Page 85 - Stock Exchange Handbook 2020 - Issue 3

P. 85

Profile’s Stock Exchange Handbook: 2020 – Issue 3 JSE – ALP

POPULAR BRAND NAMES: Altron TMT, Altron

Nexus, Altron Nexus Solutions, Altron Nexus Alphamin Resources Corp.

Distributors, Altron Nexus @Connect, Altron ALP

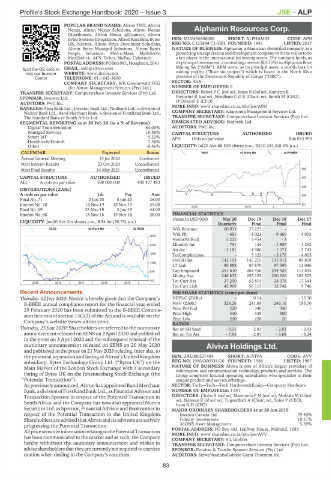

Bytes Systems Integration, Altron Karabina, Bytes ISIN: MU0456S00006 SHORT: ALPHAMIN CODE: APH

UK, Netstar, Altron Bytes Document Solutions, REG NO: C125884 C1/GBL FOUNDED: 1981 LISTED: 2017

Altron Bytes Managed Solutions, Altron Bytes NATURE OF BUSINESS: Alphamin, a Mauritian-domiciled company, is a

People Solutions, Med-e-Mass, MedeServe, pioneering tin exploration and development company with the vision to be

MediSwitch, ACS, Delter, NuPay, Cybertech a key player in the international tin mining sector. The company holds, as

POSTAL ADDRESS:POBox981, Houghton,2041 its principal investment, a controlling interest (80.75%) in Alphamin Bisie

Scan the QR code to EMAIL: info@altron.com Mining SA (“ABM”). ABM owns, as its principal asset, a world-class tin

visit our Investor WEBSITE: www.altron.com mining project (“Bisie tin project”) which is based in the North Kivu

Centre TELEPHONE: 011-645-3600 province of the Democratic Republic of Congo (“DRC”).

COMPANY SECRETARY: WK Groenewald FCG SECTOR: AltX

(for Altron Management Services (Pty) Ltd.) NUMBER OF EMPLOYEES: 0

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. DIRECTORS: BaloyiPC(ind ne), Jones B (ind ne), Kamstra B,

SPONSOR: Investec Ltd. Pretorius R (ind ne), NeedhamCDS (Chair, ne), Smith M (CEO),

AUDITORS: PwC Inc. O’Driscoll E (CFO)

BANKERS: Absa Bank Ltd., Investec Bank Ltd., Nedbank Ltd., a division of MORE INFO: www.sharedata.co.za/sdo/jse/APH

Nedcor Bank Ltd., Rand Merchant Bank, a division of FirstRand Bank Ltd., COMPANY SECRETARY: Adansonia Management Services Ltd.

The Standard Bank of South Africa Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DESIGNATED ADVISOR: Nedbank Ltd.

SEGMENTAL REPORTING as at 29 Feb 20 (asa%of Revenue)

Digital Transformation 64.00% AUDITORS: PwC Inc.

Managed Services 19.88%

ISSUED

Smart IoT 9.22% CAPITAL STRUCTURE AUTHORISED - 866 033 993

Ords no par value

APH

Healthtech/Fintech 7.36%

Other -0.46% LIQUIDITY: Jul20 Ave 68 530 shares p.w., R210 234.2(0.4% p.a.)

MINI 40 Week MA ALPHAMIN

CALENDAR Expected Status

Annual General Meeting 15 Jul 2020 Confirmed

Next Interim Results 23 Oct 2020 Unconfirmed

Next Final Results 14 May 2021 Unconfirmed 595

497

CAPITAL STRUCTURE AUTHORISED ISSUED

AEL A ords no par value 500 000 000 400 477 483

398

DISTRIBUTIONS [ZARc]

300

A ords no par value Ldt Pay Amt

Final No 71 2 Jun 20 8 Jun 20 26.00

Interim No 70 12 Nov 19 18 Nov 19 29.00 201

2018 | 2019 |

Final No 69 28 May 19 3 Jun 19 44.00

Interim No 68 13 Nov 18 19 Nov 18 28.00 FINANCIAL STATISTICS

(Amts in USD’000)

LIQUIDITY: Jun20 Ave 2m shares p.w., R54.4m(30.7% p.a.) Mar 20 Dec 19 Dec 18 Dec 17

Quarterly Final Final Final

ELEE 40 Week MA ALTRON Wrk Revenue 60 033 27 221 - -

Wrk Pft - 691 - 4 023 - 9 460 - 4 005

2810

NetIntPd(Rcd) 5 225 5 454 - 3 -

Minority Int - 751 144 - 1 807 - 1 262

2339

Att Inc - 3 181 4 980 - 1 371 - 2 743

1869 TotCompIncLoss - 5 122 - 3 178 - 4 005

Ord SH Int 142 103 145 215 131 913 83 819

1398

LT Liab 80 888 87 870 87 595 12 046

928 Cap Employed 251 610 262 456 244 429 113 835

Mining Ass 248 832 255 125 230 626 103 572

457 Tot Curr Ass 37 250 52 815 24 078 17 344

2015 | 2016 | 2017 | 2018 | 2019 |

Tot Curr Liab 45 969 56 115 12 742 9 746

Recent Announcements

PER SHARE STATISTICS (cents per share)

Thursday, 02 July 2020: Notice is hereby given that the Company’s HEPS-C (ZARc) - 0.14 - - 13.30

B-BBEE annual compliance report for the financial year ended NAV (ZARc) 324.26 241.69 246.16 198.70

29 February 2020 has been submitted to the B-BBEE Commis- Price Prd End 220 340 340 -

sion in terms of section 13G(2) of the Act and is available on the Price High 340 345 380 - -

220

20

Price Low

220

Company’s website (www.altron.com).

RATIOS

Thursday, 25 June 2020: Shareholders are referred to the cautionary Ret on SH fund - 9.21 2.93 - 2.03 - 3.93

announcementreleased on SENS on 2 April 2020 and published Ret on Tot Ass - 7.95 - 2.97 - 3.68 - 3.24

in the press on 3 April 2020 and the subsequent renewal of the

cautionary announcement released on SENS on 20 May 2020 Alviva Holdings Ltd.

and published in the press on 21 May 2020 relating, inter alia, to ALV

the potential separation and listing of Altron’s United Kingdom ISIN: ZAE000227484 SHORT: ALVIVA CODE: AVV

subsidiary, Bytes Technology Group Ltd. (“Bytes UK”) on the REG NO: 1986/000334/06 FOUNDED: 1986 LISTED: 1987

Main Market of the London Stock Exchange with a secondary NATURE OF BUSINESS: Alviva is one of Africa’s largest providers of

information and communication technology products and services. The

listing of Bytes UK on the Johannesburg Stock Exchange (the Group comprises focused operating subsidiaries who specialise in their

“Potential Transaction”). unique product and service offerings.

As previously announced, Altron has appointed Rand Merchant SECTOR: Tech—Tech—Tech Hardware&Equip—Computer Hardware

Bank,adivisionofFirstRandBankLtd., asFinancialAdvisorand NUMBER OF EMPLOYEES: 3 597

Transaction Sponsor in respect of the Potential Transaction in DIRECTORS: Chaba S (ind ne), MasemolaPN(ind ne), MokokaMG(ind

South Africa, and the Company has now also appointed Numis ne), Natesan P (ld ind ne), Tugendhaft A (Chair, ne), Spies P (CEO),

Lyon R D (CFO)

Securities Ltd. as Sponsor, Financial Advisor and Bookrunner in

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

respect of the Potential Transaction in the United Kingdom. Invesco Canada Ltd. 29.40%

Shareholders areadvisedthatAltronanditsadvisorsareactively Fidelity Investments 10.21%

progressing the Potential Transaction. 36ONE Asset Management 5.39%

AllpricesensitiveinformationrelatingtothePotentialTransaction POSTAL ADDRESS: PO Box 483, Halfway House, Midrand, 1685

MORE INFO: www.sharedata.co.za/sdo/jse/AVV

has been communicated to the market and as such, the Company COMPANY SECRETARY: S L Grobler

hereby withdraws the cautionary announcement and wishes to TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

adviseshareholdersthattheyarecurrentlynotrequiredtoexercise SPONSOR: Deloitte & Touche Sponsor Services (Pty) Ltd.

cautionwhendealing in theCompany’s securities. AUDITORS: SizweNtsalubaGobodo Grant Thornton Inc.

83