Page 102 - Stock Exchange Handbook 2020 - Issue 3

P. 102

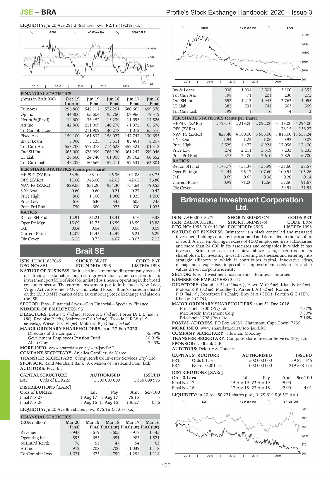

JSE – BRA Profile’s Stock Exchange Handbook: 2020 – Issue 3

LIQUIDITY: Jul20 Ave 291 366 shares p.w., R2.1m(19.3% p.a.)

GENF 40 Week MA BRAIT

GENI 40 Week MA BOWCALF

17008

13659

1016

10309

882

6960

748

3610

614

261

2015 | 2016 | 2017 | 2018 | 2019 |

480

2015 | 2016 | 2017 | 2018 | 2019 |

Inv & Loans 936 1 934 2 501 3 100 4 352

Tot Curr Ass 198 71 201 230 275

FINANCIAL STATISTICS

(Amts in ZAR’000)

Ord SH Int 553 1 213 1 945 2 763 4 055

Jun 17

Jun 18

Jun 19

Dec 19

Jun 16

LT Liab 382 791 741 563 569

Interim Final Final Final Final

Turnover 296 800 542 117 577 251 580 665 499 376 Tot Curr Liab 199 1 16 4 3

Op Inc 44 800 63 604 95 750 107 966 79 319

NetIntPd(Rcvd) - 14 600 - 36 457 - 13 239 - 11 695 - 17 526 PER SHARE STATISTICS (cents per share)

Att Inc 42 800 211 909 140 278 - 1 072 65 576 HEPS-C (ZARc) - 2 793.10 - 2 219.00 - 2 092.00 - 3 119.00 4 294.00

TotCompIncLoss - 211 909 140 278 - 1 072 65 576 DPS (ZARc) - - - 78.15 136.27

Fixed Ass 159 100 161 837 158 027 147 747 130 655 NAV PS (ZARc) 827.40 4 180.00 5 586.00 7 815.00 13 558.24

Inv & Loans 5 000 5 125 5 611 85 461 6 207 3 Yr Beta 1.94 1.23 1.06 0.92 - 0.07

Tot Curr Ass 558 700 579 073 714 628 357 321 401 313 Price High 2 529 4 477 8 924 17 056 17 400

Ord SH Int 663 000 678 999 766 120 661 247 699 046 Price Low 274 2 211 3 319 7 233 8 235

LT Liab 26 600 24 740 61 008 39 762 60 652 Price Prd End 375 2 400 3 610 7 820 16 700

Tot Curr Liab 46 200 50 562 57 211 57 531 63 801 RATIOS

Ret on SH Fnd - 175.77 - 58.37 - 35.99 - 37.60 27.57

Oper Pft Mgn 94.41 96.17 107.60 100.51 105.26

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 53.50 88.10 95.36 101.88 88.75

D:E 0.69 0.65 0.38 0.20 0.14

DPS (ZARc) 17.00 345.00 42.02 42.02 36.80 Current Ratio 0.99 71.00 12.56 57.50 91.67

NAV PS (ZARc) 829.06 831.20 934.30 754.64 790.53 Div Cover - - - - 39.91 31.51

3 Yr Beta - 0.60 - 0.60 0.21 - 0.27 - 0.47

Price High 800 1 100 1 060 1 025 1 200

Price Low 670 630 545 605 745 Brimstone Investment Corporation

Price Prd End 750 680 975 630 1 025 Ltd.

RATIOS BRI

Ret on SH Fnd 12.91 31.21 18.31 - 0.16 9.38 ISIN: ZAE000015277 SHORT: BRIMSTON CODE: BRT

Oper Pft Mgn 15.09 11.73 16.59 18.59 15.88 ISIN: ZAE000015285 SHORT: BRIMST-N CODE: BRN

D:E 0.04 0.04 0.08 0.06 0.09 REG NO: 1995/010442/06 FOUNDED: 1995 LISTED: 1998

Current Ratio 12.09 11.45 12.49 6.21 6.29 NATURE OF BUSINESS: Brimstone is a black controlled and managed

Div Cover 3.15 0.75 4.07 - 0.03 2.15 investment holding company incorporated and domiciled in the Republic

of South Africa, employing in excess of 4 500 employees in its subsidiaries

and more than 24 000 in its associates and companies in which it has

Brait SE invested. Brimstone seeks to achieve above average returns for its

shareholders by investing in wealth creating businesses and entering into

BRA

ISIN: LU0011857645 SHORT: BRAIT CODE: BAT strategic alliances to which it contributes capital, innovative ideas,

REG NO: SE1 FOUNDED: 1998 LISTED: 1998 management expertise, impeccable empowerment credentials and a

NATURE OF BUSINESS: Brait is an investment holding company focused values driven corporate identity.

on driving sustainable long-term growth and value creation in its SECTOR: Fins—Investment Instruments—Equities—Equities

investment portfolio of sizeable unlisted businesses operating in the broad NUMBER OF EMPLOYEES: 3 417

consumer sector. The current investment portfolio includes New Look, DIRECTORS: CampherPL(ld ind ne), Hewu M (ind ne), Khan N (ind ne),

Virgin Active, Premier FMCG and Iceland Foods. Brait’s shares are listed MolokoKR(ind ne), Moodley T, ParkerLA(ind ne), Roman

on the EURO MTF market of the Luxembourg Stock Exchange and also on FD(ind ne), Robertson F (Chair), Brey M A (CEO), Fortuin G G (FD),

the JSE. Khan M I (COO)

SECTOR: Fins—Financial Srvcs—Gen Financial—Specialty Finance MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2018

NUMBER OF EMPLOYEES: 95 Friedshelf 1800 (Pty) Ltd. 7.37%

DIRECTORS: BottsJC(ind ne), JacobsAS(ind ne), Porter DrLL(ind ne, Max Brozin Investment Corp 7.30%

UK), Roelofse P (alt), SeabrookeCS(ind ne), TroskieHRW(ind Friedshelf 1798 (Pty) Ltd. 7.16%

ne, Neth), Wiese DrCH(ne), Moleketi P J (Chair, ind ne) POSTAL ADDRESS: PO Box 44580, Claremont, Cape Town, 7735

MORE INFO: www.sharedata.co.za/sdo/jse/BRT

MAJOR ORDINARY SHAREHOLDERS as at 27 Feb 2020

Directors of the company 35.89% COMPANY SECRETARY: Tiloshani Moodley

Government Employees Pension Fund 10.01% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Allan Gray 7.43% SPONSOR: Nedbank CIB

MORE INFO: www.sharedata.co.za/sdo/jse/BAT AUDITORS: Deloitte & Touche

COMPANY SECRETARY: Anjelica Camilleri de Marco

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED 39 874 146

ISSUED

BRT

500 000 000

Ords 0.1c ea

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.) BRN NOrds 0.001c ea 1 000 000 000 219 558 175

AUDITORS: PwC Inc.

DISTRIBUTIONS [ZARc]

CAPITAL STRUCTURE AUTHORISED ISSUED

BAT Ords of EUR22c 1 500 000 000 1 356 608 993 Ords 0.1c ea Ldt Pay Amt Scr/100

Final No 17 15 Apr 19 23 Apr 19 45.00 -

Final No 16 17 Apr 18 23 Apr 18 42.00 4.01

DISTRIBUTIONS [ZARc]

LIQUIDITY: Jul20 Ave 50 221 shares p.w., R429 619.8(6.5% p.a.)

Ords of EUR22c Ldt Pay Amt Scr/100

Final No 27 1 Aug 17 7 Aug 17 78.15 -

Final No 26 8 Aug 16 15 Aug 16 136.27 0.86 EQII 40 Week MA BRIMSTON

LIQUIDITY: Jul20 Ave 8m shares p.w., R75.1m(31.0% p.a.) 2351

FINANCIAL STATISTICS 1981

(EUR million) Mar 20 Mar 19 Mar 18 Mar 17 Mar 16

1611

Final Final Final(rst) Final(rst) Final(rst)

Revenue - 948 - 679 - 605 - 978 1 445

1240

Operating Inc - 895 - 653 - 651 - 983 1 521

NetIntPd(Rcvd) 76 53 47 54 63 870

Att Inc - 972 - 708 - 700 - 1 039 1 118

TotCompIncLoss - 1 021 - 675 - 799 - 1 294 1 118 500

2015 | 2016 | 2017 | 2018 | 2019 |

100