JSE and is included in the FTSE/JSE

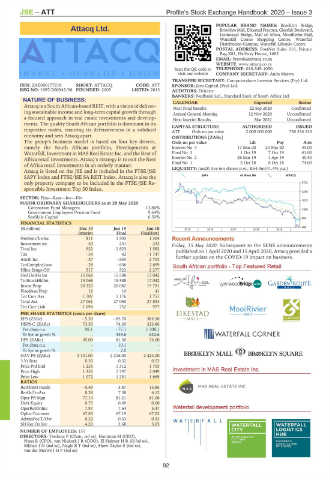

SAPY Index and FTSE/JSE SA REIT Index. Attacq is also the SAPY 40 Week MA ATTACQ

only property company to be included in the FTSE/JSE Re- 2702

sponsible Investment Top 30 Index.

2258

SECTOR: Fins—Rest—Inv—Div

1813

MAJOR ORDINARY SHAREHOLDERS as at 28 May 2020

Coronation Fund Managers 13.86% 1369

Government Employees Pension Fund 9.64%

Sesfikile Capital 6.50% 924

FINANCIAL STATISTICS

(R million) Dec 19 Jun 19 Jun 18 2015 | 2016 | 2017 | 2018 | 2019 | 480

Interim Final Final(rst)

NetRent/InvInc 811 1 503 1 304 Recent Announcements

Investment inc 50 231 233 Friday, 15 May 2020: Subsequent to the SENS announcements

Total Inc 922 1 823 1 582 published on 1 April 2020 and 15 April 2020, Attacq provided a

Tax - 34 42 - 1 747

Attrib Inc - 37 - 603 2 703 further update on the COVID-19 impact on business.

TotCompIncLoss - 28 - 636 2 699

Hline Erngs-CO 517 522 2 277

Ord UntHs Int 15 068 15 588 17 042

TotStockHldInt 15 068 15 588 17 042

Invest Prop 20 320 20 082 19 791

FixedAss/Prop 19 10 41

Tot Curr Ass 1 707 1 176 1 751

Total Ass 27 061 27 050 27 853

Tot Curr Liab 1 694 752 977

PER SHARE STATISTICS (cents per share)

EPS (ZARc) - 5.30 - 85.70 384.50

HEPS-C (ZARc) 73.50 74.20 323.86

Pct chng p.a. 98.1 - 77.1 1 308.1

Tr 5yr av grwth % - 339.6 632.6

DPS (ZARc) 45.00 81.50 74.00

Pct chng p.a. - 10.1 -

Tr 5yr av grwth % - 2.0 -

NAV PS (ZARc) 2 141.00 2 216.00 2 424.00

3 Yr Beta 0.30 0.32 0.53

Price Prd End 1 235 1 312 1 705

Price High 1 355 1 797 2 049

Price Low 1 072 1 251 1 669

RATIOS

RetOnSH Funds - 0.49 - 3.87 15.86

RetOnTotAss 8.28 7.38 6.12

Oper Pft Mgn 77.14 81.21 81.06

Debt:Equity 0.75 0.69 0.60

OperRetOnInv 7.97 7.64 5.47

OpInc:Turnover 67.83 67.19 67.02

AdminFee:T/Ovr 0.32 0.33 0.33

SH Ret On Inv 4.20 3.68 3.05

NUMBER OF EMPLOYEES: 151

DIRECTORS: Tredoux P (Chair, ind ne), Hamman M (CEO),

Nana R (CFO), van Niekerk J R (COO), El HaimerHR(ld ind ne),

MkhariIN(ind ne), NagleBT(ind ne), Shaw-Taylor S (ind ne),

van der MerweJHP(ind ne)

92