Page 84 - Stock Exchange Handbook 2020 - Issue 3

P. 84

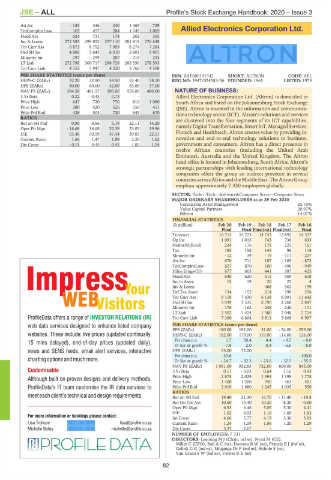

JSE – ALL Profile’s Stock Exchange Handbook: 2020 – Issue 3

Att Inc - 145 336 240 1 465 729

TotCompIncLoss 105 457 284 1 049 1 069 Allied Electronics Corporation Ltd.

Fixed Ass 624 731 174 202 355 ALL

Inv & Loans 272 585 299 852 297 110 281 818 276 638

Tot Curr Ass 6 873 8 752 7 959 8 274 7 284

Ord SH Int 4 806 5 645 6 010 6 901 5 901

Minority Int 297 299 287 218 255

LT Liab 272 798 300 717 298 729 283 556 278 593

Tot Curr Liab 4 152 5 947 4 220 3 760 4 508

ISIN: ZAE000191342 SHORT: ALTRON CODE: AEL

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 32.20 32.90 34.50 53.40 58.10 REG NO: 1947/024583/06 FOUNDED: 1965 LISTED: 1979

DPS (ZARc) 80.00 60.00 42.00 63.00 37.00

NAV PS (ZARc) 394.58 461.57 505.00 555.00 480.00 NATURE OF BUSINESS:

3 Yr Beta 0.22 - 0.43 0.73 - - Allied Electronics Corporation Ltd. (Altron) is domiciled in

Price High 647 720 770 810 1 090 South Africa and listed on the Johannesburg Stock Exchange

Price Low 280 420 526 550 451 (JSE). Altron is invested in the information and communica-

Price Prd End 428 503 720 643 670

tions technology sector (ICT). Altron’s solutions and services

are clustered into the four segments of its ICT capabilities,

RATIOS

Ret on SH Fnd 0.90 6.56 5.19 22.11 14.20 namely Digital Transformation, Smart IoT, ManagedServices,

Oper Pft Mgn - 16.68 16.68 22.39 23.05 19.96

D:E 53.46 50.59 47.44 39.83 22.51 Fintech and Healthtech. Altron creates value by providing in-

Current Ratio 1.66 1.47 1.89 2.20 1.62 novative and end-to-end technology solutions to business,

Div Cover - 0.15 0.45 0.45 1.82 1.54 government and consumers. Altron has a direct presence in

twelve African countries (including the United Arab

Emirates), Australia and the United Kingdom. The Altron

head office is located in Johannesburg, South Africa. Altron’s

strategic partnerships with leading international technology

companies offers the group an indirect presence in several

countriesacrossAfricaandthe Middle East. The AltronGroup

employs approximately 7 330 employees globally.

SECTOR: Tech—Tech—Software&Computer Srvcs—Computer Srvcs

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2020

Coronation Asset Management 25.75%

Value Capital Partners 20.97%

Biltron 14.07%

FINANCIAL STATISTICS

(R million) Feb 20 Feb 19 Feb 18 Feb 17 Feb 16

Final Final Final(rst) Final(rst) Final

Turnover 16 713 15 723 14 743 13 892 14 357

Op Inc 1 091 1 015 745 736 633

NetIntPd(Rcvd) 234 176 178 223 161

Tax 185 158 145 98 114

Minority Int - 12 39 - 19 - 117 - 227

Att Inc 670 711 187 - 185 - 873

TotCompIncLoss 627 870 100 - 496 - 949

Hline Erngs-CO 677 663 441 387 425

Fixed Ass 648 620 615 569 618

Inv in Assoc 15 19 20 23 4

Inv & Loans - - 468 302 199

Def Tax Asset 134 155 214 198 256

Tot Curr Ass 9 118 7 430 6 138 6 991 11 643

Ord SH Int 3 939 3 535 2 790 2 268 2 847

Minority Int - 176 - 162 - 245 - 240 - 111

LT Liab 2 502 1 424 1 580 2 048 2 714

Tot Curr Liab 7 360 6 804 5 811 5 808 8 997

ProfileData offers a range of INVESTOR RELATIONS (IR)

web data services designed to enhance listed company PER SHARE STATISTICS (cents per share)

EPS (ZARc) 180.00 192.00 51.00 - 54.00 - 259.00

websites. These include: live prices (updated continually, HEPS-C (ZARc) 182.00 179.00 119.00 114.00 126.00

15 mins delayed), end-of-day prices (updated daily), Pct chng p.a. 1.7 50.4 4.4 - 9.5 - 8.0

Tr 5yr av grwth % 7.8 2.0 0.4 - 6.6 - 8.0

news and SENS feeds, email alert services, interactive DPS (ZARc) 55.00 72.00 - - -

Pct chng p.a. - 23.6 - - - - 100.0

chartingoptionsandmuchmore. Tr 5yr av grwth % - 24.7 - 32.3 - 25.6 - 32.5 - 35.5

NAV PS (ZARc) 1 061.00 952.83 752.00 669.00 845.00

3 Yr Beta 0.11 - 0.03 0.64 1.16 0.93

Customisable

Price High 2 875 2 029 1 394 1 198 1 778

Although built on proven designs and delivery methods,

Price Low 1 400 1 200 950 463 401

ProfileData’s IT team customise the IR data services to Price Prd End 2 019 1 880 1 245 1 035 550

meeteachclient’stechnicalanddesignrequirements. RATIOS 19.40 21.30 16.70 - 11.40 - 19.8

Ret on SH Fnd

Ret On Tot Ass 10.60 13.40 10.20 -8.30 -0.60

Oper Pft Mgn 6.53 6.46 5.05 5.30 4.41

D:E 1.02 0.92 1.16 1.68 1.83

For more information or bookings please contact: Int Cover 4.66 5.77 4.19 3.30 3.93

Lisa Trollope 082-454-9539 lisa@profile.co.za Current Ratio 1.24 1.09 1.06 1.20 1.29

Michelle Botes 082-601-4020 michelle@profile.co.za Div Cover 3.27 2.67 - - -

NUMBER OF EMPLOYEES: 7 331

DIRECTORS: Leeming M J (Chair, ind ne), Nyati M (CE),

Miller C (CFO), BallAC(ne), DawsonBW(ne), FrancisBJ(ind ne),

GelinkGG(ind ne), Mnganga Dr P (ind ne), Sithole S (ne),

Van GraanSW(ind ne), VenterRE(ne)

82